Whale and institutional ETH accumulation signal strong confidence in Ethereum’s long-term growth.

Technical charts show Ethereum poised for breakout above $4,200, targeting $4,500 and beyond.

Experts predict Ethereum could hit $7K–$8K by Dec 2025 as adoption and tokenization surge.

Ethereum price is gaining strong momentum today, driven by a mix of whale activity, institutional accumulation, and bullish technical indicators. Over the past few days, several on-chain signals and expert insights have pointed toward a potential Ethereum breakout as the network’s fundamentals strengthen.

Ethereum Whales Accumulation Surge

One major catalyst for Ethereum’s price surge today is large-scale whale accumulation.

In the past 6 hours, a crypto whale sold 45.5 million TRX worth $13.6 million to buy 3,332.6 ETH at $4,084.

Over the past three months, the same whale has reportedly sold 629.27 million TRX (worth $217.3 million) to purchase 48,390 ETH at an average price of $4,490.

The transactions were made using addresses 0xc37704a457b1ee87eb657cae584a34961e86acac and TWtyvNirqUENVo7zyihU8Zzd4fhxxvRPLw, with the TRX tokens withdrawn directly from Binance.

This shows whales are shifting capital from TRON to Ethereum, a clear sign of growing confidence in ETH’s long-term potential.

Not all whale activity is bullish, though. Crypto influencer Richard Heart recently deposited over $105.9 million in ETH to Tornado Cash, a privacy mixer. While he still holds over $500 million worth of ETH, such large transfers sometimes create short-term selling pressure or market speculation.

However, the broader sentiment remains positive, as most on-chain data shows accumulation outweighing distribution.

SharpLink Gaming Buys $80 Million Worth of ETH

Institutional accumulation is another major driver behind Ethereum’s rising price. According to recent data, SharpLink Gaming purchased 19,271 ETH worth $80.37 million, bringing its total holdings to 859,295 ETH valued at $3.58 billion.

Such large institutional purchases add upward pressure to Ethereum’s price and signal growing trust from big investors who see Ethereum as the backbone of Web3, tokenization, and decentralized finance (DeFi).

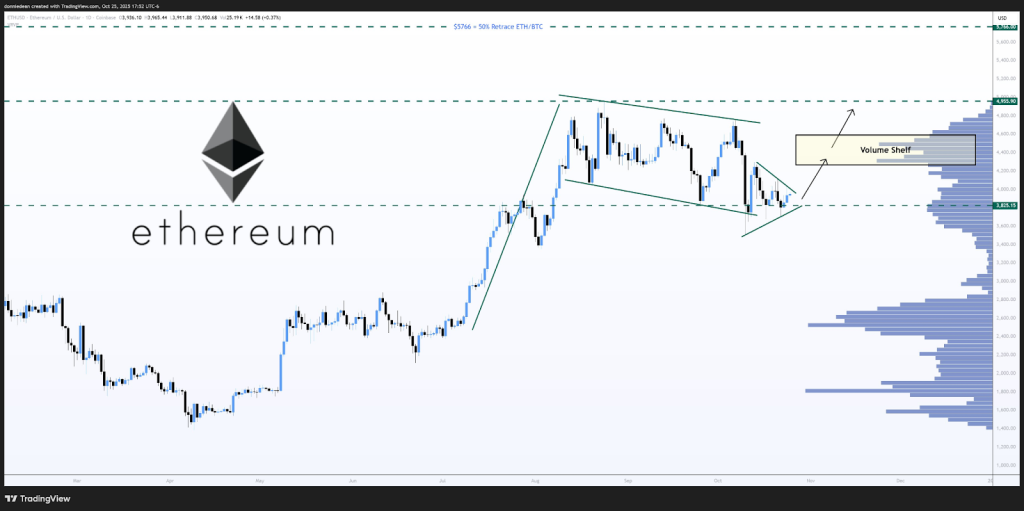

ETH Price Analysis

From a technical perspective, Ethereum’s chart shows a bull flag pattern, which often precedes strong price rallies. Currently, ETH is consolidating near the $3,825 support level within a triangle formation, with key upside targets at:

- $4,500 – First breakout target

- $4,955 – Challenge previous highs

- $5,766 – 50% ETH/BTC ratio

- $6,658 – 0.618 Fibonacci level

- $9,547 – 100% ETH/BTC ratio retrace

If Ethereum breaks out above the $4,100–$4,200 zone, traders could see a rapid move toward $4,500 and beyond.

- Also Read :

- Crypto News Today (Live) Updates : Bitcoin Price, XRP Price Today,Zcash Price,GameStop,Ethereum Price

- ,

Ethereum Entering a “Supercycle”

Fundstrat’s Tom Lee recently told CNBC that Ethereum activity across both L1 and L2 networks is growing fast, but the price hasn’t yet reflected that growth. He believes Ethereum could make a big move by year-end, with increasing adoption and on-chain utility driving momentum.

He even suggested that Ethereum might be in a supercycle similar to Wall Street’s explosive growth phase in 1971. According to Lee, if Ethereum regains its ETH/BTC ratio from 2021 highs, it could reach around $21,000 in the long term.

He added that companies like Larry Fink’s BlackRock and Robinhood are working to tokenize real-world assets, and nearly 70% of that tokenization is happening on Ethereum, solidifying its leadership position.

Ethereum Price Prediction for December 2025

If Ethereum continues mirroring Bitcoin’s post-halving performance ETH could reach between $7,000 and $8,000 by December. With whales accumulating, institutions buying, and strong technicals backing the rally, Ethereum appears to be entering a powerful uptrend.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $9,428.11.

According to our Ethereum Price Prediction 2030, the ETH coin price could reach a maximum of $71,594.69 by 2030.

As per our Ethereum price prediction 2040, Ethereum could reach a maximum price of $4,128,680.

By 2050, a single Ethereum price could go as high as $238,189,500.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.