Arthur Hayes says Fed backed yen support could inject liquidity and fuel Bitcoin rally.

Japanese yen jumped to strongest level this year sparking speculation of coordinated US intervention.

Meanwhile, Hayes targets Bitcoin at $200K, if money printing resumes through Fed support.

BitMEX co-founder Arthur Hayes said Bitcoin could get a major boost if global central banks step back into money printing.

He linked the recent rise in the Japanese yen to possible U.S. Federal Reserve action, saying new liquidity could enter markets and help push Bitcoin toward $200,000 by March 2026.

Bitcoin To Benefit From Yen Intervention and Fed Liquidity

According to Hayes, there is growing talk that Japan may step in to strengthen its currency, possibly with help from the U.S. Federal Reserve. Recently, the yen jumped about 1.75% to 155.63 per dollar.

This sudden move followed reports that the New York Fed contacted major banks to check conditions in the yen market.

Arthur Hayes believes that if the Fed supports the yen, it would likely do so by printing dollars, creating new banking reserves, and using those funds to buy yen. If this happens, the Fed’s balance sheet would expand under its foreign currency assets line, a figure that is reported weekly in the H.4.1 release.

Right now, that line sits near $19.1 billion.

Hayes says this kind of liquidity expansion has historically been very positive for Bitcoin.

Although no official action has been confirmed, traders see this as a sign that intervention may be coming.

- Also Read :

- Bitcoin Price Analysis: Rising Profit-Taking Signals More Volatility—What’s Next for BTC?

- ,

Hayes’ Bold Bitcoin Price Targets

Hayes remains strongly bullish if liquidity returns. He believes Bitcoin could reach $200,000 by March 2026 if the Fed starts expanding its balance sheet again.

In an even more aggressive outlook, he has suggested Bitcoin could climb as high as $500,000 by the end of the year if global money flows accelerate.

Despite rising speculation, Bitcoin is currently trading near $89,500, showing little reaction so far.

Bitcoin Price Outlook

Despite rising speculation, Bitcoin is currently trading near $89,471, showing little reaction so far.

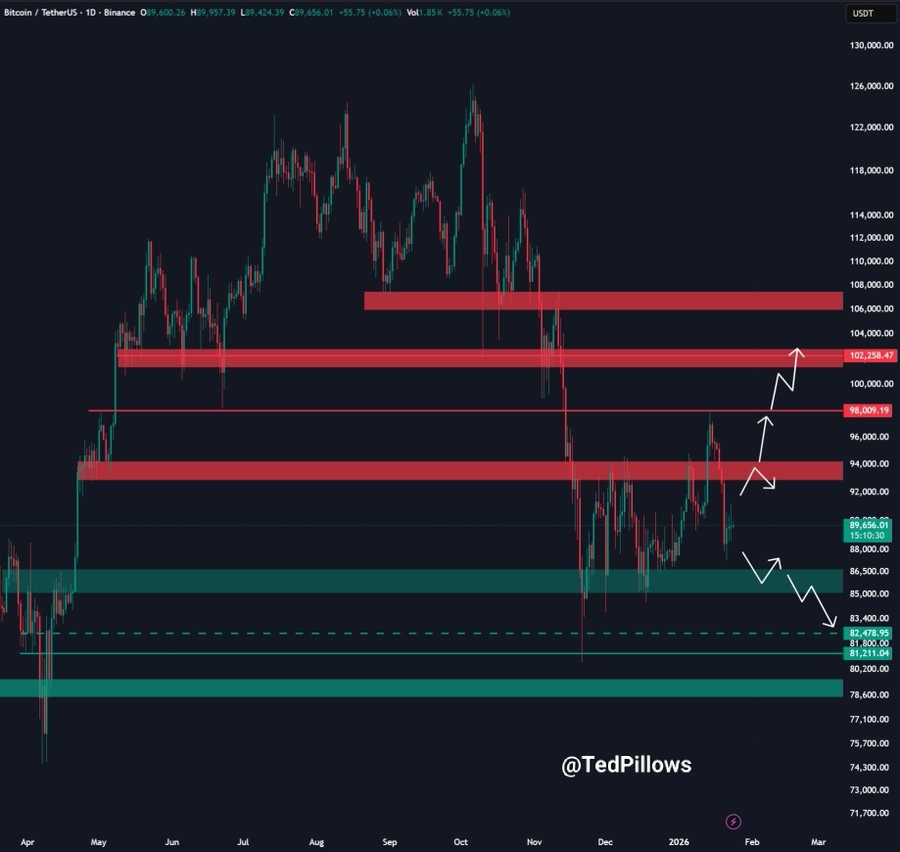

Looking at the daily chart, crypto trader TED, bitcoin trading back inside what many traders call a “no-trading zone. This area sits between key support and resistance levels, where price often moves sideways without a clear direction

The chart highlights a major resistance zone around $91,000. If Bitcoin manages to break above this level with strong spot demand, it could open the door for a cleaner move toward $98,000 and even $102,000.

On the downside, the chart shows important support levels near $89,000, followed by stronger support around $86,500 to $83,000.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Hayes suggests Bitcoin could reach $200,000 by March 2026 if global liquidity expands and demand remains strong.

Support is near $83,000–$89,000, while resistance sits around $91,000, $98,000, and $102,000, guiding potential price moves.

More liquidity usually fuels asset buying, which can lift Bitcoin prices, especially when major central banks intervene globally.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.