Bitcoin Price Today Surges 7% Ahead of December FOMC Meeting: Can BTC Break $94K Next?

-

BTC $ 65,409.16 (-3.24%)

BTC $ 65,409.16 (-3.24%)

Bitcoin jumps 7% to reclaim $93K as traders await the December 10 FOMC decision, with markets pricing in an 87% chance of a 25 bps Fed rate cut.

All eyes on key resistance at $99K and $122K as Bitcoin momentum grows; a daily close above $94K could spark a run toward the $100K mark.

Bitcoin price today surged more than 7% to reclaim the $93,000 level, gaining strong momentum as markets prepare for a crucial Federal Reserve decision next week. Traders are pricing in nearly 90% odds of another 25 bps rate cut, while gold continues to hold above $4,200.

Expectations that White House adviser Kevin Hassett may become the next Fed Chair have further strengthened the market’s dovish outlook.

Investors Brace for the December FOMC Meeting

All attention is now on the Federal Open Market Committee (FOMC) meeting on December 10, which is expected to set the direction for global markets and crypto.

During this two-day meeting, officials will vote on interest rates, release updated economic projections, and possibly discuss when quantitative easing (QE) could begin.

Even a small hint of QE or a change in the rate-cut roadmap could trigger significant moves in Bitcoin and other risk assets.

Key Data to Watch Before the Decision

Before the meeting, traders are closely monitoring two important economic reports: Friday’s PCE inflation data and Tuesday’s JOLTs job openings report.

- Inflation: Still above the Fed’s 2% target, and recent rate cuts have not cooled it enough.

- Jobs: Strong job numbers suggest the U.S. economy remains resilient. Treasury Secretary Scott Bessent even expects economic growth to pick up in early 2026.

- Liquidity: Markets are also adjusting to the end of quantitative tightening (QT), which has already increased liquidity in the system.

What to Expect on Meeting Day

The Fed’s rate decision will be announced at 2:00 PM ET on December 10, followed by Jerome Powell’s press conference at 2:30 PM ET. His tone, whether cautious or optimistic, will likely guide Bitcoin’s next major move.

Current CME FedWatch data shows an 87% probability of a 25 bps rate cut, which would bring the target range down to 3.50%–3.75%.

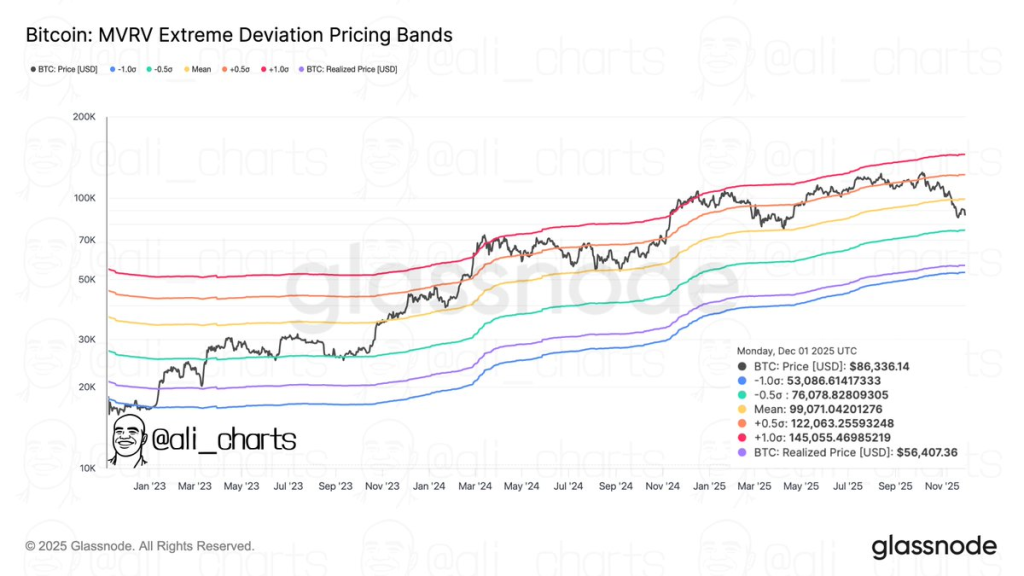

On-chain analyst Ali Martinez highlights two major resistance levels based on Glassnode’s pricing bands. According to him, Bitcoin must break:

- $99,070

- $122,060

These levels will be key as Bitcoin attempts to push toward new price milestones.

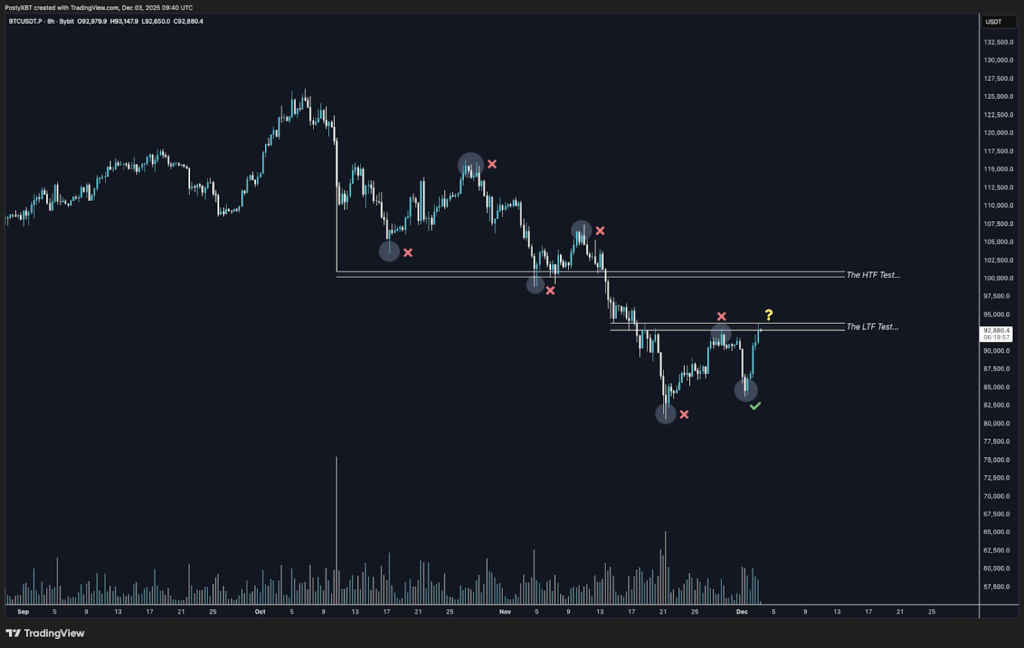

Crypto trader Posty adds that Bitcoin may have ended its pattern of lower highs and lower lows after forming a higher low around $84,000.

The next critical step is a daily close above roughly $94,000. If that happens, he expects a potential move toward $100,000.

However, he cautions traders to move carefully, noting that the larger market structure still needs confirmation.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

A rate cut or dovish tone could lift Bitcoin by lowering borrowing costs and improving liquidity, while a cautious stance may slow momentum.

Markets are focused on PCE inflation and JOLTs job data, which reveal how quickly price pressures are easing and how strong hiring remains.

Yes. The end of quantitative tightening is boosting liquidity, and even small policy shifts can increase demand for Bitcoin and other risk assets.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

The Fed’s next FOMC meeting is on December 10, with the rate decision at 2:00 PM ET and Jerome Powell’s press conference at 2:30 PM ET.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.