The US Federal Reserve cut interest rates by 0.25%, the third such cut this year, aiming for a more balanced economy.

Fed Chairman Powell emphasized a cautious approach to further reductions, citing economic data and risks as key determinants.

Despite the rate cut, the US stock and cryptocurrency markets experienced significant declines, with Bitcoin dropping by over 5%.

On December 18, the US Federal Reserve made headlines by cutting its interest rate by 0.25%, just as many had predicted. But what does this rate cut mean for the economy—and for your investments?

In a press conference following the announcement, Fed Chairman Jerome Powell gave insight into the central bank’s next moves, hinting at more caution ahead. While the decision sparked sharp reactions in the markets, including a significant dip in both stocks and cryptocurrencies, the real question is: what’s coming next?

Keep reading to find out how this rate cut is shaking things up.

US Fed Rate Cut & Inflation Goals: What You Should Know

The Fed reduced the Fed Funds rate to 4.5%, marking the third major rate cut this year. The first reduction happened on September 18, lowering the rate to 5%. A second cut followed on November 7, bringing it down to 4.75%.

During the press conference, Powell emphasized that the Fed remains committed to supporting the US economy and the job market.

However, he added that there is no fixed plan for future rate cuts. Any further reductions will depend on key factors, such as new economic data, the outlook for the economy, and risks to inflation.

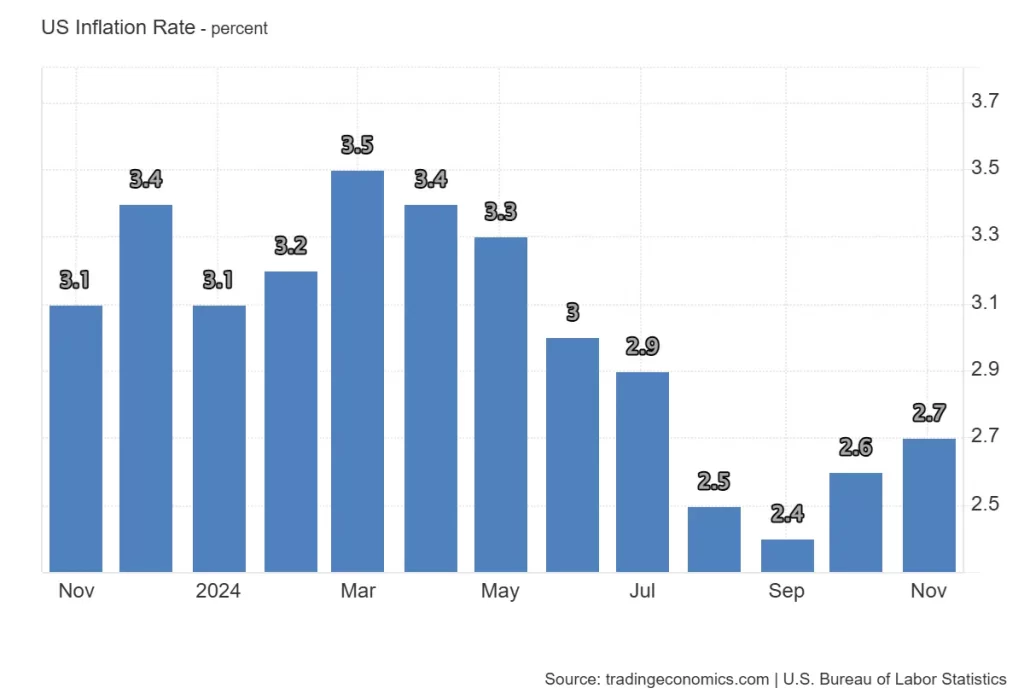

Inflation Trends: Rising and Falling

At the beginning of 2024, the US inflation rate stood at 3.1%. It reached a yearly peak of 3.5% in March before steadily declining to 2.4% by September. However, inflation has been rising again since then, reaching 2.7% in November.

Market Reactions: Stocks and Crypto Plunge

The Fed’s rate cut announcement impacted the markets. On December 18, the cryptocurrency market dropped by about 0.58%. Bitcoin, which started the day at $106,080.05, dropped by 5.85%, closing at $100,207.97. The S&P 500 index also fell sharply by over 2.90%.

After the Fed rate cut, Bitcoin and crypto took a hit, with Bitcoin dropping 5.85% read Bitcoin price prediction to find out what’s next for the market!

Altcoins Face Steeper Challenges

At the beginning of December 18, the total market cap of the crypto market excluding BTC was at $1.53T. At the time of the market closing, it came down to as low as $1.42T, recording a notable decline of 7.74%. In the last 24 hours, Ethereum has declined by over 4.7%, XRP by 6.8%, BNB by 1.6%, Solana by 3.3%, Dogecoin by 6.2%, and Cardano by 4.9%.

In conclusion, the Fed’s hawkish outlook suggests prolonged challenges for markets.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The US Federal Reserve reduced interest rates by 0.25%, lowering the rate to 4.5% on December 18, 2024.

The crypto market dropped by 3.29% to $3.51 trillion after the Fed’s 0.25% rate cut. However, trading volume surged by 34.78% to $265.97 billion, indicating increased activity.