Bitcoin's recent volatility shows short-term dips, but on-chain analysis suggests reduced selling pressure from short-term holders.

Analysts note long-term holder accumulation and positive signals from potential economic policies could drive Bitcoin's price significantly higher.

Historical data indicates April is generally a positive month for Bitcoin, and recent daily gains support a potential price stabilization.

The Bitcoin market is currently trading over 30% below its all-time high. February saw a significant 17.5% drop, following a modest 2.19% decline in the previous months. Over the past seven days, Bitcoin has fallen by 3.2%, yet in the last 24 hours, it has shown a slight recovery, rising by 0.9%.

But could a price rebound be on the horizon? On-chain analysis suggests a shift in investor behavior that might hint at an upcoming recovery.

Short-Term Holders Are Selling Less

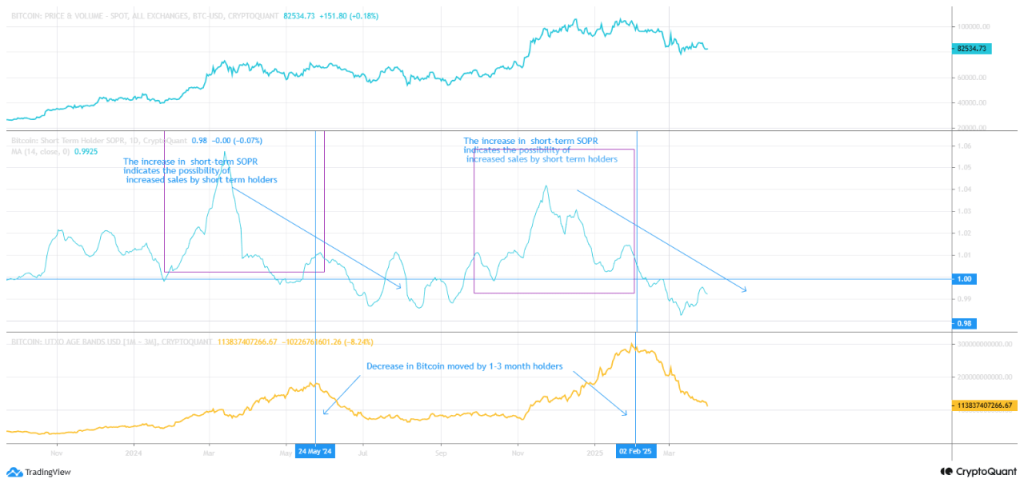

A key indicator—the Short-Term Spent Output Profit Ratio chart and UTXO Age Band (1-3 months)—reveals that short-term Bitcoin investors are selling less.

This metric tracks Bitcoin that hasn’t moved for one to three months, offering insights into whether recent buyers are holding or offloading their assets.

According to a crypto analyst, the data suggests that these short-term holders are showing confidence in Bitcoin’s future prospects.

Why Are Short-Term BTC Investors Holding Back?

Market analysts have been anticipating a significant shift in Bitcoin’s trajectory. Experts, including Axel Adler Jr., note that long-term holders have resumed accumulating Bitcoin—a bullish sign.

Adler even speculated that if the U.S. Federal Reserve or the Trump administration provides positive signals, Bitcoin could surge to an astonishing $130K.

Key Technical Indicators

Several technical indicators also support the possibility of growth:

- 24-Hour Trading Volume: $29,690,672,629

- Relative Strength Index (RSI): Currently at 48.30, suggesting room for an upward movement.

- Current BTC Price: $84,853.24

- 50-Day SMA: $88,056.04

- 100-Day SMA: $93,407.43

- 200-Day SMA: $86,309.97

Analysts suggest that the reduced selling pressure could help stabilize Bitcoin’s price in the near term.

April: A Historically Bullish Month for Bitcoin

Bitcoin’s recent 3.08% rise yesterday has further fueled optimism. Historically, April has been a strong month for Bitcoin, showing positive momentum at least nine times since 2011. This compares favorably to six bullish instances in March and eight in May.

With historical trends and investor behavior aligning, could Bitcoin be gearing up for its next big rally? The coming weeks will be crucial in determining its next move.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

On-chain data suggests short-term BTC investors are selling less, indicating confidence in a potential price rebound.

Historically, April has shown positive momentum for BTC in 9 out of the last 13 years, making it a strong month for potential gains.