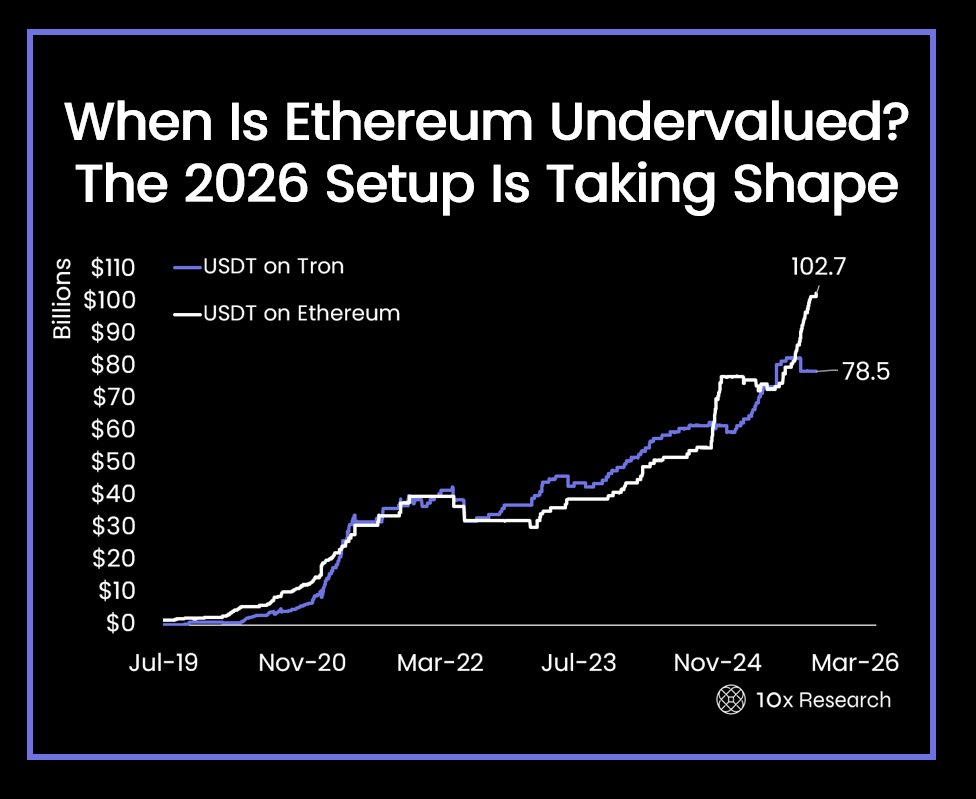

10x Research predicts Ethereum forming a strong setup for a major 2026 breakout rally.

Ethereum’s on-chain liquidity doubles as USDT supply surges past $102 billion since election.

ETH price holds above $3,580, with key resistance levels at $3,650 and $3,920.

While most traders are chasing short-term market pumps, a quiet structural shift is taking place behind the scenes, and it’s forming around Ethereum. According to 10x Research, stablecoin inflows and staking activity are showing signs of a major structural setup that could shape Ethereum’s next big move heading into 2026.

Liquidity Is Returning to Ethereum

Despite Ethereum’s slow price performance in recent months, on-chain liquidity tells a very different story.

Data from 10x Research shows that USDT (Tether) supply on Ethereum has surged from $54 billion to over $102 billion since President Trump’s election. That’s almost a doubling of liquidity, quietly flowing into Ethereum’s ecosystem while market attention remains elsewhere.

Meanwhile, Tron, which had long dominated stablecoin activity due to lower fees, is now falling behind. The steady rise in Ethereum-based USDT suggests that capital is shifting back to the Ethereum ecosystem, potentially laying the groundwork for a major recovery phase.

Institutional Eyeing For Ethereum

Behind this liquidity shift is a broader regulatory and institutional trend. U.S. crypto policy under the new administration has started to favor transparent, on-chain activity, a development that plays directly into Ethereum’s strengths.

At the same time, major staking providers like P2P Validator, which oversees more than $10 billion in assets, are making staking easier and more secure for institutional investors.

This is helping Ethereum become the hub for both liquidity and yield, a combination that could strengthen price momentum once market confidence grows.

The 2026 Setup Is Forming

While price charts may still look dull, the network’s fundamentals, liquidity, staking, and policy support are aligning for what could be a massive breakout phase by 2026.

Ethereum might look quiet for now, but history shows that the biggest moves often begin in silence.

As of now, ETH is trading around $3,580, holding well above the $3200 resistance level. If the recovery continues, resistance levels to watch are $3,650, $3,710, and potentially $3,920.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

USDT on Ethereum has nearly doubled, signaling returning liquidity as traders and institutions move capital back into the network.

Large staking platforms simplify secure participation, attracting institutional funds and supporting Ethereum’s long-term growth potential.

Yes, rising liquidity, staking activity, and favorable regulations are aligning, setting up a potential recovery and price surge by 2026.

Ethereum’s growing stablecoin liquidity, institutional support, and on-chain transparency are making it more attractive than Tron for capital flows.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.