XRP price prediction November 2025 turns bullish as ETF optimism, whale accumulation, and surging network activity converge.

Canary Capital’s XRP ETF launch could trigger a breakout above $5, that will pump XRP’s strongest rally since mid-2025.

On-chain growth, derivatives activity, and institutional demand strengthen XRP’s setup heading into year-end.

As the XRP price prediction November 2025 gains attention, the token’s outlook is brightening ahead of ETF approval. With the XRP ETF launch date drawing near, Ripple’s expanding payment infrastructure and a surge in on-chain metrics could ignite a significant rally, potentially driving prices toward the long-awaited $5 mark.

ETF Momentum: Canary Capital’s Launch Could Redefine XRP’s Market

After months of anticipation, the XRP community is preparing for a defining moment as Canary Capital’s XRP ETF gears up for a potential November 13, 2025 debut.

This development follows the firm’s amended filing that removed the “delaying amendment,” allowing the ETF to become auto-effective 20 days after submission.

If approved, this ETF would mark a major turning point, potentially mirroring the success of earlier Bitcoin and Ethereum ETF launches. Ripple’s previous legal victory against the SEC already boosted investor confidence earlier this year, and this ETF approval could provide the next wave of momentum.

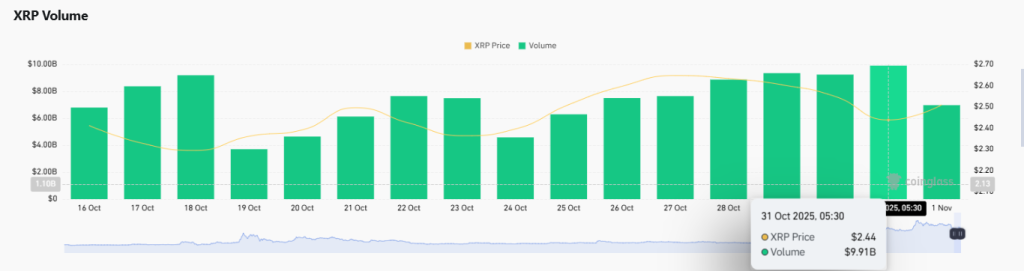

Currently, XRP price today sits near $2.5, recovering steadily from October’s pullback. Analysts believe that confirmation of a U.S.-listed ETF could set off a bullish breakout, supported by increasing speculative activity in XRP derivatives and growing institutional participation.

On-Chain Activity and Utility Paint a Bullish Picture

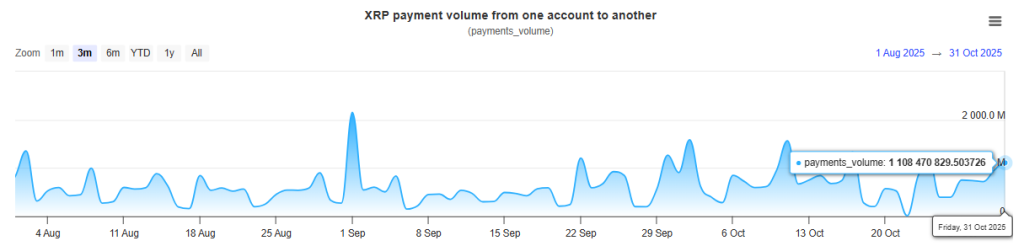

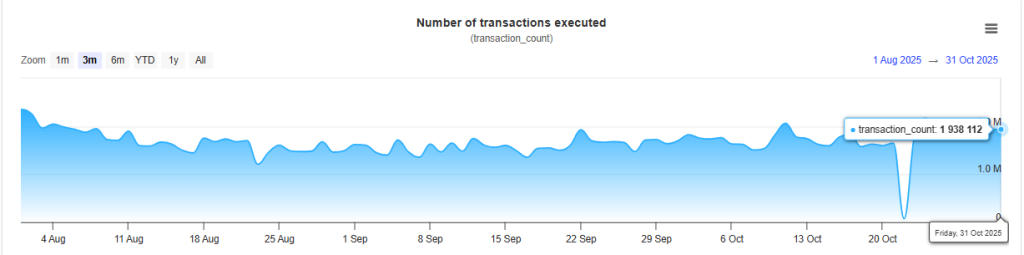

Beyond ETF headlines, Ripple’s ecosystem continues to show powerful on-chain expansion. According to data from XRPSCAN, the number of daily payments jumped from 37,539 in early October to over 1.05 million by month-end. Payment volumes have also skyrocketed from 11.19 million to 1.108 billion, underscoring renewed network demand.

Even the count of active sender accounts surged from just 2,035 to 28,297, while total transactions hit 1.93 million by late October. These metrics suggest growing adoption across Ripple’s payment network, driven by its efficient cross-border infrastructure that continues to bridge traditional finance and blockchain technology.

Such utility-driven expansion strengthens the XRP price forecast, reflecting both fundamental and speculative interest. With the weekly XRP price chart showing strong consolidation after a major breakout from a seven-year symmetrical triangle, the pattern indicates bullish accumulation before a potential next leg higher.

Derivatives and Institutional Signals Support the Upside Case

In the derivatives market, XRP crypto activity remains robust. Futures open interest now hovers around $4.21 billion, while derivative volumes have surged to $9.91 billion, up sharply from early October’s $3.7 billion lows. These figures highlight that traders are actively positioning for heightened volatility ahead of the ETF launch.

At the same time, competition among major asset managers is heating up. Besides Canary, several firms including WisdomTree, Grayscale, Bitwise, Franklin Templeton, and 21Shares have already filed for XRP ETF approval. The growing institutional race indicates that market confidence in XRP’s long-term utility is at an all-time high.

From a technical standpoint, XRP’s weekly chart suggests strong structural support, pointing to a potential move toward $5–$5.25 by year-end. The first half of 2026 could see prices advancing toward $7, with XRP price prediction models hinting at a $10 potential if institutional demand sustains.

As November unfolds, the XRP price prediction November 2025 reflects an turning point defined by utility growth, ETF momentum, and market conviction. Also it is signaling that the next breakout may just be around the corner.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.