BitMine buys 14,618 ETH worth $44M, company now holds 3.63M ETH, controlling 3% of ETH overall supply.

Following the ETH purchases, BitMine stock jumps 9% on news, yet remains weak after month of market declines.

Meanwhile, ETH price stays near $3,030 despite buying, weighed by ETF outflows and weak liquidity.

BitMine Immersion Technologies, led by market strategist Tom Lee, has continued its ETH buying spree into its treasury. In its latest purchase, BitMine added 14,618 ETH worth more than $44 million to its holdings.

But even with millions flowing into Ethereum, the ETH price refuses to pump, trading near $3000.

BitMine Adds 14,618 ETH Into Treasury

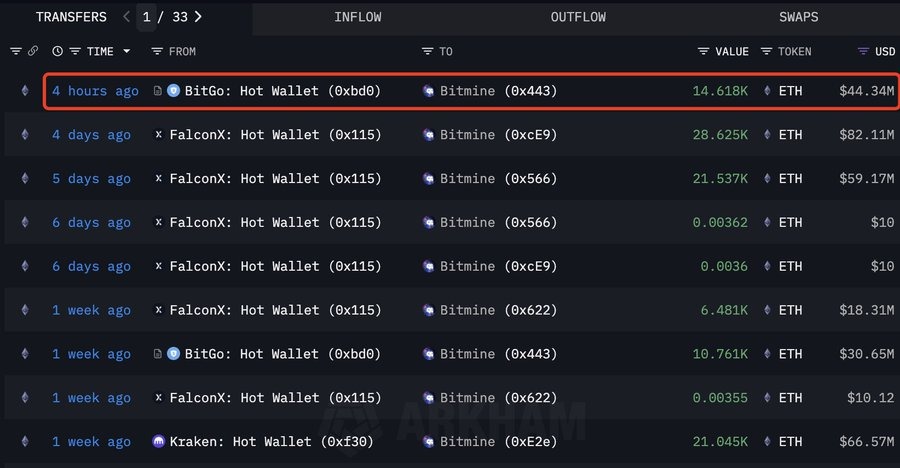

Data from Arkham Intelligence shows BitMine bought 14,618 ETH worth about $44.34 million on November 28. This is part of the company’s larger plan to own 5% of Ethereum’s total supply, equal to nearly 6 million ETH.

With this latest addition, BitMine is now halfway to its target. The company currently holds 3.63 million ETH, which represents about 3% of the total Ethereum network.

At the current price of around $3,027, BitMine’s Ethereum holdings are valued at roughly $10.39 billion, placing it among the biggest corporate ETH holders globally.

Corporate ETH holdings are rising fast, with companies now owning $24.97 billion, about 5.01% of the entire supply. This shows large institutions are quietly preparing for Ethereum’s future role in staking, yields, and tokenized assets.

- Also Read :

- Crypto News Today [Live] Updates On November 28,2025 : Bitcoin Price, Ethereum Price, XRP ETF, CME Futures

- ,

BitMine Stock Jumps 9%, But Still Under Pressure

Interestingly, BitMine’s stock (BMNR) saw a strong reaction to the news, rising nearly 9% to around $31.74, outperforming ETH itself.

Despite the recent jump, BitMine’s stock is still down about 37% over the past month. The main reason is its strong correlation with Ethereum and the broader crypto market.

Since the crypto market has dropped nearly 22% during this period, BMNR stock has also faced heavy selling pressure.

Ethereum Price Stays Flat

Even with this accumulation, Ethereum continues to trade near $3,030, down 25% from the month before.

Some experts point to large outflows from spot ETH ETFs and shaken institutional sentiment as key reasons why the market hasn’t reacted. With liquidity still weak, big buys are not enough to flip the trend in the short term.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

BitMine is building a long-term ETH treasury and aims to hold 5% of all ETH, betting on future staking rewards and blockchain growth.

BitMine holds about 3.63M ETH, roughly 3% of the total supply, making it one of the largest corporate Ethereum holders.

Large corporate accumulation supports long-term confidence, but it won’t quickly change ETH’s short-term price trend.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.