[Live] Crypto Market News Today: Latest Updates on December 9, 2025 : FED Rate Cut, Pi Network News, Terra Luna And More…….

December 9, 2025 13:33:39 UTC

SharpLink Earns 446 ETH in Weekly Staking Rewards

SharpLink added 446 ETH in staking rewards last week, pushing its total earnings to 8,776 ETH since launching the strategy on June 2, 2025. The company said all ETH remains fully staked using institutional-grade infrastructure, allowing rewards to compound over time. This approach continues to grow treasury value through consistent staking income. The underlying asset is ETH, while SharpLink trades under the ticker $SBET.

December 9, 2025 13:31:43 UTC

PNC Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading

Today marks a key moment for institutional crypto adoption. Coinbase’s Crypto-as-a-Service platform is now powering PNC Bank’s launch of direct bitcoin trading for PNC Private Bank clients. This makes PNC the first major U.S. bank to roll out such an offering. The move shows growing demand from wealthy and institutional clients and highlights how traditional banks are increasingly using trusted crypto infrastructure to enter the digital asset space.

December 9, 2025 13:19:53 UTC

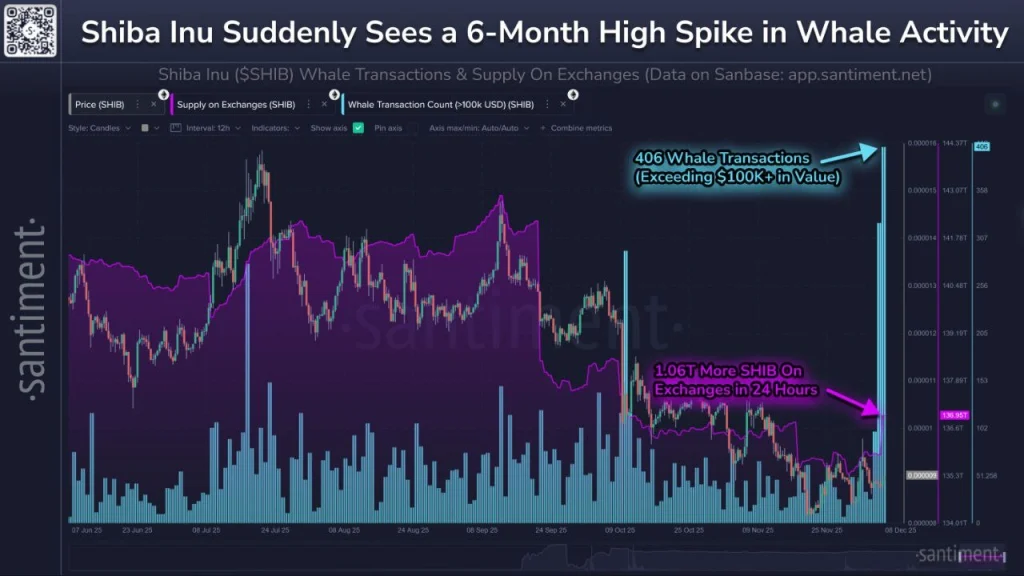

SHIB Sees Record Whale Activity, Volatility Ahead

Shiba Inu ($SHIB) has recorded its highest level of whale transfers since June 6, signaling increased movement by large holders. At the same time, exchanges saw a net inflow of about 1.06 trillion SHIB. This sharp rise in big transactions often points to major positioning shifts. With large amounts of SHIB moving around, the token is likely to see strong price swings and heightened volatility in the coming days.

December 9, 2025 12:25:00 UTC

Trump Says Next Fed Chair Must Deliver Immediate Rate Cuts

President Donald Trump has said that cutting interest rates would be a key requirement for the next Federal Reserve Chair. Trump wants rates lowered quickly, signaling a push for a much looser monetary policy if he influences the next appointment. Trump has long criticized the Federal Reserve for keeping rates too high during his presidency. This time, however, he is making rate cuts a clear condition for future Fed leadership. The comments raise fresh debate over the independence of the central bank, which is expected to make decisions based on economic data rather than political demands.

December 9, 2025 12:25:00 UTC

Cryptocurrencies May Recover as Fed Signals Rate Cut

Bitcoin and other major cryptocurrencies could extend their rebound as the U.S. Federal Reserve is expected to cut interest rates this week, according to IG analyst Chris Beauchamp. Lower rates may encourage fresh inflows into crypto markets, especially after recent declines created more appealing buying levels.Over the weekend, dips in bitcoin and ether attracted buyers, pointing to a possible short-term support. Bitcoin rose 1.5% to $91,541, while ether gained 1.8% to $3,144.

December 9, 2025 12:11:21 UTC

Bitcoin Price Prediction For Today

Bitcoin is moving lower inside a tight descending channel, showing strong sell-side pressure. Price is slowly drifting toward the $76,000–$77,000 support zone, an area that has triggered sharp reactions in the past. Sellers remain in control for now. However, if buyers manage to push price above the channel, momentum could quickly shift and open the door for a stronger recovery move.

December 9, 2025 07:44:33 UTC

Crypto Market Remains in Extreme Fear

The crypto Fear and Greed Index dropped 2 points from yesterday and now sits at 19, keeping the market in “extreme fear.” The 7-day average stands at 23, while the 30-day average is also 19, showing fear has remained steady over time. Sentiment is clearly weak right now. Historically, such low sentiment levels often appear during market bottoms, when risk is high but long-term buying opportunities start to emerge.

