$647M liquidated as bulls get trapped amid Middle East conflict-driven sell-off

Crypto market cap dips to $3.1T, BTC and ETH lead losses as fear grips traders

RSI hits 38.41, Bollinger Band breached, technical signs hint at relief bounce

The crypto market today is facing turbulent waters following an escalation in Middle East tensions. After U.S. airstrikes targeted three major Iranian nuclear sites, President Donald Trump declared the attacks a “success,” warning of intensified retaliation if provoked. These strikes come after a week of conflict between Israel and Iran, rattling global markets.

Against this geopolitical backdrop, the market capitalisation of the industry dropped 1.50% to $3.1 trillion. Trading volume spiked 26.23% to $136.38 billion as volatility followed with full force. Bitcoin is down 1.27% at $101,497.55, Ethereum lost 1.99% to trade at $2,241.94, and XRP slipped 2.52% to $2.02. Talking about sentiments, the Fear & Greed Index dropped to 37, highlighting growing investor anxiety.

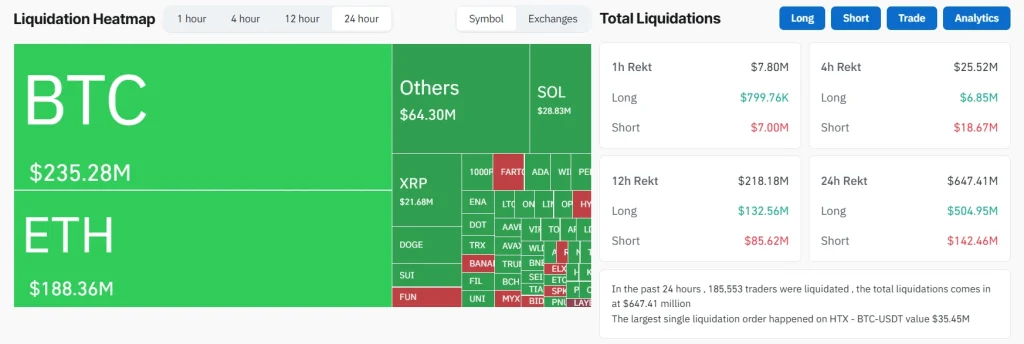

Crypto Liquidations Today Surge to $647M

In the past 24 hours, total crypto liquidations rose to $647.41 million, affecting over 185,000 traders. Of these, long positions accounted for a whopping $504.95 million, indicating that bullish traders were caught off guard by the swift price reversal. It is worth nothing that the largest liquidation was a $35.45 million BTC-USDT long on HTX.

Bybit led the exchanges with $252.46 million in liquidations, followed by Binance at $137.57M and Gate with $96.57M. The majority of liquidated positions were long, with ratios as high as 95.14% on Bitmex and over 90% on Bitfinex and CoinEx. Which signal a strong bias toward expecting upward price movement that ultimately collapsed.

Crypto Market Cap Analysis

The total crypto market cap currently sits at $3.09 trillion, recovering slightly from an intraday low of $3.04T. Technically, the price touched the lower Bollinger Band, suggesting potential oversold conditions. The RSI at 38.41 also hints at bearish exhaustion, with room for a short-term relief bounce.

However, the market remains below the 20-day SMA of $3.23T, confirming ongoing downward pressure. With BTC dominance at a cycle-high of 64.9%, altcoins are underperforming. ETH dominance has slipped to 8.7%, reflecting broader weakness across major Layer 1s.

While the market has witnessed the wrath of external influences, the business still has top gainers in this chaotic session. Which include Story IP with +11.35% intraday gains, Four with +10.39% price surge, and Sonic with +7.68% gains, showing that select microcaps are still attracting speculative interest.

Also read our Bitcoin (BTC) Price Prediction 2025, 2026-2030!

FAQs

The $647M liquidation spike comes from a sharp market downturn triggered by geopolitical tensions and overly optimistic long positions getting wiped out.

An index reading of 37 signals “Fear,” indicating investors are cautious.

Technically, the RSI and Bollinger Band levels suggest a potential short-term rebound. However, recovery will heavily depend on geopolitical developments.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.