December 10, 2025 12:10:35 UTC

When Is the Next Fed Meeting?

Today marks the Fed’s rate cut decision, with recent data reinforcing expectations for policy easing. The focus is on Wednesday’s FOMC announcement and Chair Powell’s remarks, which will shape near-term market direction. While official projections remain cautious, markets are pricing in a more dovish path, anticipating around three rate cuts by 2026, signaling expectations for easier financial conditions over the medium term.

December 10, 2025 12:07:17 UTC

BTC Price–OI Divergence Raises Caution Ahead of FOMC

Bitcoin price action continues to diverge from open interest, signaling caution beneath the surface. With the market still structurally driven by derivatives, the ongoing rally could struggle to sustain itself if rate-cut expectations weaken ahead of the FOMC meeting. Elevated leverage without strong spot conviction increases the risk of volatility, making macro signals and Fed messaging critical for BTC’s next directional move.

December 10, 2025 11:30:46 UTC

FOMC Rate Cut Today: What Markets Could Do

The FOMC interest rate decision is set for 2:00 p.m. ET today, with a 25 bps cut largely expected at 90% probability. Fed Chair Jerome Powell’s press conference will follow at 2:30 p.m. ET, and any mention of QE or future liquidity support could push markets sharply higher. If the Fed signals further cuts or balance-sheet support, risk assets may rally. A neutral tone could create short-term volatility, while a hawkish stance due to inflation worries could trigger a market sell-off.

December 10, 2025 11:16:55 UTC

Japan in Focus: BOJ Meeting Could Stir Volatility

All eyes are on Japan ahead of the 19 December BOJ meeting, as government bond yields climb to multi-decade highs. USDJPY carry trades are crowded, and any unexpected policy shift could trigger broader cross-asset volatility. Bitcoin and other risk assets remain vulnerable despite appearing calm, trading in a narrow 90K–93K range year-to-date. Corporate balance-sheet buying provides some support, but markets remain sensitive to both Fed and BOJ developments in the coming weeks.

December 10, 2025 11:13:33 UTC

FOMC Tonight: Powell Speech to Set Risk Tone

Markets are eyeing tonight’s FOMC decision, where a widely anticipated rate cut could be overshadowed by Powell’s comments. His Speech will likely dictate near-term risk appetite, especially with limited fresh data and key releases pending. While the rate move is mostly priced in, investors are watching for cues on policy direction in 2026. Any hints of further accommodation could prompt renewed buying, while cautious signals may maintain sideways or muted action across crypto markets.

December 10, 2025 11:13:33 UTC

Bitcoin Holds Steady Around $92K Amid Mixed Market Sentiment

$BTC is trading around $92K, showing a steadier tone as recent selling eases. ETF flows turned slightly positive at $56.5M after heavy outflows in November, but traders remain cautious across derivatives markets. Overall, Bitcoin is moving sideways, with sentiment restrained despite short-term relief. While some institutional buying continues, the market remains hesitant to add risk ahead of upcoming macro events and the FOMC meeting later today.

December 10, 2025 11:08:01 UTC

$8B in Shorts Could Liquidate as FOMC Sparks Bitcoin Rally

A $10% BTC pump could wipe out $8 billion in short positions, setting the stage for massive market moves. Today’s FOMC meeting is the key catalyst, with traders watching closely for any hints of QE or further easing. If Powell signals liquidity support, risk assets, including Bitcoin, could surge sharply, triggering short squeezes and fueling a strong upward momentum. Market participants are bracing for high volatility around the announcement.

December 10, 2025 11:06:03 UTC

QE Hints and Powell’s Future Could Move Markets

The market is watching for potential MBS or T-bill purchases, signaling minor QE, which would boost risk assets. Looking ahead to Q1–Q2 2026, stability is likely unless Powell resigns and Hasset takes over, which could trigger a swift risk-on move. Unexpected scenarios, like no rate cut or a hawkish statement, could cause sharp sell-offs, making a January cut nearly guaranteed. Traders might position aggressively into ETH, holding through early-to-mid January for optimal gains.

December 10, 2025 11:06:03 UTC

Dot Plot in Focus: How Many Rate Cuts Are Ahead?

All eyes are on the FOMC dot plot as markets seek clues on future rate cuts. Investors will assess the number of cuts projected for 2025 and beyond. Even with today’s expected 25 bps cut, forward guidance could shift sentiment significantly. Traders are watching for subtle changes, as any hint of faster easing could fuel risk appetite, while a cautious outlook may keep markets steady, waiting for clear direction from Powell.

December 10, 2025 11:04:21 UTC

FOMC 25bps Cut Already Priced In – Statement Tone Will Drive Markets

Markets are bracing for today’s FOMC decision, with a 25 bps cut largely priced in. If the Fed surprises with a bigger cut, markets could spike, but that’s unlikely. Instead, the statement’s tone is key — bold messages like “employment matters more than inflation” could move markets immediately. A bland statement may result in muted action, leaving traders focused on nuances and market positioning ahead of Powell’s press conference.