December 9, 2025 07:10:58 UTC

ETH Price Reflects Security Value of Ethereum Network

Ethereum’s Proof-of-Stake creates a security budget tied to the total staked ETH. To protect the network, ETH is priced so that the cost of an attack outweighs potential profits. Observations show this balance holds, meaning markets effectively price in the network’s security needs. This explains the link between ETH’s price and the total value secured on Ethereum, providing a natural floor for ETH’s valuation based on the economic security of its ecosystem.

December 9, 2025 07:10:58 UTC

21Shares Amends XRP ETF Filing, Moves Closer to U.S. Approval

21Shares has filed an amended S-1 for its $XRP ETF ($TOXR) with the SEC, signaling progress toward a fully regulated XRP investment product in the U.S. market. This marks a key step in the approval process and highlights growing institutional interest in XRP, showing that demand for regulated crypto investment products continues to build.

December 9, 2025 06:27:41 UTC

Solana Validator Count Drops Sharply, Sparking Debate

Community data shows Solana’s active validators have dropped from over 2,500 in March 2023 to about 800 today, a fall of nearly 68%. Some believe this is positive, saying weak or fake nodes were removed. Others, including infrastructure teams, argue many real validators quit due to high costs and technical pressure. Experts say the real risk to decentralization depends less on raw numbers and more on how evenly stake and voting power are spread among remaining validators.

December 9, 2025 06:24:46 UTC

Bitcoin ETFs See Outflows as Ethereum and XRP Attract Inflows

Data from SoSoValue shows that on December 8 (ET), U.S. spot Bitcoin ETFs recorded net outflows of $60.48 million. This came despite BlackRock’s IBIT leading the day with $28.76 million in inflows. In contrast, spot Ethereum ETFs saw $35.49 million in net inflows. Spot Solana ETFs added $1.18 million, while spot XRP ETFs posted strong inflows of $38.04 million, showing shifting investor interest across crypto funds.

December 9, 2025 05:58:36 UTC

Terra LUNA Surges as Volume Spikes, Speculation Drives Rally

Terra (LUNA) is seeing a sharp price rise as renewed market optimism and heavy trading push the token higher. Traders are betting on upcoming network upgrades, which has lifted short-term confidence. LUNA also broke important price levels, attracting momentum buyers and boosting activity on social platforms. Trading volume has jumped sharply, helping fuel fast moves. However, the rally looks mostly driven by speculation rather than long-term progress, so price swings are likely. Still, the move shows LUNA can react strongly when market focus returns.

December 9, 2025 05:58:36 UTC

Do Kwon Case Nears Verdict, Sending Signal to Crypto Market

Do Kwon’s case has reached a key moment. U.S. prosecutors are seeking a 12-year sentence, while his lawyers want five years, pointing to time already spent in custody. The final decision could shape how regulators worldwide respond to major crypto failures. Meanwhile, LUNA is seeing short-term price swings driven by speculation, not real progress. The bigger takeaway for crypto is clear: rules are tightening, accountability is rising, and legal outcomes will play a major role in future market trust.

December 9, 2025 05:54:19 UTC

Terra (LUNA) Price Jumps as Traders React to Key Events

Terra (LUNA) surged over 20% in the last 24 hours, driven by a mix of news and market signals. Traders are watching Do Kwon’s Dec 11 sentencing, which many see as closing the 2022 collapse chapter. LUNA also gained support from a major v2.18 network upgrade backed by Binance. On charts, the price broke a key level, with strong momentum indicators and a sharp rise in trading volume. Optimism is high, but post-event moves remain key to watch.

December 9, 2025 05:52:43 UTC

XRP’s Global Payments Push Gains Attention, Faces Competition

DAS Research says XRP and Ripple are shaping up as global payment infrastructure, offering fast and low-cost transfers with growing interest from institutions. However, they face tough competition from stablecoins and ongoing regulatory pressure. Future growth depends on RippleNet partnerships, the expansion of stablecoins like RLUSD, and possible ETF approvals. While adoption is rising, DAS notes that direct on-chain usage by banks is still limited, leaving real-world payment volume as a key test ahead.

December 9, 2025 05:51:30 UTC

CFTC Launches Pilot Allowing Bitcoin and Ethereum as Collateral

Acting CFTC Chairman Caroline Pham announced a new pilot program that allows Bitcoin, Ethereum, and USDC to be used as collateral in U.S. derivatives markets. The move supports the use of digital and tokenized assets in regulated trading. Along with this, the Market Participants Division withdrew Staff Advisory 20-34, saying it is no longer relevant. Officials said recent progress in digital assets and new laws like the GENIUS Act made the old guidance outdated.

December 9, 2025 05:43:10 UTC

Vitalik Buterin Says Ethereum Has Fixed a Key Network Weakness

Ethereum co-founder Vitalik Buterin said the Ethereum Foundation earlier paid too little attention to the network layer, focusing more on economics, consensus, and blocks. He admitted that peer-to-peer networking skills were lacking before. However, Vitalik said this has changed now. He highlighted the strong performance of PeerDAS as proof, praising Raul Victor and Ethereum Foundation contributors for their “heroic” work. The new roadmap aims for faster data sharing, better stability, and improved network privacy.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.