Bitcoin Cycle Repeats? Analysts Watch for Post-Halving Bounce After ‘August Dip’

-

BTC $ 124,862.11 (1.68%)

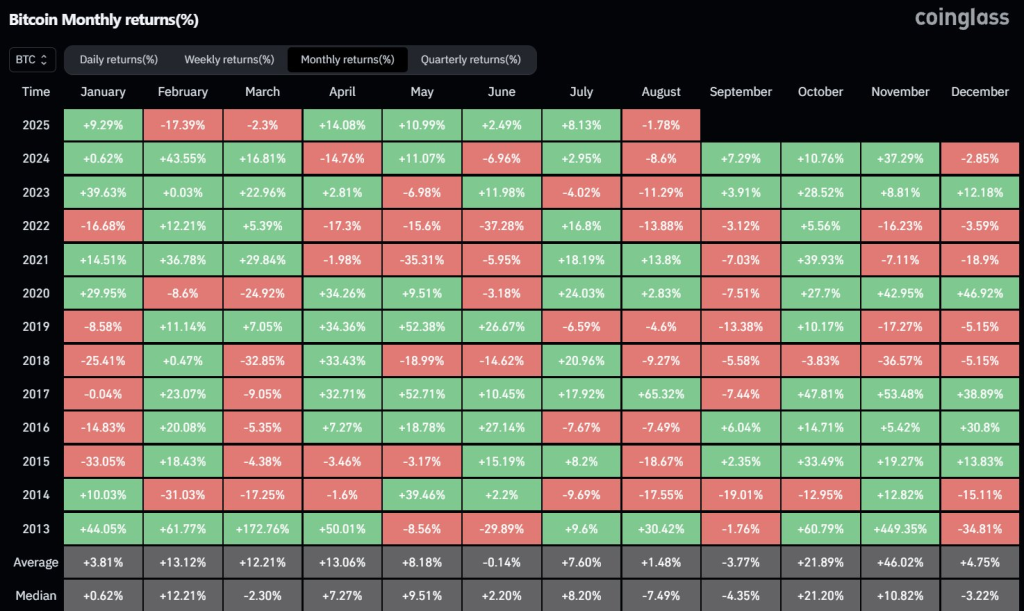

Bitcoin dropped nearly 7% in August 2025, echoing post-halving patterns from past cycles.

The current dip mirrors August corrections seen in 2013, 2017, and 2021.

But with rising macro risks, traders are urged to prioritize strategy over historical trends.

Here we go again. Or do we?

Bitcoin’s August dip is here and for anyone watching closely, it looks all too familiar.

The world’s largest cryptocurrency fell nearly 7% in early August, pulling back from July highs of around $123,000 to $115,010 now. It’s the kind of move that’s played out before in 2013, 2017, and 2021 – right after each halving.

Each time, the pattern followed a similar path: a halving the year before, strong gains into mid-year, a sharp August drop, and then a big rally in Q4. So far, 2025 is ticking every box.

That’s not the full story, though. Here’s what you need to know.

Is History Repeating for Bitcoin Price?

Here’s why the numbers line up:

- August 2013: Bitcoin fell 9.79%

- August 2017: Down 10.30%

- August 2021: A 12.49% correction

- August 2025: So far, a 6.68% drop

This year’s dip is smaller but it fits the same pattern. Just like previous cycles, Bitcoin surged in the first half, only to cool off in August.

Naturally, many are wondering: Is this the usual reset before another Q4 breakout?

But This Market Isn’t the Same

While the chart might look familiar, it is important to note that the conditions around it aren’t.

Back in 2017, Bitcoin wasn’t facing as many geopolitical tensions, Trump-era tariffs, or a market shaped by institutional capital. Now, those factors are front and center. And they could easily shift the direction of the market no matter what history says.

This time, the setup may be the same, but the stakes are higher.

“Patterns Aren’t Promises”

Many in the crypto community called out that circumstances are different this year.

“Solid observation — history does lean that way. But patterns aren’t promises. Timing the bottom is art and risk management combined… Let strategy lead, not just seasonality.,” @MiningMiranda wrote.

So, the advice that simply following the past to predict the future could be risky.

Key Takeaway

Yes, Bitcoin’s August dip is in line with post-halving history. And yes, those years often ended with all-time highs. But this isn’t just about price cycles anymore.

Global politics, capital flows, and macro risks are playing a bigger role than ever.

So while history might point to a Q4 rally, this time, it may take more than just timing to get it right.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Keep an eye on Coinpedia for reliable price action analysis so you never get it wrong!

FAQs

If following past cycles, BTC may test $110K support before rebounding, though current macro risks could deepen the correction.

Caution advised – while history hints at a Q4 rally, current markets face unique pressures (elections, macro risks) that may disrupt the pattern.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.