December 10, 2025 11:00:23 UTC

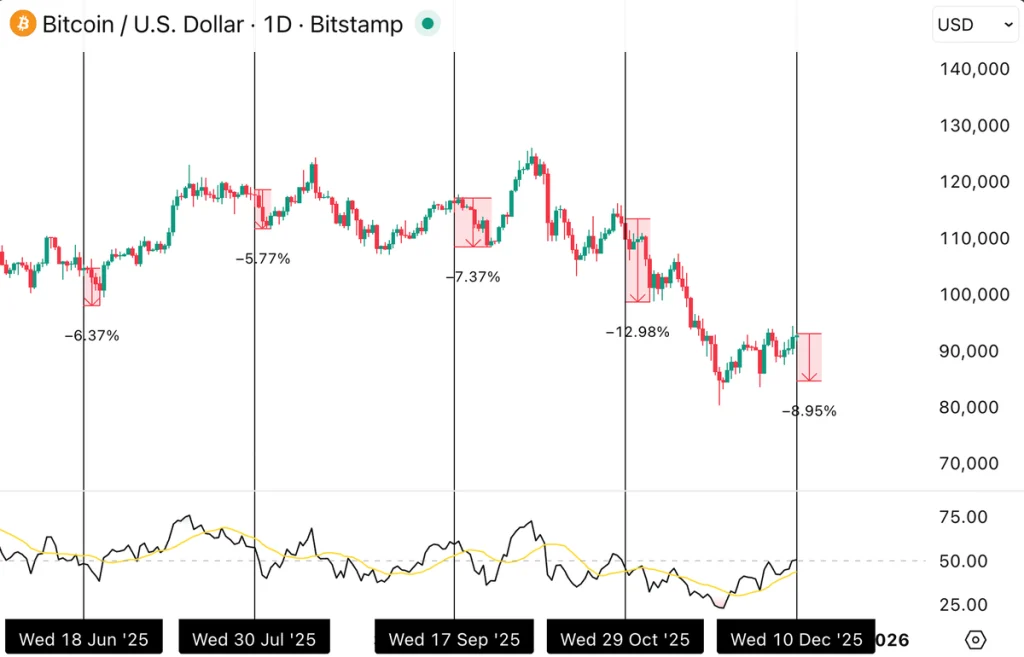

FOMC Rate Cut Hype vs. Reality: Bitcoin’s Pattern Says Caution

A rate cut is expected today, and much of Crypto Twitter is calling for a massive pump. But the chart tells a different story. Across the last four FOMC meetings, Bitcoin saw sharp sell-offs: -7% (June 18), -6% (July 30), -9% (Sept 17), and -12% (Oct 29). With a 99% probability of a cut already priced in, there’s little reason to expect a different outcome. If the pattern holds, BTC could revisit the $88K zone.

December 10, 2025 10:55:51 UTC

Bitcoin Holds Bullish Structure as FOMC Volatility Looms

Bitcoin price continues to support my bullish bias, with the structure favoring a strong upside breakout in the coming week. Ideally, I’d like to see $91.5K hold as support, but for now, the more important factor is avoiding choppy, low-conviction price action. FOMC days are often misleading. Price often moves just enough to trap both bulls and bears before the real direction emerges. So even a dip toward $91K wouldn’t change the bigger picture for Bitcoin.

December 10, 2025 10:54:47 UTC

What Time is the FED Meeting Today?

The FOMC meeting will take place on December 9–10. The Federal Reserve will release its policy statement at 2:00 p.m. ET on December 10, followed by a press conference led by Fed Chair Jerome Powell. For Indian markets, the announcement is scheduled for 12:30 a.m. IST on December 11.

December 10, 2025 10:51:59 UTC

Hawkish Rate Cut in Focus as Fed Signals Caution

Markets are braced for what’s widely seen as a “hawkish rate cut,” with expectations centered on a 25 bps reduction that would bring rates to 3.50%–3.75%. Any outcome short of added hawkish signals could be read as dovish. Dissenting votes are likely, highlighting growing divisions within the Fed. The dot plot may show resistance to further easing beyond this move, while economic projections should see only minor tweaks. Powell is expected to stick to a data-dependent stance, avoiding clear guidance on future cuts.

December 10, 2025 10:51:59 UTC

Bitcoin Price Ahead of FOMC Meeting Today

Bitcoin Price has printed a fresh higher high, reinforcing bullish momentum as the $91,000–$93,000 range flips back into strong support ahead of the crucial FOMC meeting. Buyers remain in control, signaling confidence despite looming macro uncertainty. With liquidity improving and risk appetite returning, the setup favors further upside. If Fed Chair Jerome Powell avoids hawkish surprises, Bitcoin could stay on track for a decisive push toward the $100,000 milestone

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2025/03/17174037/Why-Crypto-Market-Is-Going-Up-Today-Top-Factors-Driving-Prices-Higher-390x220.webp)