Bitcoin sentiment turns fearful again as Santiment shows bearish social posts dominating bullish buy-the-dip conversations online.

Google search interest for Bitcoin falls sharply, signaling lower public attention and reduced retail excitement overall.

Historical Santiment trends show extreme fear phases often appear before strong Bitcoin price recovery moves.

Bitcoin price has been struggling to break above the key $71K resistance level and has now slipped to $67,012. Market intelligence platform Santiment reports that social sentiment around Bitcoin remains heavily bearish, with negative posts still far outweighing positive ones.

Adding to the concern, overall public interest in Bitcoin is declining, as shown by the Fear & Greed Index dropping sharply to 11.

Bitcoin Sentiment Turns Fearful Again

The Santiment chart shows that Bitcoin traders are still in strong fear mode, even after the price recovery from the recent drop near $60K. Market sentiment has not recovered at the same pace as the price.

According to Santiment data, social media discussions around words like “selling,” “lower,” and “bearish” expectations continue to outnumber positive ones like “buy-the-dip” and “higher price” optimism across social platforms.

This sentiment gap suggests retail traders remain uneasy and are not fully trusting the current recovery. Many are still waiting on the sidelines rather than buying at present levels, which highlights continued hesitation across the market.

Eventually, Santiment’s social volume and social dominance charts indicate that fear-driven narratives remain stronger than recovery confidence. After Bitcoin’s sharp drop and partial rebound of roughly 10%, many traders are still expecting another leg down instead of a sustained uptrend.

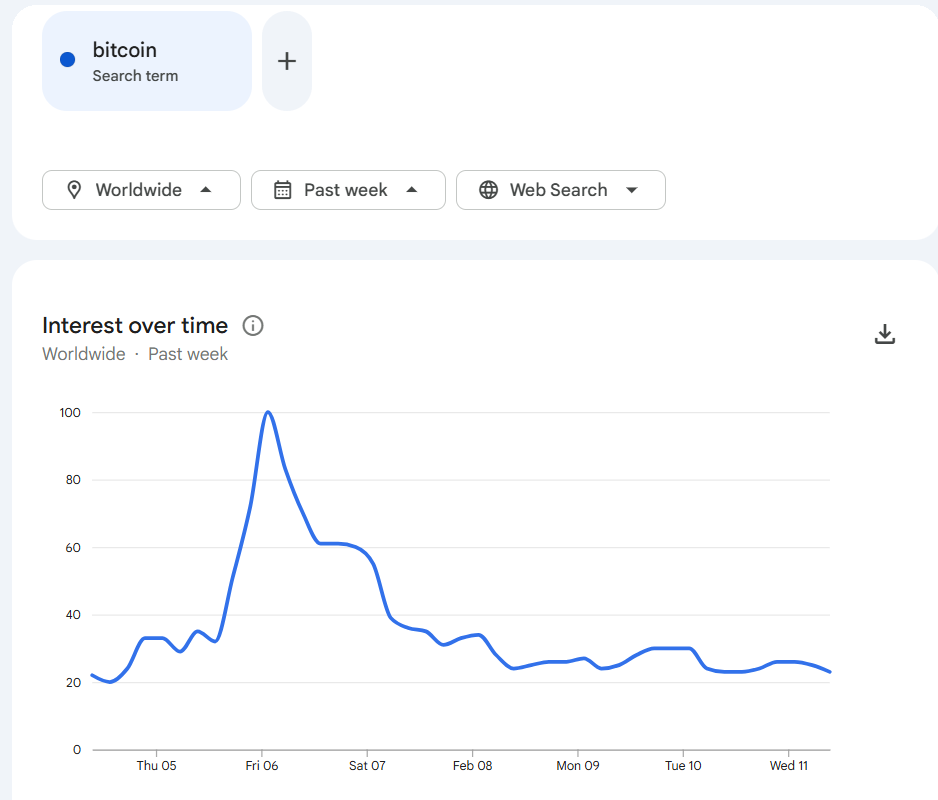

Google Trends Show Drop In Bitcoin Searches

However, this negative trend can also be seen in the Google Trends chart, which shows search interest for the word “Bitcoin” has dropped sharply over the past week to near the 20–25 range.

This means fewer people are actively searching for Bitcoin-related news, which usually signals lower retail attention and reduced market excitement.

A major spike in searches appeared on February 6, when interest reached 100. This happened because Bitcoin quickly recovered toward $70K, after crashing hard below $60K.

Falling search interest generally suggests the market is entering a calm or consolidation phase rather than a strong bullish trend.

- Also Read :

- Binance Partners With Franklin Templeton to Offer Tokenized Real-World Assets as Crypto Collateral

- ,

Why Bearish Crowd Mood Can Be Bullish for Bitcoin

Even though market sentiment is currently negative, history shows that strong pessimism often creates good opportunities for price rebounds. When most traders are fearful, they hesitate to buy, allowing large investors and key market players to accumulate Bitcoin with little competition.

Santiment data confirms that in the past, periods of extreme fear have frequently been followed by strong price recoveries.

As of now, Bitcoin is trading at $66,911, down 3.6% for the day. Experts predict that if BTC fails to recover and hold above the $66K level, it could drop again to test the $62,455 support zone.

On the flip side, if Bitcoin sees a strong recovery above $71K, it could open the door for an upside rally toward $78,792.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin is slipping as it struggles below $71K resistance. Weak sentiment, low retail interest, and fear-driven selling are pressuring price short term.

Yes, extreme fear often creates opportunity. When most traders hesitate, larger investors may accumulate before a recovery phase.

If Bitcoin holds above $66K and breaks $71K, it could target $78K. Losing $66K may push price toward $62K support first.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is the Crypto Market Going up Today [Live] Updates on March 3, 2026](https://image.coinpedia.org/wp-content/uploads/2026/03/03170220/Why-Is-the-Crypto-Market-Going-up-Today-Live-Updates-on-March-3-2026-2-390x220.webp)