Say you’ve finally got started with cryptocurrency. You’re excited about Bitcoin, curious about Ethereum, and maybe even eyeing some altcoins.

But then… crash! You wake up one morning to see your investments have dropped 20% overnight. Scary, right?

That’s the wild, unpredictable world of crypto. But what if I told you there’s a way to invest in crypto without all the heart-stopping volatility?

You can do that with stablecoins.

What Are Stablecoins?

Let’s start simple.

Stablecoins are a type of cryptocurrency, but they’re not like Bitcoin or Ethereum. Their value is tied to something stable — usually a fiat currency like the US dollar, a commodity like gold, or even a basket of assets.

The goal? Stability.

One stablecoin is almost always equal to one unit of its underlying asset. For example, a US dollar-backed stablecoin like USDT (Tether) or USDC is designed to stay at $1.

So, why do stablecoins matter? They are calm in the middle of the crypto storm. They’re here to give you a safe harbor while still letting you benefit from the advantages of blockchain technology.

Why Stablecoins Are Gaining Popularity?

You’ve probably heard about crypto’s volatility. It’s both thrilling and terrifying.

One moment you’re up, and the next, you’re down. Stablecoins, however, offer a solution.

They’re predictable, reliable, and… well, stable.

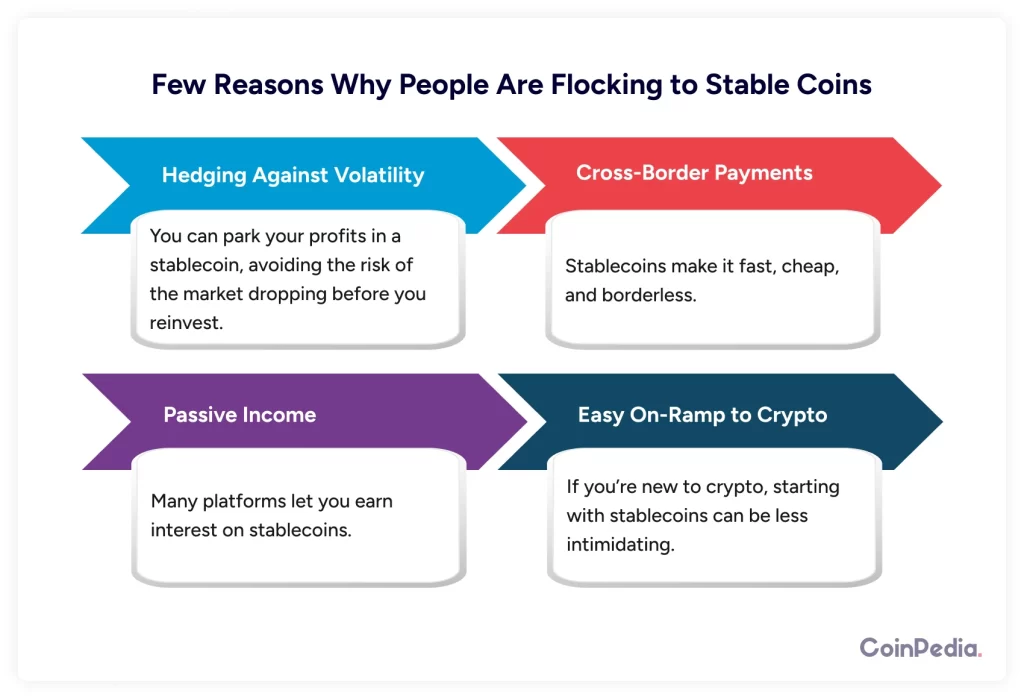

Here are a few reasons why people are flocking to stablecoins:

Hedging Against Volatility:

Consider that you’ve just sold some Bitcoin for a big profit. What now? You could move it to cash, but that’s slow and comes with fees. Enter stablecoins. You can park your profits in a stablecoin, avoiding the risk of the market dropping before you reinvest.

Cross-Border Payments:

Sending money internationally can be a hassle. Stablecoins make it fast, cheap, and borderless. No middlemen, no hefty fees.

Passive Income:

Many platforms let you earn interest on stablecoins. Think of it like a high-yield savings account but with crypto.

Easy On-Ramp to Crypto:

If you’re new to crypto, starting with stablecoins can be less intimidating. They let you explore the space without the stress of wild price swings.

Say you’ve finally got started with cryptocurrency. You’re excited about Bitcoin, curious about Ethereum, and maybe even eyeing some altcoins.

But then… crash! You wake up one morning to see your investments have dropped 20% overnight. Scary, right?

That’s the wild, unpredictable world of crypto. But what if I told you there’s a way to invest in crypto without all the heart-stopping volatility?

You can do that with stablecoins.

What Are Stablecoins?

Let’s start simple.

Stablecoins are a type of cryptocurrency, but they’re not like Bitcoin or Ethereum. Their value is tied to something stable — usually a fiat currency like the US dollar, a commodity like gold, or even a basket of assets.

The goal? Stability.

One stablecoin is almost always equal to one unit of its underlying asset. For example, a US dollar-backed stablecoin like USDT (Tether) or USDC is designed to stay at $1.

So, why do stablecoins matter? They are calm in the middle of the crypto storm. They’re here to give you a safe harbor while still letting you benefit from the advantages of blockchain technology.

Why Stablecoins Are Gaining Popularity?

You’ve probably heard about crypto’s volatility. It’s both thrilling and terrifying.

