Bitcoin remains trapped between $112K and $113K as traders await new market triggers.

CryptoQuant shows CME futures, options, and Binance funding rates indicate cautious investor sentiment.

Meanwhile, U.S. economic reports this week could drive Bitcoin above $118K or down $107K.

Bitcoin kicked off the week with a sharp drop, slipping under $112K and wiping out last week’s one-month high. Since then, the price has been stuck in a tight range between $112K and $113K, leaving traders restless.

Many are now waiting to see Bitcoin’s next move, as investor caution grows ahead of three key U.S. economic reports this week, which could decide Bitcoin’s next big move.

What the Charts Are Showing

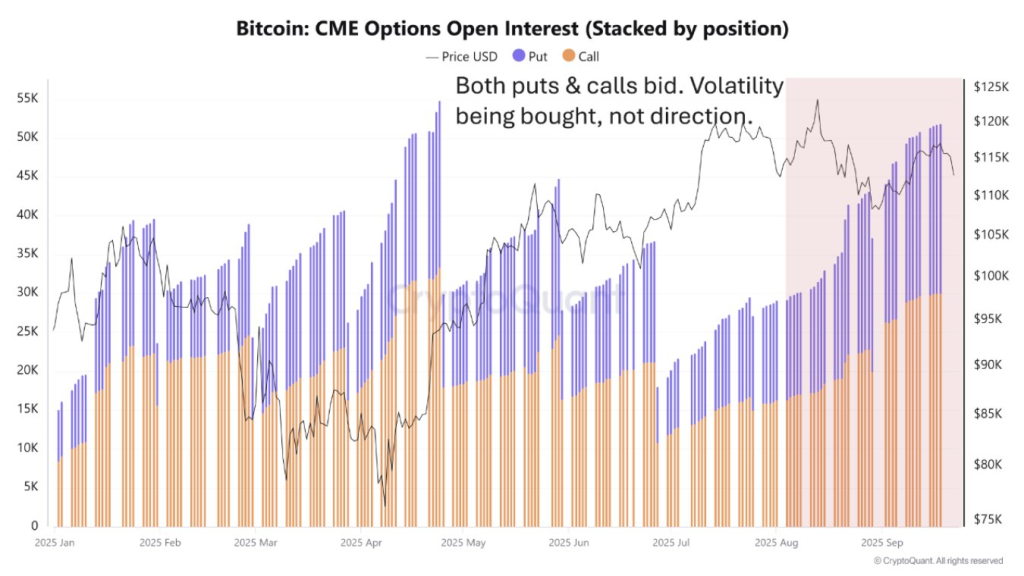

CryptoQuant’s analysis highlights three key indicators: CME futures, CME options, and Binance funding rates. Each of them tells the same story, investors are cautious, preparing for volatility, but not yet choosing a clear direction.

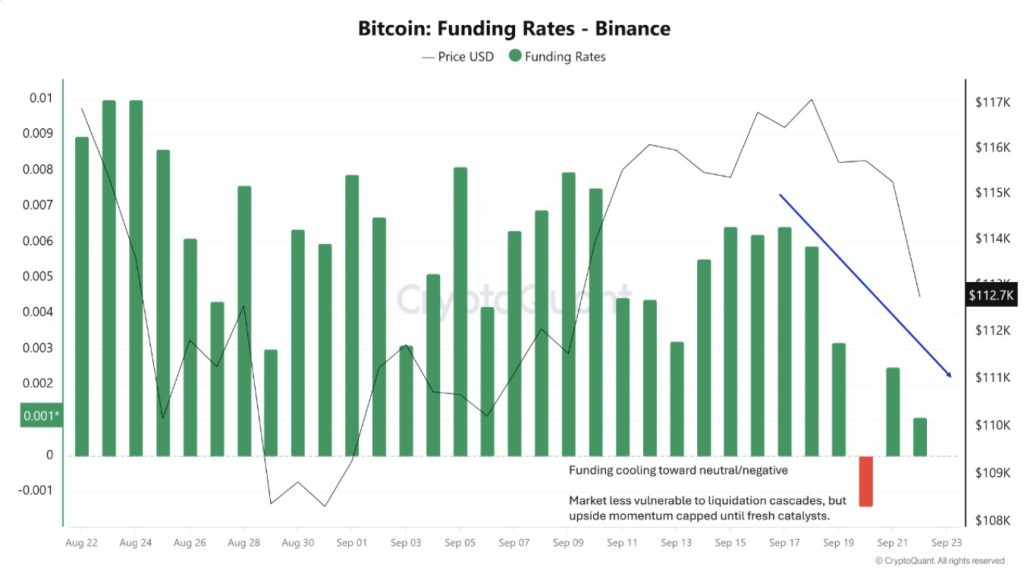

On Binance, funding rates have dropped toward neutral and even dipped slightly negative. This shows that bullish traders are no longer taking heavy risks. The good news is that the market is less likely to face sudden liquidation crashes.

But the bad news is that without strong long bets, Bitcoin also struggles to gain upward momentum unless new triggers appear.

CME Futures and Options Activity

Looking at CME, the go-to platform for institutional traders, CME futures open interest is sitting in the October–November expiry window. This suggests professional traders are hedging, not chasing rallies, waiting for clarity before making directional bets.

Meanwhile, CME options open interest tells another story. CryptoQuant Research notes a rise in both calls and puts, meaning traders are buying volatility instead of betting on one side.

As a result, Bitcoin stays trapped in a narrow band until some strong event breaks the balance.

US Economic Data Could Trigger Breakout

What makes the current Bitcoin situation even more delicate is the timing. The next few days are packed with heavy U.S. economic data. On Thursday, Jobless Claims, GDP, and Durable Goods Orders will hit the wires, giving investors a clearer picture of whether the U.S. economy is cooling down or still running hot.

Then on Friday, traders will get the Fed’s favorite inflation gauge, Core PCE, alongside consumer sentiment data.

If the numbers point to stronger inflation, Bitcoin could be dragged toward $107K. But if data shows the economy slowing and inflation easing, markets may expect an early Fed rate cut.

This could weaken the dollar and push Bitcoin toward $118K or more.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin is consolidating because traders are cautious, awaiting key U.S. economic data that will influence the Federal Reserve’s future interest rate decisions.

Strong inflation data could push Bitcoin lower, while signs of a cooling economy could boost prices on expectations of a sooner Fed rate cut.

A slightly negative funding rate indicates reduced bullish leverage, which lowers crash risk but also means upward momentum needs a fresh catalyst

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.