The total crypto market cap dropped further to $3.4 trillion following the renewed selling pressure.

The fear of further crypto selloff has remained elevated amid low fresh capital inflows.

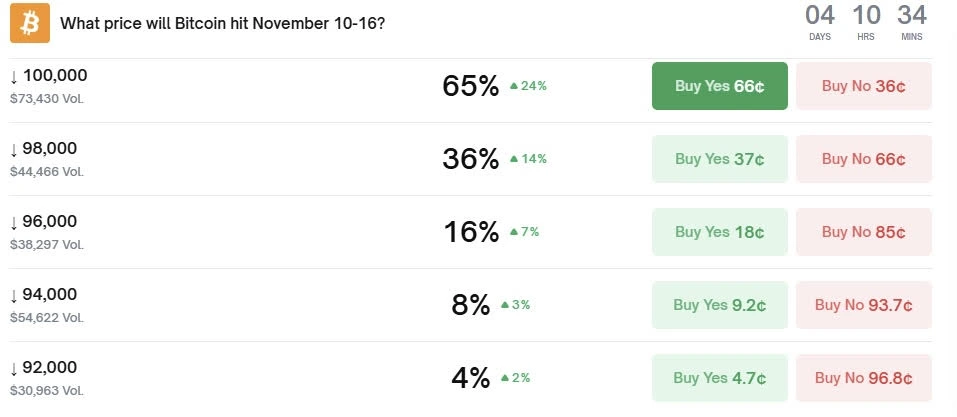

The odds that the Bitcoin price will drop below $100k in the coming day have surged on Polymarket.

The crypto market continued with its recent bloodbath on Wednesday, November 12. Bitcoin (BTC) led the wider altcoin market in heightened selling pressure.

The total crypto market cap dropped by 2% to hover around $3.42 trillion at press time. BTC price slipped below $102k again after the bullish momentum failed to gain traction.

Main Reasons Why Crypto Dropped Today

Low market demand amid notable fear of further crypto capitulation

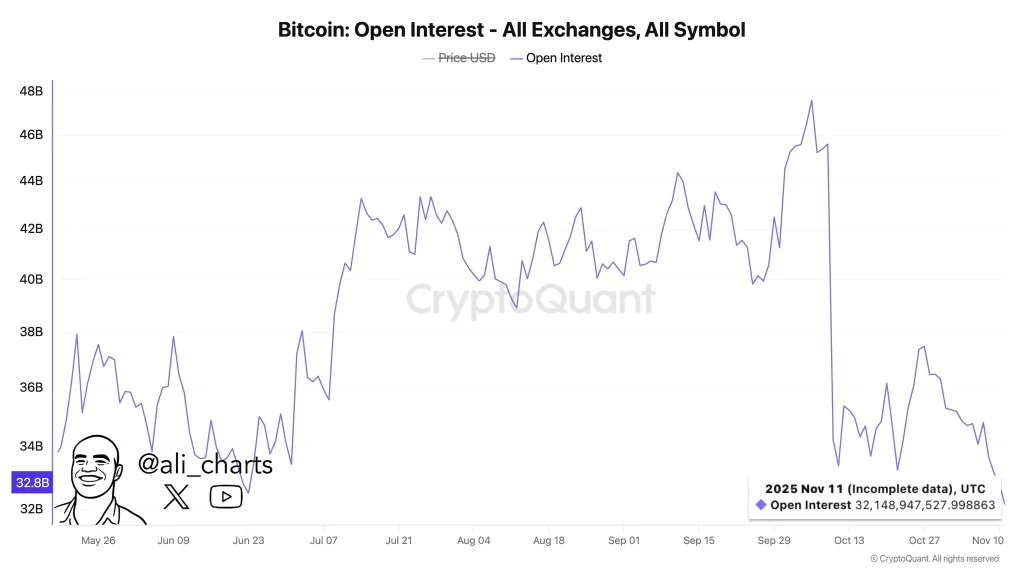

The overall capital inflow to the crypto market has significantly declined in the recent past, as shown by the spot Bitcoin and Ethereum ETFs. Notably, Bitcoin’s Open Interest (OI) across all crypto exchanges has dropped to a seven-month low.

Source: X

Meanwhile, Polymarket traders have been betting that the Bitcoin price will continue to drop further in the coming days, potentially below $100k.

Source: Polymarket

Heavy liquidation of long crypto traders amid fears of Hyperliquid attack

Following the wider crypto correction, more than $612 million was rekt from leveraged traders, with around $502 million involving long traders. The crypto market was also gripped with fear of a potential attack on Hyperliquid, the largest DEX futures platform.

Technical headwinds amid sell-the-news impact due to the reopening of the U.S. government

Bitcoin price has led the wider altcoin market in bearish sentiment as gold investors enjoy more gains. As the wider crypto market recorded bearish sentiment in the past 24 hours, the Gold price surged 2% to trade at about $4,200 per ounce at press time.

The technical headwinds in the wider crypto market coincided with the reopening of the U.S. government after 40 days of shutdown. Although the re-opening of the U.S. government is positive for the economy, the crypto market experienced a potential sell-the-news impact.

Is the Bull Market Over?

The crypto bull market 2025 is likely to resume in the coming weeks fueled by the Fed’s money printing. Furthermore, Gold price has likely topped out and has been forming a macro double top, which is bullish for the wider crypto bull market.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.