One moment you’re up, and the next, you’re down. Stablecoins, however, offer a solution.

They’re predictable, reliable, and… well, stable.

Here are a few reasons why people are flocking to stablecoins:

Hedging Against Volatility:

Consider that you’ve just sold some Bitcoin for a big profit. What now? You could move it to cash, but that’s slow and comes with fees. Enter stablecoins. You can park your profits in a stablecoin, avoiding the risk of the market dropping before you reinvest.

Cross-Border Payments:

Sending money internationally can be a hassle. Stablecoins make it fast, cheap, and borderless. No middlemen, no hefty fees.

Passive Income:

Many platforms let you earn interest on stablecoins. Think of it like a high-yield savings account but with crypto.

Easy On-Ramp to Crypto:

If you’re new to crypto, starting with stablecoins can be less intimidating. They let you explore the space without the stress of wild price swings.

In extreme market conditions, some stablecoins might struggle to maintain their peg if there’s a sudden rush to redeem them.

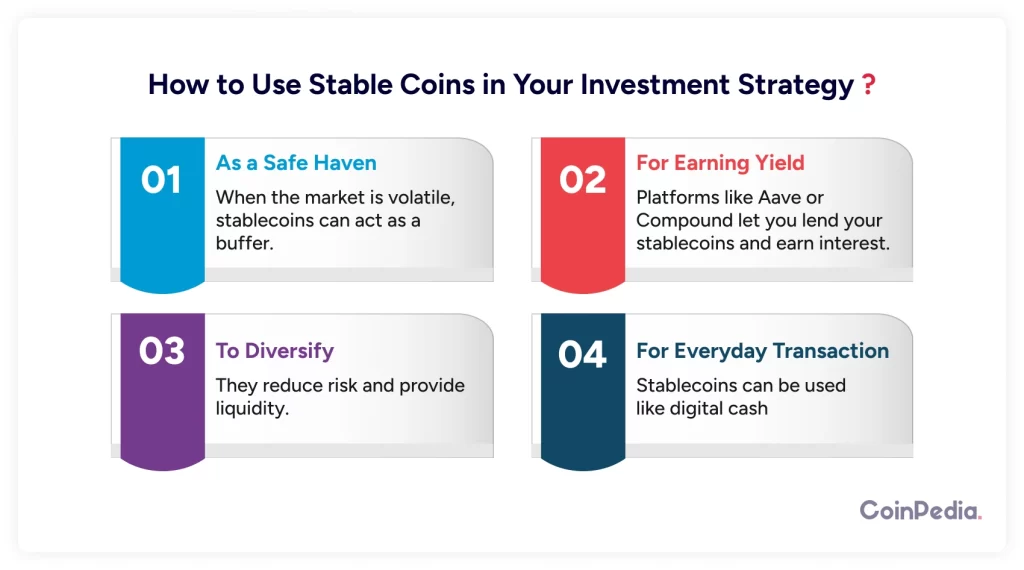

How to Use Stablecoins in Your Investment Strategy?

Now that you know the pros and cons, let’s talk strategy. How can stablecoins fit into your crypto journey?

As a Safe Haven

When the market is volatile, stablecoins can act as a buffer. Instead of cashing out into fiat, you can convert your crypto to stablecoins to wait out the storm.

For Earning Yield

Platforms like Aave or Compound let you lend your stablecoins and earn interest. Some rates are much higher than traditional banks, making stablecoins an attractive option for passive income.

To Diversify

Even if you love the thrill of investing in Bitcoin or altcoins, having some stablecoins in your portfolio can balance things out. They reduce risk and provide liquidity.

For Everyday Transactions

Stablecoins can be used like digital cash. Pay for goods and services, send money to friends, or even use them in decentralized finance (DeFi) applications.

Choosing the Right Stablecoin

Not all stablecoins are equal, so how do you pick one?

Reputation

Stick to well-known stablecoins like USDT, USDC, or DAI. They’ve been around long enough to build trust.

Transparency

Does the issuer provide regular audits of their reserves? Transparency is key to ensuring the stablecoin is truly backed as promised.

Use Case

Are you using it for trading, earning interest, or payments? Choose a stablecoin that fits your needs.

Platform Support

Check if the stablecoin is supported on the exchanges or wallets you use. The more widely accepted, the better.

The Future of Stablecoins

Stablecoins are evolving fast.

As governments explore central bank digital currencies (CBDCs), stablecoins could play a big role in the future of money. They’re bridging the gap between traditional finance and crypto, making it easier for people to join the digital revolution.

However, the road ahead isn’t without challenges. Regulatory scrutiny, competition from CBDCs, and technological risks could shape their future. Still, the potential is enormous. Stablecoins could redefine how we think about money, payments, and financial inclusion.

What’s next?

Stablecoins are not flashy like Bitcoin or Ethereum, but they’re practical, reliable, and incredibly useful. Whether you’re a crypto newbie or a seasoned investor, stablecoins can add stability and flexibility to your portfolio.

So, next time you’re navigating the rollercoaster of crypto, remember there’s a way to stay grounded. Stablecoins might just be your safest bet in an unpredictable market.

Ready to give them a try?

FAQs

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar, offering price stability in the volatile crypto market.

Stablecoins can be fiat-backed (e.g., USDT), commodity-backed (e.g., PAXG), crypto-backed (e.g., DAI), or algorithmic (e.g., UST).

Use stablecoins to hedge against volatility, earn passive income, diversify your portfolio, or for everyday transactions in crypto.

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.