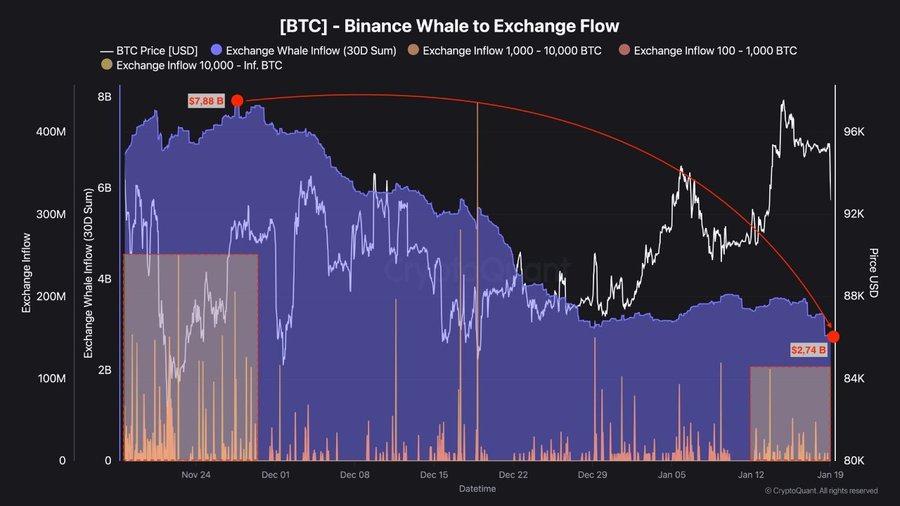

Bitcoin price dips near $90K as whale selling activity on Binance drops sharply.

CryptoQuant data shows BTC whale inflows to exchanges fell from $8B to $2.7B.

However, BTC must reclaim $92K–$95K to target $100K, while $84K stays key support.

Bitcoin price today slipped closer to the $90,000 level, while whale activity on Binance has dropped sharply. On-chain data from CryptoQuant shows a clear fall in BTC inflows to exchanges, suggesting whales are stepping back after weeks of heavy selling and liquidations.

Meanwhile, Bitcoin’s long-term trend remains positive, leaving room for a possible upside move.

Bitcoin Whale Selling on Binance Falls Significantly

According to the CryptoQuant data, Bitcoin inflows from whales to Binance have dropped sharply in recent weeks. These inflows, often linked with selling activity, have declined from nearly $8 billion at their peak to around $2.74 billion, marking a clear slowdown in whale-linked sell-offs.

The data tracks Bitcoin transfers to Binance across three major whale categories: transactions between 100–1,000 BTC, 1,000–10,000 BTC, and transfers above 10,000 BTC.

A fall across all these groups suggests that large holders are no longer rushing to move coins to exchanges.

What Triggered the Whale Slowdown?

The latest chart shows a very different picture. Whale inflows to Binance have now been cut by nearly 3x compared to late November. Large transactions have become less frequent, and selling clusters have almost disappeared.

This suggests whales are choosing patience over panic. Instead of selling aggressively, they appear to be holding their Bitcoin during the current consolidation phase.

This change comes after a sharp sell-off in recent days, when whales sold around 22,918 BTC, worth nearly $4 billion. That wave of selling triggered market panic, caused over $500 million in long liquidations, and pushed Bitcoin price down by about 2.5%, from around $97,000 to near $90,934.

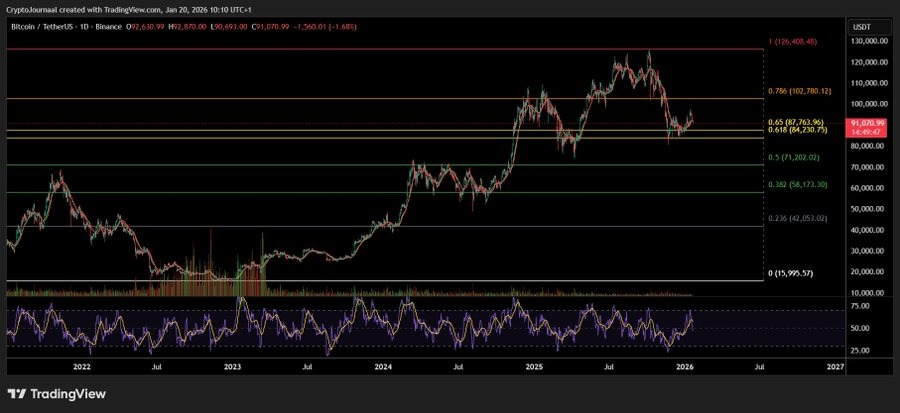

Bitcoin Price Analysis

As of now, Bitcoin is still in a long-term uptrend after rising strongly from the $83,000 area to new record highs. However, the price faced strong selling near $126,000, which pushed it lower.

Since then, Bitcoin has moved into a key support range between $84,000 and $92,000, where it is now moving sideways.

If Bitcoin breaks above $92,000–$95,000 and holds, buying strength could return and push the price toward the $100,000–$102,000 area.

But if Bitcoin drops below $84,000, selling pressure may increase and lead to a deeper pullback.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Large holders often influence short-term liquidity and volatility. Changes in whale activity can affect market confidence, even when broader trends remain intact.

Lower sell pressure can ease sudden price swings, giving retail investors more predictable trading conditions. However, it doesn’t eliminate risk from macro or sentiment-driven moves.

Clear confirmation would come from strong volume either on a breakout above resistance or a breakdown below support. Until then, the market is likely to remain range-bound.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.