Gold rally nearing mature phase raises expectations for delayed but strong Bitcoin price breakout.

Past cycles show Bitcoin surged sharply after gold peaked in 2017 and 2021

Historical patterns suggest Bitcoin could jump nearly 400% if cycle repeats.

Gold has started 2026 with a powerful rally, with a strong rally, hitting a new all-time high near $5,000 per ounce. In just the first 23 days of the year, gold is up by 13.5%, while Bitcoin has mostly moved sideways.

Despite this gap, veteran crypto experts believe Bitcoin could be setting up for a parabolic surge, and here’s why.

Geopolitical Tensions Fuel Gold Price To Hits $5,000

The recent jump in gold price came after Donald Trump said the U.S. had deployed naval ships toward Iran, increasing fears of wider conflict. These events made investors more cautious and pushed them toward safer assets, with gold seeing the strongest demand.

Even three days earlier, Trump also warned about possible tariffs on the European Union linked to talks around U.S. access to Greenland through NATO.

Alongside geopolitics, strong buying from central banks has continued to support prices. Many countries are increasing gold reserves as they reduce dependence on the U.S. dollar.

This de-dollarisation trend has helped gold nearly triple from around $1,900 in late 2023 to today’s $5,000 level.

Bitcoin Falls Behind as Gold Outperforms

While gold continues to rise, Bitcoin has struggled to keep pace. The Bitcoin-to-gold ratio has fallen to multi-year lows, with one Bitcoin now equal to about 18 ounces of gold. This clearly shows how much gold has outperformed crypto during this risk-off period.

Meanwhile, critics like Peter Schiff continue to point out that Bitcoin has lagged behind gold since 2021, raising doubts about its role as a long-term store of value.

Bitcoin Could Explode 400% Next

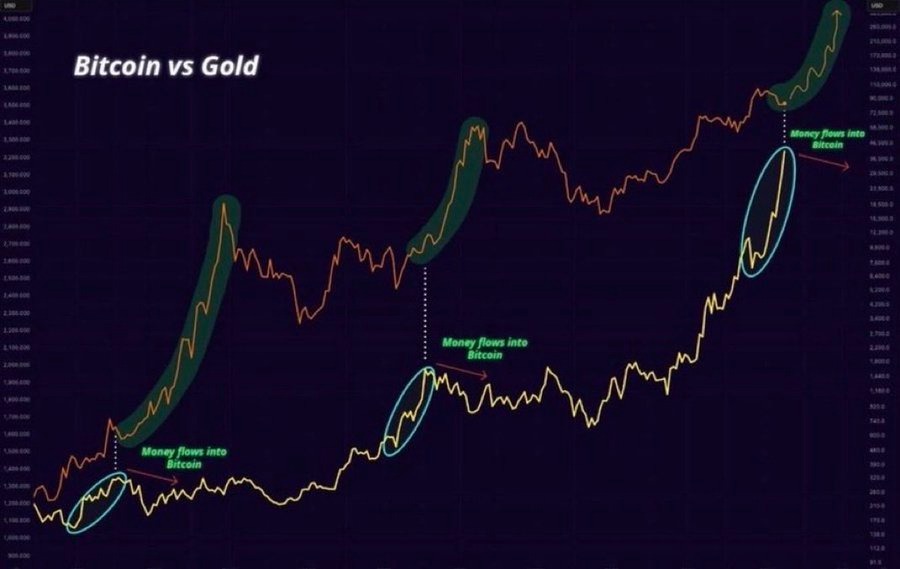

Despite Bitcoin lagging behind gold, many crypto supporters remain optimistic. Crypto trader Crypto Gems points to a familiar pattern: when gold reaches its peak, money often starts moving into Bitcoin, leading to strong rallies.

According to the Bitcoin vs Gold chart, this shift may already be starting. Gold has been rising for almost 28 months, which suggests the rally may be getting close to its top.

Earlier in 2017, when gold rose 30%, Bitcoin jumped 1,900%. A similar move happened again in 2021.

With gold still strong and Bitcoin quiet, Crypto Gems believes the next Bitcoin rally could be starting. Based on past trends, traders now expect Bitcoin to rise by around 400% if history repeats.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

In past market cycles, prolonged gold rallies have been followed by capital moving into higher-risk assets. Bitcoin often benefits once investors shift from capital preservation to growth.

Not necessarily. Short-term divergence is common during geopolitical stress, when traditional safe havens dominate before risk appetite returns.

Traders typically watch the Bitcoin-to-gold ratio, on-chain activity, and liquidity conditions. A reversal in these indicators could suggest capital rotation is underway.

Macro-focused investors and portfolio managers are most affected. The relationship can influence asset allocation decisions between commodities, crypto, and risk assets.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.