Bitcoin price surged over 5% after recovering from a crucial support level and retesting its all-time high range.

Bitcoin's Futures Open Interest increased, while its funding rate declined, indicating reduced market volatility.

Long-term investors and whales are accumulating Bitcoin, driven by institutional adoption and potential US regulatory approval.

Bitcoin (BTC) saw a more than 5% rise on Wednesday after bouncing back from a key support range between $94.3k and $96.6k earlier in the week. The cryptocurrency then revisited its previous all-time high (ATH) range of $101,219 to $101,998 before slightly retracing. By Thursday, December 12, during the mid-London session, Bitcoin was trading around $100,780.

Bitcoin’s Futures Open Interest (OI) rose by 6%, reaching approximately $62.8 billion at the time of this report. Despite recent heavy liquidations in the leveraged market, Bitcoin’s funding rate has dropped below its recent average.

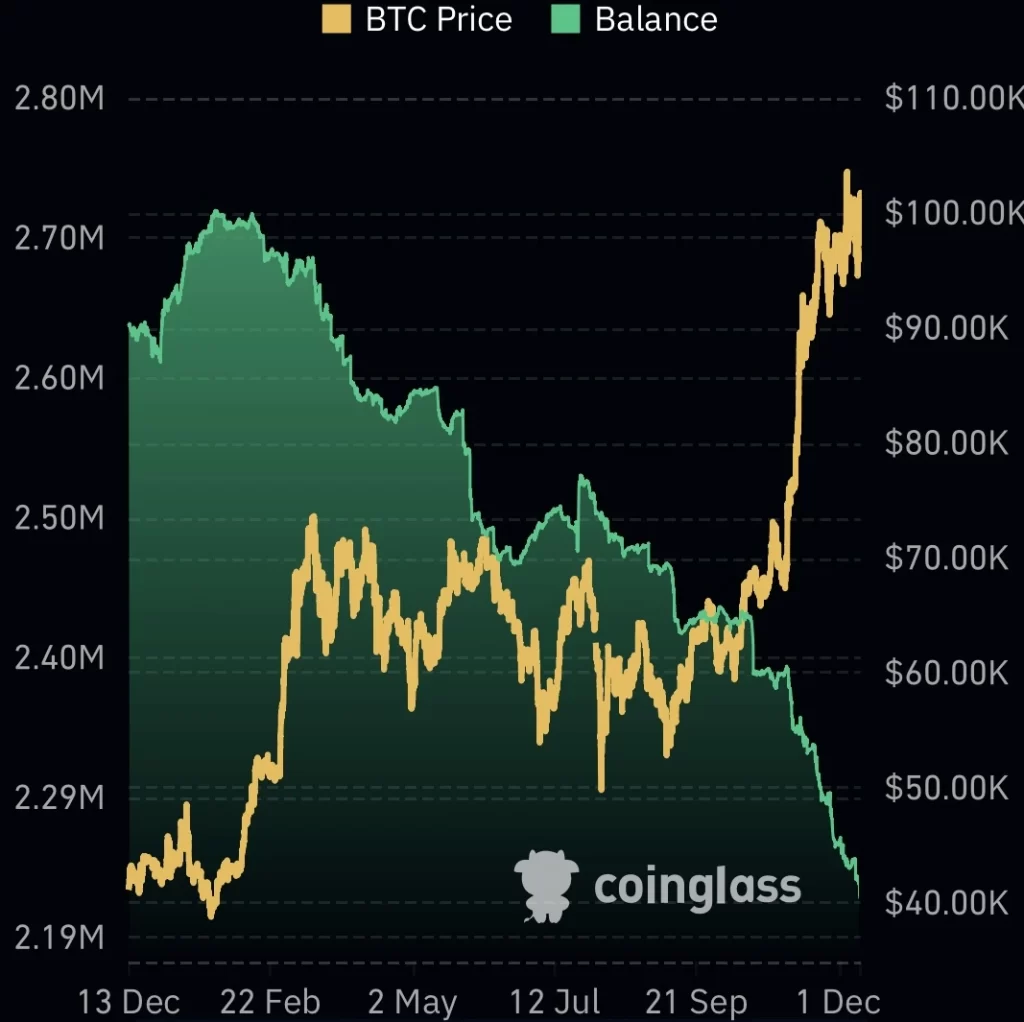

Bitcoin Supply Is Declining

The supply of Bitcoin on centralized exchanges (CEXes) has dropped sharply over the past year, driven by growing demand from institutional investors. In the last 30 days alone, the supply of Bitcoin on CEXes fell by about 120,000 BTC, leaving around 2.23 million BTC available at the time of writing.

As more institutions adopt Bitcoin, its market potential grows. Read our Bitcoin price prediction for expert insights on what’s next!

As institutional interest in Bitcoin increases, its market potential continues to expand. Market data from Cryptoquant shows that long-term investors have been investing about $80 billion into Bitcoin each month over the past year. These recent capital inflows have significantly outpaced Bitcoin’s funding over the last 15 years.

Whale Activity and US Bitcoin ETFs

Whale investors are also accumulating Bitcoin in anticipation of the U.S. approving a strategic BTC reserve. According to the latest data, U.S. spot Bitcoin ETFs saw a net cash inflow of around $223 million on Wednesday, bringing the cumulative total to approximately $34.58 billion.

What Technicals Tell Us

Looking at the technical side, Bitcoin’s price is showing mixed signals. On the daily chart, Bitcoin has formed a potential double top pattern, combined with a bearish divergence on the daily Relative Strength Index (RSI), which suggests a possible correction in the short term.

If Bitcoin manages to close consistently above $102k in the coming weeks, it could target $120k, in line with the 0.618 daily Fibonacci extension. However, Bitcoin may also retrace toward the support level above $85k before the bullish trend resumes into early next year.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The balance between bullish potential and market corrections makes Bitcoin’s journey one to watch closely in the coming months.

FAQs

Bitcoin ETFs attract institutional investments, increasing demand and reducing supply, often driving BTC prices higher.

BTC may target $120k if it breaks $102k resistance or retrace to $85k support before resuming its bullish trend in 2024.