First altcoin season happened in 2017 when many tokens gained hundreds to thousands percent.

Meanwhile, Crypto trader Don Wedge says third altcoin season could start within next 112 days window.

Although, Altcoin Season Index sits at 43 showing Bitcoin still leading market overall dominance.

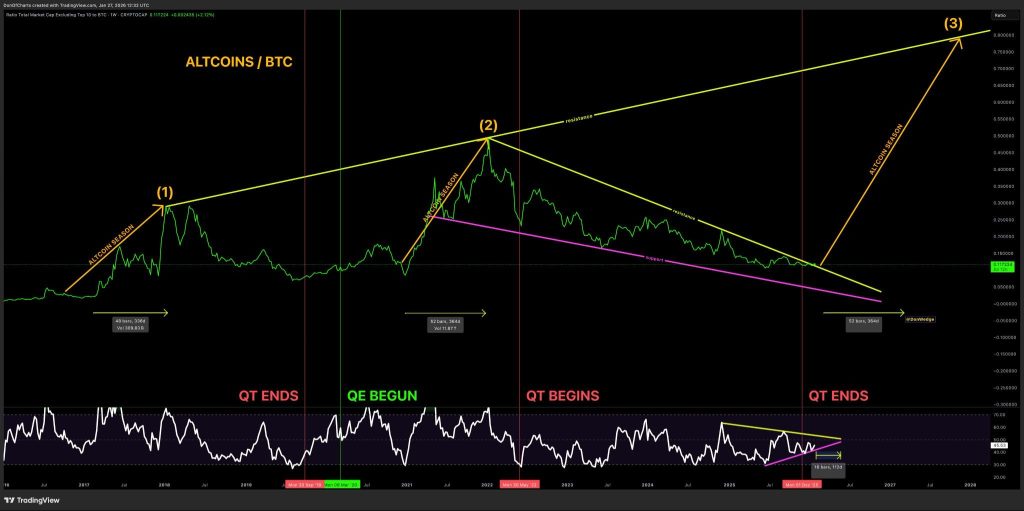

Altcoin investors have heard this many times before that Altcoin Season is about to start, but the question is exactly when. Well-known crypto trader Don Wedge believes the next altcoin season may already be forming quietly and could begin within the next 112 days, based on past market patterns.

Altcoin Season Just 112 Days Away

According to Don Wedge, the long-term Altcoins/BTC chart shows a pattern that keeps repeating. So far, the market has seen two major altcoin seasons.

The first came in 2017, when Bitcoin dominance dropped, and many altcoins jumped 500% to over 2,000%. This happened after months of slow, boring price action, when most traders had already lost interest.

The second followed in 2021. After Bitcoin peaked near $69,000, money moved into altcoins. Ethereum gained over 400%, and many smaller coins rose even more. Once again, the rally started after a long consolidation phase and weak market confidence.

Both times, altcoins began rising when sentiment was low, not during hype.

Don now points out that the Altcoins/BTC chart is again near a key long-term support level. In past cycles, this same zone marked the start of strong altcoin rallies. Based on this setup, Don believes a third altcoin season could begin within the next 112 days.

Altcoin Season 3 Could Be Bigger

Unlike 2017 and 2021, institutional capital is still mostly sidelined. Many large players are waiting for clearer regulations. If clarity arrives while altcoins are already trending higher, the next altcoin season could be larger and faster than previous ones.

Also, current market data suggests early rotation into specific sectors rather than broad altcoin pumps.

Utility tokens, AI-related projects, real-world asset (RWA) tokens, and infrastructure-focused coins are showing early strength.

Altcoin Season Index Still Favors Bitcoin

Despite the bullish signal, the Altcoin Season Index currently stands at 43, down 4 points recently. This means Bitcoin is still outperforming most of the top 100 coins over the last 90 days.

Historically, altcoin seasons do not start when the index is high. They usually begin when the index is below 50, and Bitcoin appears dominant. The index often rises only after altcoins have already started moving.

For now, the market feels calm and tiring. But history shows that this exact phase is often when altcoin seasons quietly begin.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Altcoin seasons often start when Bitcoin dominance is high, sentiment is low, and capital begins rotating into smaller coins quietly.

Utility tokens, AI-related projects, real-world asset (RWA) coins, and infrastructure-focused tokens are showing early strength.

The Altcoin Season Index measures whether altcoins outperform Bitcoin; below 50 suggests Bitcoin leads, often signaling the start of a new altcoin season.

Yes, with institutional capital mostly sidelined, clearer regulations could boost adoption, making the next altcoin rally faster and larger.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.