The Trump administration is considering a zero capital gains tax for US-based cryptocurrency projects, potentially making them more attractive to investors.

Non-US crypto projects may face a 30% capital gains tax, creating a clear tax advantage for US-based ventures.

The policy could significantly boost US crypto innovation, making the country a key player in the global blockchain industry.

The United States is preparing to introduce a significant tax relief policy aimed at boosting crypto innovation and attracting investment. Eric Trump, son of President Donald Trump

Donald Trump

Donald J. Trump is a US-based business tycoon, pro-crypto politician, and 47th (present) President of the United States. He comprehends the significance and needs of the modern fintech world, and people look up to him as a dominant pro-crypto politician.

Once doubtful about Bitcoin's dominance, he said in a tweet in 2019, “I am not a fan of Bitcoin", but now has a significant amount of cryptocurrency holdings in his pool. He has also signed an Executive Order to establish a Strategic Bitcoin Reserve, which highlights his commitment to the future of cryptocurrency.

Quick Facts

Full name Donald John Trump Birth 14-06-1946, New York, United States Nationality American Education BS from the University of Pennsylvania Famous For Business, Politics

Donald Trump - Career Highlights & Events

2016 – Elected as the 45th President of the United States from the Republican Party. 2017 – Signed the Tax Cuts and Jobs Act, impacting investment environments 2019 – Slammed crypto king Bitcoin on X, calls it "not money". 2025 – A gala party was hosted by him for the top 220 Trump meme coin holders. President recently suggested that the Trump administration might introduce a zero capital gains tax policy specifically for cryptocurrency projects.

Donald Trump

Donald J. Trump is a US-based business tycoon, pro-crypto politician, and 47th (present) President of the United States. He comprehends the significance and needs of the modern fintech world, and people look up to him as a dominant pro-crypto politician.

Once doubtful about Bitcoin's dominance, he said in a tweet in 2019, “I am not a fan of Bitcoin", but now has a significant amount of cryptocurrency holdings in his pool. He has also signed an Executive Order to establish a Strategic Bitcoin Reserve, which highlights his commitment to the future of cryptocurrency.

Quick Facts

Full name Donald John Trump Birth 14-06-1946, New York, United States Nationality American Education BS from the University of Pennsylvania Famous For Business, Politics

Donald Trump - Career Highlights & Events

2016 – Elected as the 45th President of the United States from the Republican Party. 2017 – Signed the Tax Cuts and Jobs Act, impacting investment environments 2019 – Slammed crypto king Bitcoin on X, calls it "not money". 2025 – A gala party was hosted by him for the top 220 Trump meme coin holders. President recently suggested that the Trump administration might introduce a zero capital gains tax policy specifically for cryptocurrency projects.

But will this policy benefit only US-based projects, or will non-US ventures also see relief?

Zero Capital Gains Tax for US Crypto Projects

Reports indicate that US-based crypto projects, including popular ones like XRP and HBAR, will benefit from the zero capital gains tax policy. This announcement has stirred excitement in the crypto industry, with many believing that the policy could make US-based projects even more appealing to investors and developers.

Non-US Projects Left Behind

However, the policy is unlikely to offer any relief to non-US crypto projects. Eric Trump stated that these projects would be subject to a 30% capital gains tax. This creates a clear tax divide between US-based and non-US ventures, raising concerns about the potential impact on global crypto competition.

US-based Crypto Projects: An Overview

Experts believe the sharp difference in tax rates is designed to give US projects a competitive edge while encouraging crypto companies to establish operations within the United States. The total market cap of US-linked cryptocurrencies now stands at $550 billion, with a 24-hour trading volume of $37.47 billion.

The “Made in USA” category includes cryptocurrencies with strong ties to the United States. The top ten cryptos in this category by market cap are XRP, Solana, USDC, Cardano, Chainlink, Avalanche, Stellar, Hedera, Sui, and Polkadot.

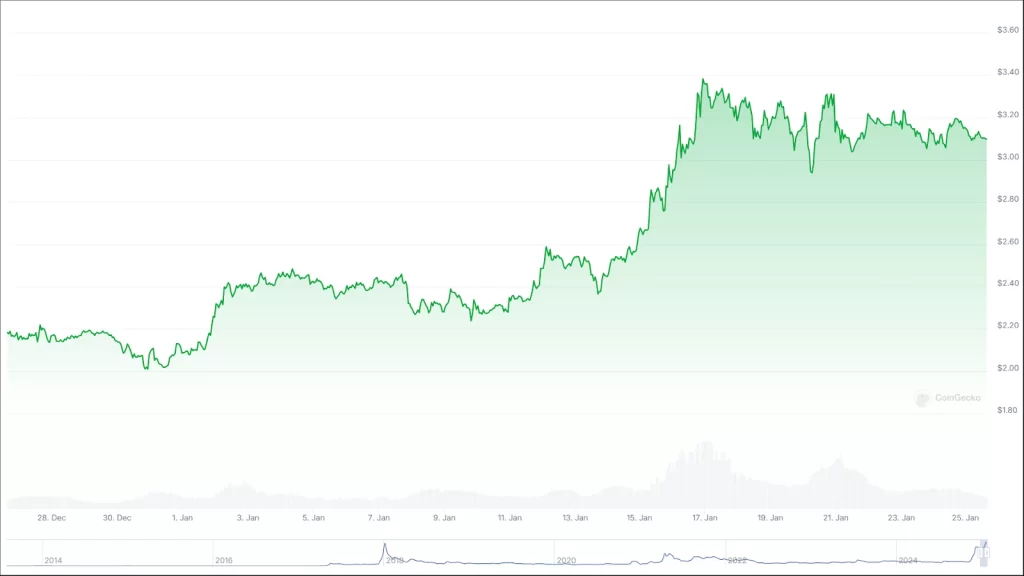

Positive Trends for US-Based Cryptos

Over the past 30 days, most of the top ten cryptos in this category have shown strong growth. XRP has risen by 42%, Solana by 31.7%, and Cardano by 12.3%. Chainlink, Stellar, and Hedera have also experienced positive movements. However, not all US-based cryptos have performed equally well—Avalanche, Sui, and Polkadot saw declines during this period.

In conclusion, the Trump administration’s proposed crypto tax relief policy could be a game-changer for the industry. If implemented, it could create a favorable environment for US-based crypto projects, while potentially challenging non-US players.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The coming months will determine whether this tax relief can turn the US into the ultimate destination for crypto innovation.