VanEck says Bitcoin’s path to $2.9M depends less on hype and more on global trade and central bank behavior.

Even in VanEck’s worst-case scenario, Bitcoin doesn’t collapse, raising questions about long-term downside risk.

The real takeaway isn’t the price target, but why institutions may see zero Bitcoin exposure as the bigger risk.

Asset manager VanEck just dropped a 25-year Bitcoin forecast that has the crypto community talking. The firm projects BTC could hit $2.9 million per coin by 2050, assuming a 15% annual growth rate from today’s prices.

Matthew Sigel, VanEck’s head of digital assets research, and senior analyst Patrick Bush published the outlook on Wednesday. The price target is built on specific assumptions about how Bitcoin fits into the global financial system over the next two decades.

How Does Bitcoin Get to $2.9 Million?

VanEck’s model rests on two big shifts.

First, they expect Bitcoin to settle 5-10% of global international trade and 5% of domestic trade by 2050. To put that in context, the British pound currently handles about 7.4% of international payments. Bitcoin would need to reach similar territory.

Second, the firm projects central banks will hold 2.5% of their reserves in Bitcoin as trust in government debt erodes.

“Bitcoin is not a tactical trade in this framework; it functions as a long-duration hedge against adverse monetary regime outcomes,” the analysts wrote.

Three Scenarios, One Takeaway

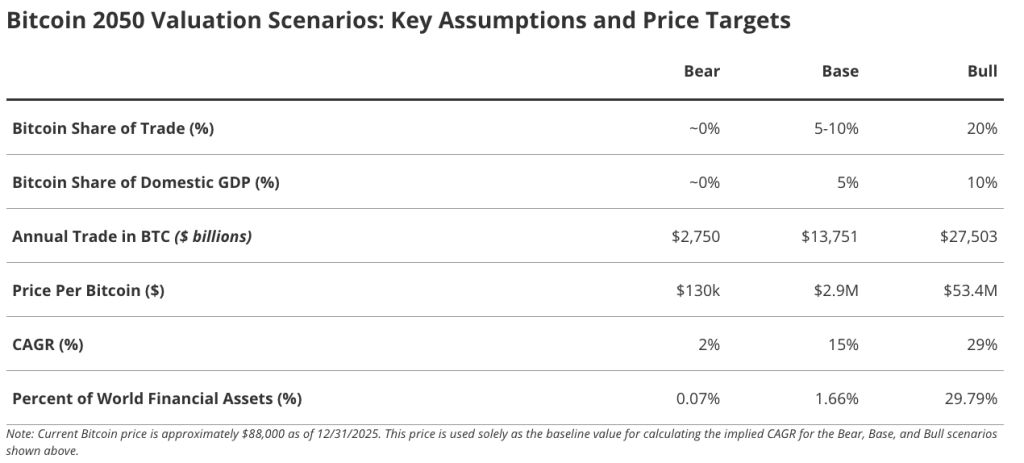

VanEck mapped out bear, base, and bull cases.

The bear case lands at $130,000 with a 2% annual return. The base case hits $2.9 million at 15%. And a bull scenario pushes to $53.4 million at 29% annual growth, though that would require Bitcoin to rival gold as a global reserve asset.

Here’s the interesting part: even VanEck’s worst-case scenario sits above Bitcoin’s current price of roughly $88,000.

What This Means for Investors

VanEck suggests putting 1-3% of a diversified portfolio into Bitcoin. Their data shows a 3% allocation to a traditional 60/40 portfolio historically produced the best risk-adjusted returns.

The firm’s bottom line is: “The cost of zero exposure to the most established non-sovereign reserve asset may now exceed the volatility risk of the position itself.”

Worth noting: this 15% growth assumption is actually down from VanEck’s December 2024 projection, which used 25%.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Central banks might add Bitcoin to diversify away from traditional government debt, hedge against inflation, and reduce exposure to currency volatility. This reflects growing interest in non-sovereign assets as a financial safety measure.

If Bitcoin handles a significant share of international payments, it could lower transaction costs, speed cross-border settlements, and reduce reliance on traditional banking networks. It may also prompt regulatory adjustments in multiple countries.

Volatility, regulatory uncertainty, and technological vulnerabilities could disrupt trade if adoption scales rapidly. Businesses and governments would need robust infrastructure and risk management to integrate Bitcoin safely.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.