Analyst Timothy Peterson predicts BTC could reach $200,000 by June 2026, possibly even higher.

Bitcoin’s 10-year seasonality shows strongest performance from October to June, signaling potential major gains.

Meanwhile, currently BTC price struggles under $110,500 resistance, with potential downside toward $105,000 support.

Bitcoin, the pioneer cryptocurrency, has slipped to a four-week low, trading under $109,500, leaving many traders anxious about its next move. But veteran analyst Timothy Peterson believes the drop could just be part of a bigger setup.

Using Bitcoin’s 10-year seasonality trends, he suggests the BTC to climb as high as $200,000 by June 2026, and even higher if seasonality repeats.

Bitcoin Bull Run Timeline

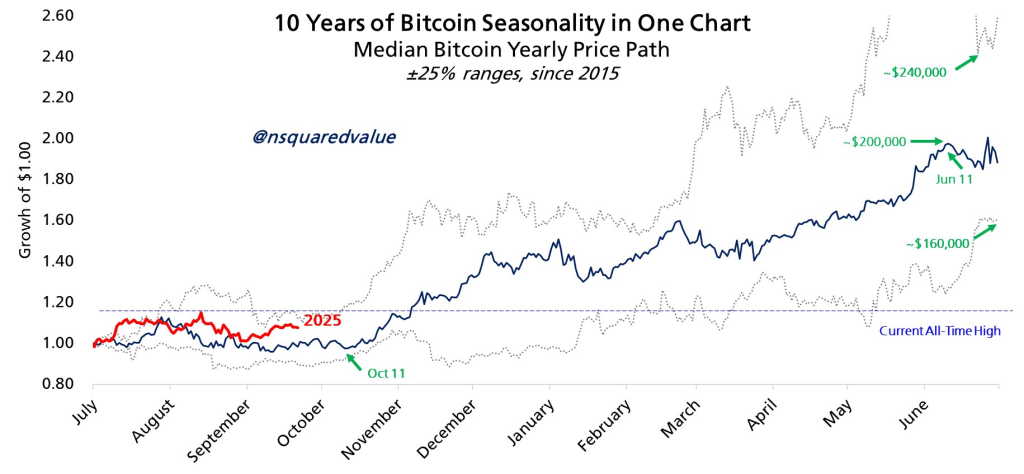

In his analysis, Peterson highlighted Bitcoin’s 10-year seasonality chart, which tracks the asset’s typical behavior over the course of a year. Instead of looking at the calendar year, he shifted the timeline by six months to better capture Bitcoin’s bull cycles.

According to his research, Bitcoin’s strongest performance window runs from October 11 to June 11. Historically, this period has produced the steepest gains in Bitcoin’s cycle.

If history repeats itself, Bitcoin could climb at an average pace of 7% per month, which works out to around 120% yearly gains.

Bitcoin Price Prediction

According to analyst Peterson, Bitcoin now has a 50% or higher chance of reaching $200,000 by June 2026. That would mean the price would nearly double from current levels in less than a year.

In a stronger rally, the move could stretch even further, with Bitcoin potentially climbing toward $240,000 later in the cycle.

Peterson also highlighted early November as a key period to watch, since Bitcoin has a history of breaking into new all-time highs around that time. Therefore, Peterson suggests that a more cautious move could see Bitcoin climb toward $160,000 as the first major milestone.

BTC Price Forecast – Short Term

As of now, Bitcoin price is trading at $109,422, down 3% in the past 24 hours, erasing billions from the market. Meanwhile, a key factor that analysts are watching closely is the Short-Term Holder (STH) Cost Basis, currently at $111,500.

This level is increasingly seen as a critical line between bullish and bearish market behavior. Thus, the immediate support lies at $108,600, with stronger support near $108,000.

A break below these levels may accelerate the downturn, potentially dragging Bitcoin toward the $105,000 zone, which could spark a wider market panic.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The current drop is a short-term correction. Analysts view it as a potential setup within a larger cycle, with key support levels being tested around $108,000.

The immediate focus is on the $111,500 level. Holding above key supports like $108,600 is crucial to avoid a deeper correction toward $105,000 in the near term.

Historical data indicates Bitcoin’s strongest performance period typically runs from mid-October to mid-June, suggesting the next major bull phase could be approaching.

Based on 10-year seasonality trends, analysis suggests Bitcoin has a strong chance of reaching $200,000 by June 2026, implying significant growth from current levels.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.