Bitcoin whales accumulate heavily as exchange balances fall to seven-year lows near 13.7% levels.

Wallets holding 10,000–12,000 BTC added 56,227 coins since December, signaling strong conviction among institutions.

Over 200,000 BTC moved off exchanges, tightening supply while price consolidates near $93,000 levels.

Bitcoin’s large whales are buying aggressively while the price drops below $92,000. On-chain data shows large investors adding BTC, and exchange supply has dropped to a 7-year low.

The big question now is simple, What do whales know that others don’t?

Bitcoin Whale Accumulation BTC At Large

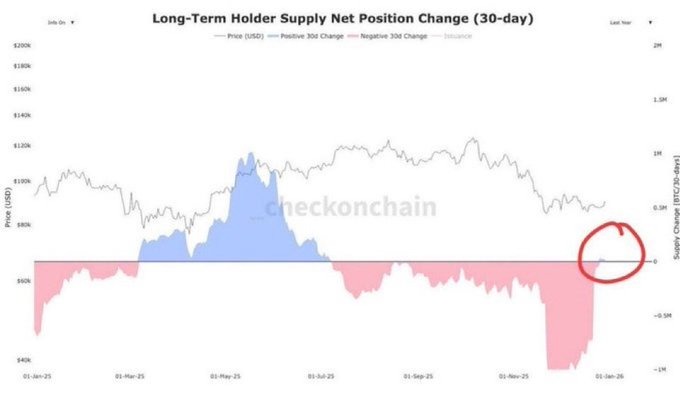

According to on-chain data in early January 2026, Bitcoin whales have sharply slowed selling and moved into heavy accumulation.

Since December 17, wallets holding 10,000 to 12,000 BTC have added a total of 56,227 BTC. At the same time, large wallets holding more than 1,000 BTC have added roughly $5 billion worth of Bitcoin since mid-December.

Recently, Lookonchain also reported that three large wallets, likely linked to the same whale, bought 3,000 BTC worth nearly $280 million in just 10 hours, highlighting aggressive buying activity.

Adding to this trend, wallets that have held Bitcoin for more than 155 days have stopped net selling for the first time since July 2025, a sign of growing confidence in the market.

In contrast, retail wallets holding less than 0.01 BTC have been taking profits, showing Bitcoin supply is shifting from small holders to bigger players.

Bitcoin Exchange Supply Drops as BTC Moves to Cold Storage

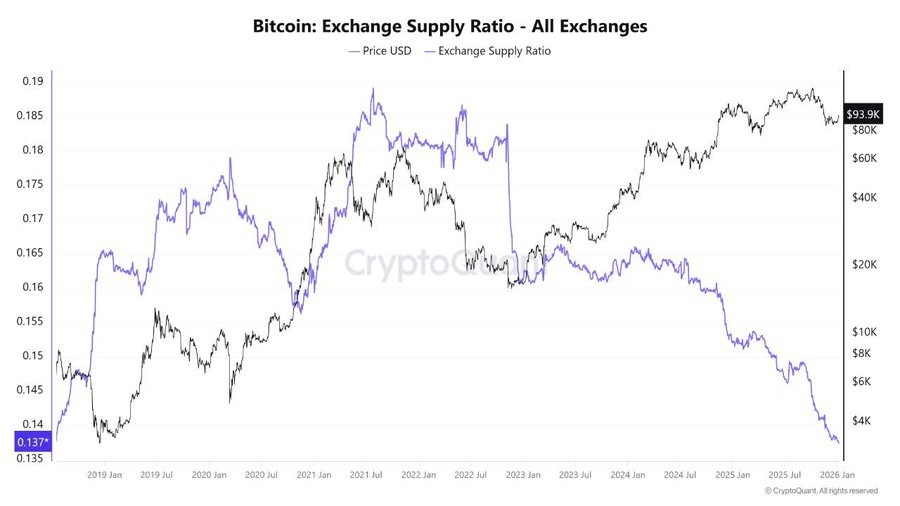

Apart from whale accumulation, Bitcoin supply on exchanges has fallen to around 13.7%, one of the lowest levels since 2018. On Binance, exchange balances are even tighter, close to 3.2%.

In the last seven days alone, 21,400 BTC left exchanges. Over the past few months, more than 200,000 BTC, valued at nearly $18 billion, has moved off exchanges into long-term storage.

This sharp drop in available supply reduces selling pressure and tightens the market, even as the price remains stable around $92,000–$93,000.

Institutional Quietly Accumulating BTC

BlackRock CEO Larry Fink recently said that sovereign wealth funds have been buying Bitcoin gradually, adding exposure at price levels near $80,000, $100,000, and even above $120,000.

Even though spot Bitcoin ETFs are also showing steady accumulation. Instead of large spikes, inflows remain slow and consistent, pointing to long-term positioning rather than short-term hype.

Bitcoin Price Structure Signals Long-Term Strength

Even with Bitcoin trading above $93,000, on-chain demand still looks weak, meaning a stronger recovery is needed before price can move confidently toward $100,000.

On the weekly chart, Bitcoin is forming a long consolidation pattern often called a cup-and-handle, which usually signals slow accumulation by strong holders.

From a technical view, the price is slowly moving upward. Crypto analyst Jelle expects another push toward $94,500. If Bitcoin clears this level, the path toward $100,000 could open up more smoothly.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Major risks include global recessions, tighter crypto regulations, declining liquidity, or a sustained breakdown below key support levels.

Bitcoin price forecasts for 2030 range from $380K to $900K, driven by scarcity, long-term adoption, and expanding institutional participation.

While uncertain, many long-term projections suggest Bitcoin could exceed $1 million by 2050 if it becomes a global store of value.

Bitcoin’s fixed supply makes it attractive as an inflation hedge, especially during currency debasement and long-term economic uncertainty.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.