Bitmine buys 80,325 ETH worth $358M, becoming Ethereum’s largest corporate holder worldwide.

With 1.95M ETH, Bitmine now controls nearly 1.6% of Ethereum’s circulating supply.

Ethereum price rises 1.6% after Bitmine’s huge purchase, currently trading near $4,375.

Ethereum has just seen one of its biggest corporate accumulation moves in recent months. Bitmine Immersion Technologies, under the leadership of strategist Tom Lee, has made headlines by acquiring a massive 80,325 ETH worth about $358 million on September 4, 2025.

Meanwhile, the massive purchase quickly pushed ETH up 1.6%, with the token trading around $4,375.

Bitmine Becomes Ethereum’s Largest Corporate Holder

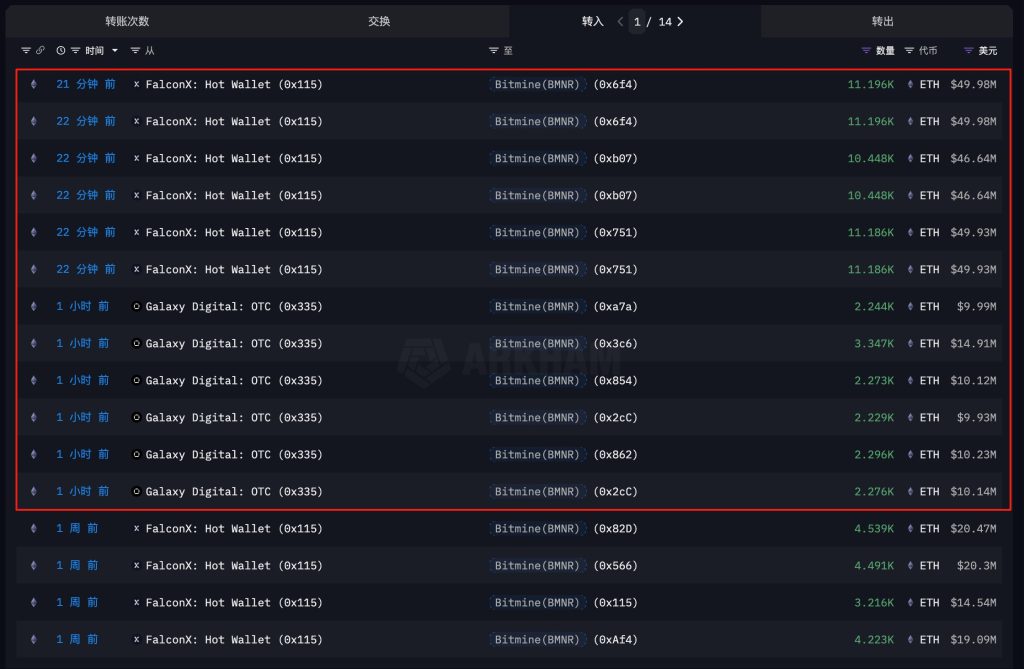

According to data from Arkham, Bitmine purchased 80,325 ETH worth about $358 million, which came from the institutional business platforms Galaxy Digital and FalconX.

This move is part of what Bitmine calls its Ethereum “Strategy,” a program aimed at building a long-term position in the network’s ecosystem.

With this buy, Bitmine now holds a total of 1,947,299 ETH, worth around $8.69 billion at current prices.

That makes the company the single largest corporate holder of Ethereum worldwide, controlling nearly 1.6% of the token’s circulating supply. This gives the company growing influence in the ecosystem, much like MicroStrategy’s role with Bitcoin.

Other Company Added ETH Into Its Treasury

Bitmine isn’t the only firm loading up on Ethereum. Sharplink also boosted its treasury, raising its total holdings to 837,230 ETH, worth more than $3.6 billion, after buying 39,008 ETH at an average price of $4,531.

Another company, Ether Machine, announced a fresh purchase of 150,000 ETH. This move brought its total to 500,000 ETH, valued at about $2.19 billion.

Together, these moves highlight a growing trend of major firms treating Ethereum as a long-term strategic asset.

Ethereum Price Outlook

This wave of accumulation has given Ethereum’s price strong support. ETH is now trading around $4,375, marking a 21% gain in just a month and an impressive 82.5% surge over the past year.

After touching an all-time high, the coin saw a quick correction as some investors took profits. Still, ETH has managed to stay above the key $4,300 support level, showing signs of resilience.

Looking ahead, analysts expect fresh bullish momentum by October. If the trend holds, Ethereum could end the year trading above $5,000

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitmine Immersion Technologies is now the largest corporate holder, with 1.947M ETH worth ~$8.69B, controlling ~1.6% of the supply.

The massive purchase immediately pushed Ethereum’s price up 1.6%, providing strong support and highlighting institutional demand.

Yes, firms like Sharplink and Ether Machine are also significantly boosting their ETH treasuries, treating it as a strategic asset.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.