Makina Finance lost 1,299 ETH after hackers drained its DUSD/USDC CurveStable liquidity pool completely.

Blockchain security firm PeckShieldAlert first reported the exploit, confirming losses near $4.2 million total.

No exchange deposits detected yet, while Makina Finance has issued no official update publicly.

Makina Finance, a non-custodial DeFi execution platform, has been hit by a major exploit that resulted in losses of roughly 1,299 ETH, valued at around $4.2 million.

The attack drained a key CurveStable pool, which triggered concerns about fund safety. As of now, there is no update from Makina Finance regarding the hack.

Makina Finance Exploit Drains Curve Pool Funds

According to blockchainsecurity firm PeckShieldAlert, Makina Finance’s DUSD/USDC CurveStable pool was drained through an exploit. The attack targeted the non-custodial DeFi execution engine and led to losses of roughly 1,299 ETH, worth about $4.13 million at the time.

After draining the pool, the attacker quickly converted the stolen tokens into ETH, which offers higher liquidity and easier movement across wallets and the Ethereum network.

This step is commonly seen in DeFi exploits, especially when attackers plan to move large sums without causing immediate alerts.

MEV Builder Used to Hide Transaction Trail

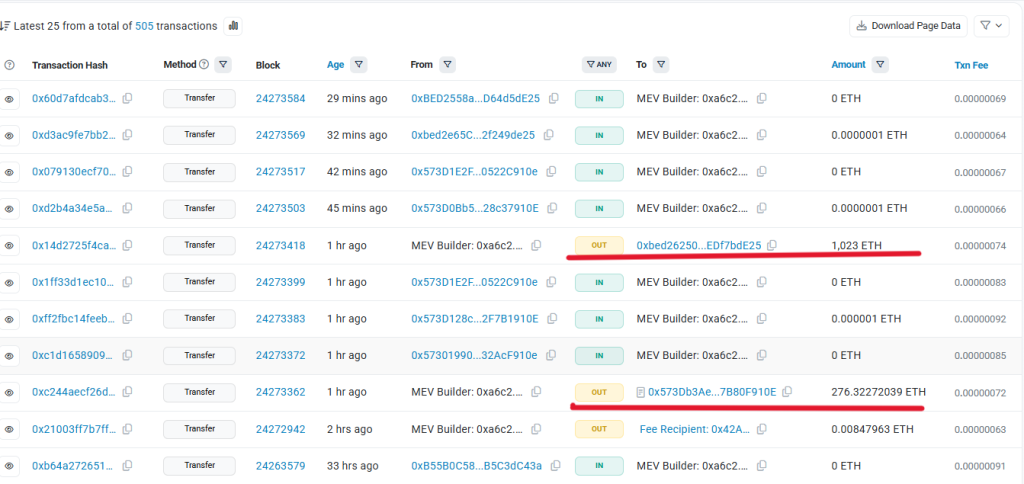

Further on-chain data shows that the hacker routed the ETH through an MEV builder address. This method helps hide transaction paths and makes tracking more difficult, due to blurred transaction patterns.

Following the MEV routing, the ETH was split into two main wallets. One wallet (0xbed….bdE25) currently holds 1,023 ETH, worth around $3.3 million, while a second wallet (0x573….F910E) contains 276 ETH, valued near $880,000.

Meanwhile, the stolen fund is kept in these two wallet, as of now, there is no evidence of funds being sent to exchanges.

No Update From Makina Finance

Until now their is no update from Makina Finance regarding the hack. There has been no confirmation about user impact, recovery efforts, or planned security fixes.

The lack of communication has added to user uncertainty, while investigators continue to monitor wallet activity and track any further movement of the stolen funds.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Makina Finance was exploited through its DUSD/USDC CurveStable pool, resulting in the theft of 1,299 ETH worth around $4.2 million.

The attacker stole roughly 1,299 ETH, valued at about $4.2 million, making it one of the significant DeFi platform hacks in 2026.

Makina Finance has not released any official update regarding the hack, recovery efforts, or security measures, leaving users uncertain.

Investigators usually track wallet activity while platforms assess vulnerabilities and potential fixes. Any recovery or compensation depends on whether funds can be frozen, traced, or voluntarily returned.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates on March 3, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/03170220/Why-Is-the-Crypto-Market-Going-up-Today-Live-Updates-on-March-3-2026-2-390x220.webp)