Say you’re at a party. Some people are talking about Bitcoin, others about Ethereum, and a few about Solana. They’re all excited about their own blockchains.

But here’s the catch—these blockchains don’t naturally talk to each other. It’s like a room full of people speaking different languages with no translator.

That’s where blockchain bridges come in. They act as translators, allowing blockchains to communicate. Bridges let you transfer assets, like cryptocurrencies, or even information between different blockchains.

What Exactly Is a Blockchain Bridge?

Blockchain bridge is like a literal bridge connecting two islands. Each island is a blockchain with its own unique rules, currencies, and systems. The bridge helps people and resources travel back and forth without getting stuck.

In technical terms, a blockchain bridge is a tool that allows data, tokens, or other digital assets to move from one blockchain network to another. For instance, you might want to use Bitcoin (from the Bitcoin blockchain) on Ethereum’s network.

A bridge makes this possible.

Why Are Blockchain Bridges Important?

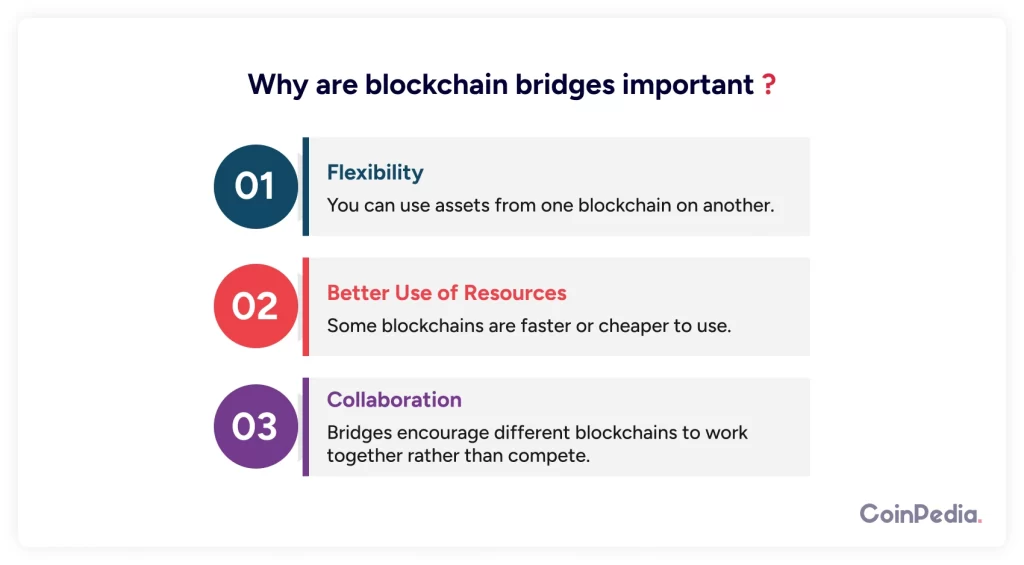

Blockchains are like closed ecosystems. Bitcoin stays on Bitcoin’s blockchain. Ethereum stays on Ethereum’s. But sometimes, you want the best of both worlds. Here’s why bridges matter:

- Flexibility: You can use assets from one blockchain on another. For example, bringing Bitcoin into Ethereum lets you access Ethereum’s smart contracts.

- Better Use of Resources: Some blockchains are faster or cheaper to use. With bridges, you can transfer your assets to a blockchain with lower fees.

Collaboration: Bridges encourage different blockchains to work together rather than compete. This is great for the entire crypto ecosystem.

How Do Blockchain Bridges Work?

Alright, now let’s get into the nuts and bolts. How does a bridge actually transfer something from one blockchain to another? Here’s a step-by-step explanation:

- Locking Assets: When you want to move an asset, the bridge “locks” it on the original blockchain. Let’s say you want to move Bitcoin to Ethereum. The bridge takes your Bitcoin and locks it in a smart contract. Think of it like putting your Bitcoin in a safe.

- Minting a New Token: Once your Bitcoin is locked, the bridge creates an equivalent token on the target blockchain. In this case, it could be Wrapped Bitcoin (WBTC) on Ethereum. This new token represents your original Bitcoin.

- Using the Token: Now, you can use the new token (WBTC) on Ethereum just like any other Ethereum-based token. You can trade it, lend it, or invest in DeFi projects.

- Redeeming the Token: When you’re done, you can redeem your WBTC for the original Bitcoin. The bridge will burn (destroy) the WBTC and release your Bitcoin from the smart contract.

