Binance and Bybit lead liquidation numbers, surpassing $800M collectively

Bitcoin and Ethereum face steep losses, dragging market cap down 2.51%

Investors flee to gold-backed tokens as turmoil takes a toll on risk assets

The crypto market today has witnessed a steep fall. The prime reason for this is the war tensions between Israel and Iran. The dispute escalated again as Israel launched an air strike on Iran’s nuclear facilities on June 13. Moreover, the U.S. Federal Reserve’s latest inflation report refused hopes for any interest rate cuts in June.

This dual pressure from geopolitics and monetary policy has sent shockwaves through the market, leading to over $1.14 billion in liquidations. As crypto traders took the brunt, many sought refuge in safer assets like gold, with PAX Gold and Tether Gold among the rare green tokens in a sea of red.

$1.14 Billion Worth Liquidation Hits Traders

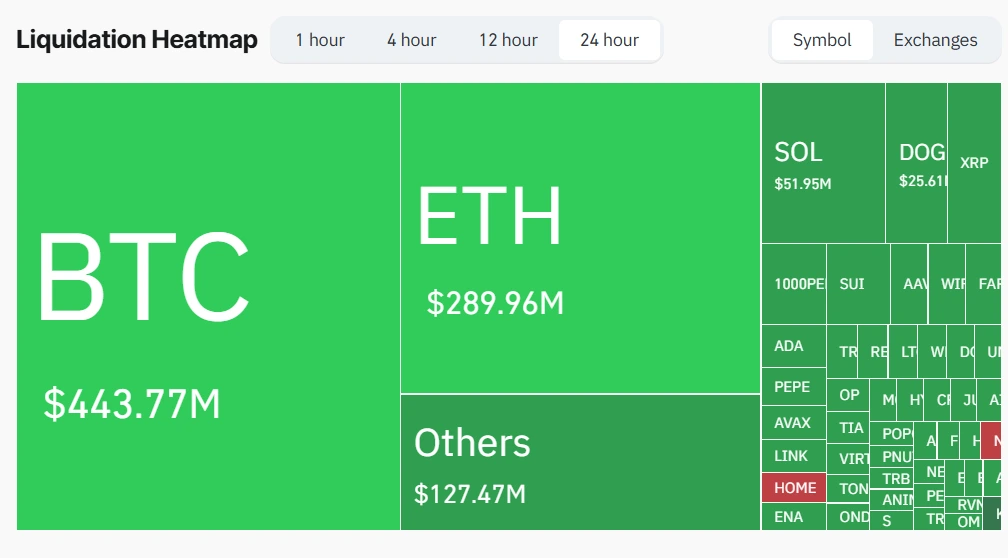

In the past 24 hours, 246,590 traders have been liquidated, which highlights a severe slash across the derivatives market. The total liquidations as of press time have spiked to $1.14 billion, emphasizing the intense volatility triggered by the external factors.

The single largest liquidation was registered on Binance’s BTC/USDT pair, wiping out a jaw-dropping $201.31 million in one go. Binance accounted for the largest share overall, registering $455.60M, Bybit followed next with $370.83M, and OKX with $125.58M.

Bitcoin and Ethereum took the major brunt among cryptocurrencies, with $443.77M and $289.96M, respectively, in liquidation volume. Other altcoins, such as SOL, saw $51.95M, and DOGE took $25.61M in liquidations.

Where Is the Crypto Market Heading?

At the time of press, the total market cap of the industry stands at $3.37 trillion, down 2.51%, while 24-hour trading volume is down 4.77% at $129.97 billion. The Fear & Greed Index remains at a greed-driven score of 61, which is expected to come lower as the day passes.

Bitcoin presently trades 3.12% lower at $104,437.94, while Ethereum has taken a bigger hit, down 8.85% at $2,517.03. Major altcoins also faced pressure, with XRP at a 5.47% loss to $2.12 and SOL down 9.74% to $144.33.

With BTC dominance at 63.2% and ETH at 9.8%, the market remains heavily reliant on Bitcoin’s resilience. However, unless geopolitical risks settle and macroeconomic stability returns, further downside could be in store.

Also read our Bitcoin (BTC) Price Prediction 2025, 2026-2030!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Rising war tensions between Israel and Iran, along with inflation data from the Fed, triggered panic selling and long liquidations across exchanges.

Binance and Bybit saw the largest exchange-based liquidations, while Bitcoin and Ethereum led token-wise liquidations with $443.77M and $289.96M, respectively.

Yes, gold-backed tokens like PAX Gold and Tether Gold gained traction as investors sought safety amidst global uncertainties.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.