Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100?

Story Highlights

- The live price of the Avalanche is $ 16.86470487.

- Price predictions for 2025 suggest highs of $50 and potential ETF approval.

- Long-term forecasts indicate AVAX could reach $518.50 by 2030.

Avalanche (AVAX) has become a go-to platform for developers, especially after its Avalanche 9000 mainnet upgrade and the launch of the AVAX card in early 2025. With lower fees and growing real-world use cases, plus backing from giants like Mastercard and SMBC, AVAX is gaining serious traction.

As a result, many are intrigued to know Avalanche prediction and are wondering: “How high can AVAX price go?” or “Will AVAX reach $50?” or “Does Avalanche have a good long-term future?” So, if you’re planning an investment in Avalanche (AVAX). Explore our in-depth Avalanche Price Prediction 2025 to 2030.

Table of Contents

Avalanche Price Today

| Cryptocurrency | Avalanche |

| Token | AVAX |

| Price | $16.8647 |

| Market Cap | $ 7,202,736,705.90 |

| 24h Volume | $ 430,929,560.7920 |

| Circulating Supply | 427,089,401.33 |

| Total Supply | 460,425,301.33 |

| All-Time High | $ 146.2179 on 21 November 2021 |

| All-Time Low | $ 2.7888 on 31 December 2020 |

CoinPedia’s Avalanche Price Prediction

According to Coinpedia’s AVAX price prediction, the altcoin may surpass the $49.46 mark in 2025. Moreover, the upcoming years are expected to be bullish, with a conservative momentum.

With an optimistic outlook, we expect the AVAX coin price to reach $50 in 2025.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $12.36 | $30.91 | $49.46 |

AVAX Price Prediction 2025

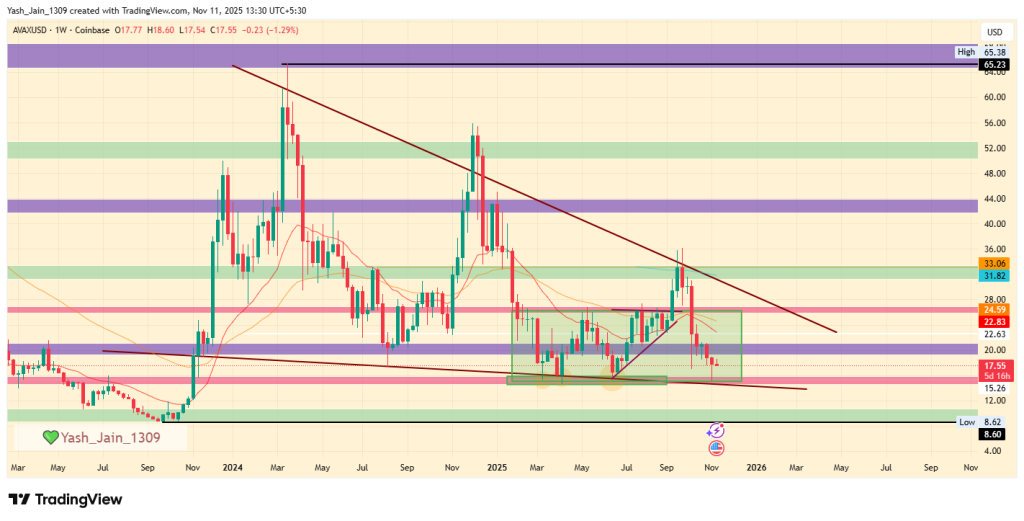

The Avalanche price USD (AVAX) exhibited compressed price action from the start of 2024, deteriorating further in 2025. The crash followed from a height of $65 to $15.50 by March 2025.

Since then, the AVAX/USD has been trapped in a range-bound situation. In September, the token briefly tried to initiate a promising bullish rally by breaking the upper boundary of this range, but it remained brief due to the 2-year strong declining upper trendline acting as resistance again, and as a result, the falling wedge continued with AVAX price hitting $15.50 for the third time in 2025.

Since this support aligns well with the falling wedge’s lower border, it suggests bullish odds that a rebound may come soon to retest the range upper border around $26, which is next to the falling wedge’s upper border that dynamically could act as a hurdle at around $28 if $26 is briefly breached on the upside. That makes the $26-$28 key hurdle area to watch, as a weekly break here could result in a good rally on the upside, and 2025 could end by testing $44 or even $52.

Also, if things progress well due to an November granite update, which may serve as a catalyst for this rally, making the odds substantial enough for this bullish outlook, and potentially extending its price action beyond $52 to reach $65 in the first half of 2026.

However, should AVAX fail to hold the line and continue its decline, the immediate risk is a fall to $10-$8 support, which would likely lead to prolonged sideways movement for the year-end, and all hopes for a rally would shift next year, 2026.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $25 | $33 | $50 |

Avalanche Price Target November 2025

After the brief rally in September, October was taken by the bears, and even November remains in their grasp. However, that situation appears to be easing as AVAX/USD has reached a strong demand area that could spark a bullish surge if all demands are met properly.

Also, a granite update is scheduled, which could be the most likely catalyst to push it upward. However, if that doesn’t happen, consolidation around $15.50 may persist through November, and December could show a bullish move.

Also, if November fails to show any momentum, the time in December will be too short to demonstrate any fruitful upside if bullish momentum is half-baked. However, it will be a different story if bulls join on full throttle, which could result in a parabolic rally even in the short period of days.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| AVAX Price Target November 2025 | 15.00 | 26.50 | 42.50 |

Avalanche Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 20.00 | 50.00 | 80.00 |

| 2027 | 31.50 | 79.00 | 126.50 |

| 2028 | 50.50 | 126.50 | 202.50 |

| 2029 | 81.00 | 202.50 | 324.00 |

| 2030 | 129.50 | 324.00 | 518.50 |

AVAX Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments, and trend analysis of the altcoin, here are the possible AVAX price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 209 | 270 | 331 |

| 2032 | 259 | 344 | 430 |

| 2033 | 307 | 418 | 529 |

| 2040 | 1,212 | 2,055 | 2,899 |

| 2050 | 8,679 | 13,010 | 17,341 |

Market Analysis

| Firm | 2025 | 2026 | 2030 |

| Changelly | $24.72 | $40.82 | $232.67 |

| Coincodex | $32.63 | $28.42 | $19.98 |

| Binance | $25.64 | $26.92 | $32.72 |

*The aforementioned targets are the average targets set by the respective firms.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, AVAX is a profitable investment for the long term, factoring in the strengths of the network. And the sprawl of the network in terms of utility.

At the time of writing, the price of 1 AVAX crypto was $23.99.

AVAX could reach up to $50 by the end of 2025, driven by ETF rumors, tech upgrades, and growing adoption.

Considering you invested $100 in $AVAX on 1st January 2021 at an average price of $3, your investment would have increased to $643.64.

AVAX is available for trade across prominent cryptocurrency exchange platforms like Binance, OkX, and Huobi, amongst others.

The transactional finality of the Avalanche network is 0.8 seconds.

AVAX

BINANCE

Disclaimer and Risk Warning

The price predictions in this article are based on the author's personal analysis and opinions. CoinPedia does not endorse or guarantee these views. Investors should conduct independent research before making any financial decisions.