Types of Blockchain Bridges

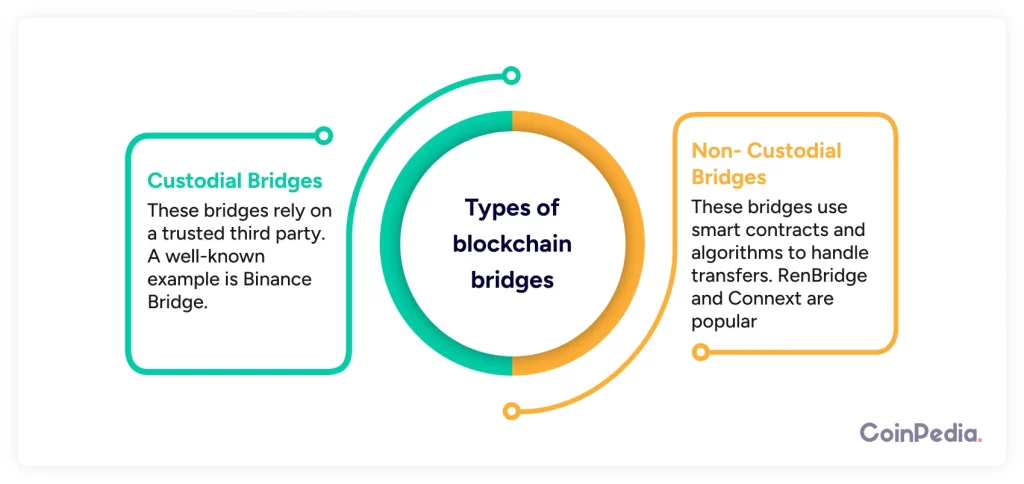

There are two main types of blockchain bridges, and understanding them is key:

- Custodial (Centralized) Bridges: These bridges rely on a trusted third party. A well-known example is Binance Bridge. You trust Binance to hold your assets securely while transferring them.

Pros:- Easy to use.

- Faster transactions.

Cons:

- Trust issues. You’re relying on a third party.

- Centralized control goes against the decentralized ethos of blockchain.

- Non-Custodial (Decentralized) Bridges: These bridges use smart contracts and algorithms to handle transfers. RenBridge and Connext are popular examples.

Pros:- No need to trust a third party.

- Fully decentralized.

Cons:

- More complex to use.

- Sometimes slower and more expensive.

Real-World Examples of Blockchain Bridges

Let’s look at a few examples to see how bridges work in action:

- Wrapped Bitcoin (WBTC): WBTC is a token on Ethereum that represents Bitcoin. It allows Bitcoin holders to access Ethereum’s decentralized finance (DeFi) ecosystem. With WBTC, you can lend your Bitcoin or use it as collateral to earn interest.

- Polygon Bridge: This bridge connects Ethereum to Polygon, a blockchain known for its low fees and fast transactions. By using the Polygon Bridge, you can move assets from Ethereum to Polygon and save on gas fees.

- Avalanche Bridge: This bridge links Ethereum and Avalanche. It’s designed to make transferring assets between these two blockchains simple and cost-effective.

Challenges of Blockchain Bridges

While blockchain bridges are super useful, they’re not perfect. Here are some challenges they face:

- Security Risks: Bridges can be targets for hackers. If a bridge’s smart contract has vulnerabilities, it could lead to stolen assets. For example, the Ronin Bridge hack resulted in the loss of over $600 million.

- High Fees: Using a bridge can sometimes be expensive, especially during network congestion. For instance, transferring assets from Ethereum to another blockchain might involve high gas fees.

- Complexity: For beginners, using a bridge can be confusing. You need to understand the process, wallet connections, and token standards.

Centralization Concerns: Custodial bridges can be a single point of failure. If the organization running the bridge fails or gets hacked, your assets might be at risk.

The Future of Blockchain Bridges

Blockchain technology is evolving fast, and bridges are no exception. Developers are working on:

- Interoperability Protocols: Projects like Polkadot and Cosmos aim to make blockchains natively interoperable without needing bridges.

- Improved Security: Advanced cryptographic techniques, like zero-knowledge proofs, are being used to make bridges safer.

- Simpler Interfaces: User-friendly designs will make bridges more accessible, even for non-tech-savvy users.

Are Blockchain Bridges Safe?

You might be wondering, “Are these bridges safe to use?” The answer is: it depends. Like any technology, the safety of a blockchain bridge depends on how well it’s built and maintained. Here are some tips to stay safe:

- Do Your Research: Choose bridges with a good reputation and positive reviews.

- Start Small: If you’re using a bridge for the first time, test it with a small amount.

- Stay Updated: Follow news about the bridge you’re using. Security updates or warnings are important.

- Use Decentralized Bridges When Possible: They’re generally more transparent.

What Next?

So, there you have it—a friendly guide to blockchain bridges! They’re essential tools that make the crypto world more connected and versatile. Whether you’re a Bitcoin fan, an Ethereum enthusiast, or someone exploring newer blockchains, bridges open up exciting possibilities.

Just remember, like crossing any bridge in real life, it’s important to tread carefully. Do your research, stay informed, and enjoy exploring the interconnected world of blockchain.

FAQs

A blockchain bridge allows assets or data to move between different blockchains by locking tokens and minting equivalent ones on the target network.

Blockchain bridges enable interoperability, allowing users to access benefits of multiple blockchains like faster transactions and lower fees.

Custodial bridges rely on a trusted third party, while non-custodial bridges use smart contracts for decentralized transfers without intermediaries.

Blockchain bridges are safe when using reputable platforms. However, always check for security updates and use decentralized bridges for added transparency.

Well Done! You have now completed the Lesson.

Complete the Quiz and Get Certified! All The Best!

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Disclaimer and Risk Warning

The information provided in this content by Coinpedia Academy is for general knowledge and educational purpose only. It is not financial, professional or legal advice, and does not endorse any specific product or service. The organization is not responsible for any losses you may experience. And, Creators own the copyright for images and videos used. If you find any of the contents published inappropriate, please feel free to inform us.