Many cryptocurrency traders say that relying solely on price action strategies is not always a sure thing. They are right. Sometimes these strategies don’t work, but it is often because traders overlook a crucial aspect: whether the market is moving in a range or a trend. It is essential to recognise that price action trading strategies designed for trending markets might not do well in ranging markets, and vice versa. In this article, we will take a close look at this idea and explore various approaches that can be used depending on whether the market is ranging or trending.

1. What Makes a Trending Market

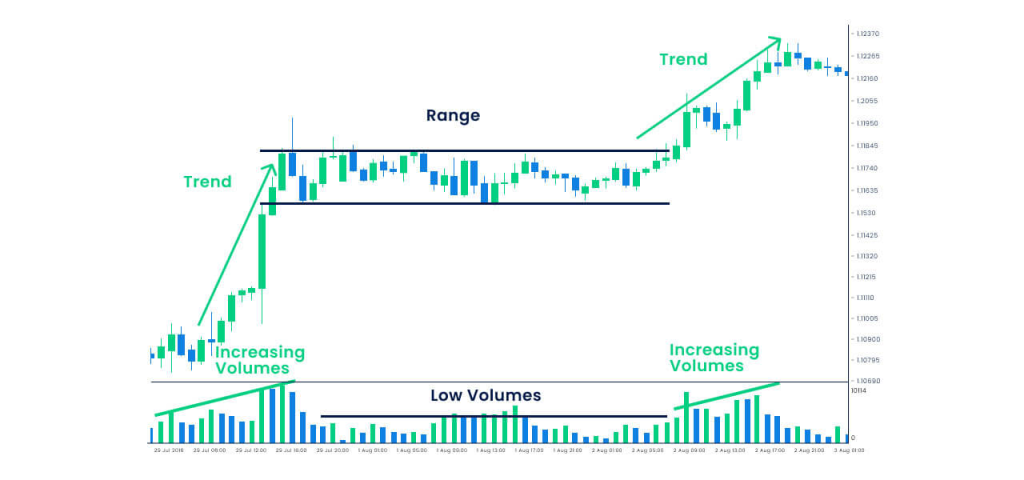

In the world of cryptocurrency price action trading, a trending market is when the price of a digital asset consistently moves either upwards (bullish trend) or downwards (bearish trend). These trends are crucial for crypto traders as they present opportunities for profit. In a bullish trend, crypto prices form a series of higher highs and higher lows, while in a bearish trend, they form lower lows and lower highs. Pullbacks, temporary reversals within the trend, also play a significant role. If these pullbacks don’t disrupt the trend’s pattern, the trend remains intact.

2. Understanding the Contrast: Trending Markets versus Ranging Markets

A ranging market occurs when the price of a digital asset moves sideways within a specific range, without establishing a clear upward or downward trend. Traders encounter ranging markets where prices oscillate between defined support and resistance levels, limiting significant directional movement. In such markets, trading opportunities may be constrained due to the absence of sustained price trends. Identifying ranging markets is crucial for crypto traders to adjust their strategies accordingly, employing techniques to identify potential reversals at support and resistance levels.

3. Simple Price Action Trading Strategy for Range Markets

Here is a simple step-by-step price trading strategy tailored for range markets.

- Identify the Range

Determine the upper and lower boundaries of the range by identifying significant support and resistance levels where price tends to fluctuate.

- Buy at Support, Sell at Resistance

When the price reaches the lower boundary (support) of the range, consider buying. Conversely, when the price reaches the upper boundary (resistance) of the range, consider selling.

- Set Stop-Loss and Take-Profit Levels

Place a stop-loss order just outside the range boundaries to manage risk in case of a breakout. Set a take-profit target near the opposite boundary of the range.

- Confirm with Indicators

Use oscillators like RSI or Stochastic to confirm overbought or oversold conditions within the range, indicating potential reversal points.

- Monitor Price Action

What for price action signals such as candlestick patterns or chart patterns that suggest a continuation or reversal within the range.

- Adjust Positions

If the price breaks out of the range, adjust your positions accordingly and consider trading with the new trend direction.

3.1. Advanced Price Action Trading Strategies for Ranging Markets

Here are a few advanced price action trading strategies for ranging markets.

- Range Breakout Trading

Wait for the price to breach the range boundary. Enter trades in the breakout direction, confirming with volume and momentum indicators to validate the move’s strength.

- Mean Reversion Trading

Purchase assets near the range’s lower boundary and sell near the upper boundary, anticipating a return to the average price. Use indicators like moving averages to identify potential reversal points.

- Range Expansion Trading

Recognise periods of low volatility within the range. Anticipate breakout or breakdown opportunities by entering trades ahead of potential price expansion, using volatility indicators to gauge the likelihood of a significant move.

- Price Consolidation Pattern

Identify consolidation patterns like triangles or rectangles forming within the range. Trade breakouts of breakdowns from these patterns, confirming with volume and price action signals to ensure validity and maximise profitability.

- Volatility Channel Trading

Calculate the average true range to measure market volatility within the range. Construct channels around the range boundaries based on multiples of the ATR. Enter trades when price approaches channel extremes, using channel breaks as signals for potential trend reversals or continuations.

4. Simple Price Action Trading Strategy for Trending Markets

Here is a simple step-by-step trading strategy tailored for trending markets:

- Identify the Trend

Determine the direction of the prevailing trend by analysing higher highs and higher lows in a bullish trend or lower highs and lower lows in a bearish trend.

- Wait for Pullbacks

During a bullish trend, wait for price retracements to find a favourable entry point. In a bearish trend, look for price bounces to enter short positions.

- Confirm with Indicator

Use trend-following indicators such as moving averages or trendlines to confirm the strength and direction of the trend. Look for price to remain above (bullish) or below (bearish) these indicators.

- Set Stop-Loss and Take-Profit Levels

Place stop-loss orders below swing lows in a bullish trend or above swing highs in a bearish trend to manage risk. Set take-profit targets based on key support and resistance levels or Fibonacci extensions.

- Trail Stops

As the trend progresses, adjust stop-loss orders to lock in profits and protect against potential reversals.

- Monitor for Trend Reversal

Be vigilant for signs of trend exhaustion or reversal, such as divergences in momentum indicators or candlestick reversal patterns.

4.1. Advanced Price Action Trading Strategies for Ranging Markets

Here are a few advanced price action trading strategies for ranging markets.

- Breakout Trading

Identify key support and resistance levels within the trend and enter trades on breaks of these levels, confirming with volume and momentum indicators.

- Trend Continuation Patterns

Look for chart patterns such as flags or pennants forming within the trend, trading breakouts from these patterns with confirmation from volume and price action signals.

- Divergence Trading

Utilise momentum oscillators like the MACD or RSI to identify divergence with price, signalling potential trend reversals or continuations.

- Multiple Time Frame Analysis

Analyse the trend on different time frames to confirm its strength and direction, entering trades aligned with the prevailing trend or shorter time frames while considering longer-term trends for overall market context.

- Moving Average Crossover

Use a short-term and long-term moving average to identify trend reversals. Enter trades when the short-term moving average crosses above (bullish) or below (bearish) the long-term moving average, confirming the trend direction.

Endnote

Mastering price action trading strategies tailored for both ranging and trending markets is paramount for cryptocurrency traders seeking consistent profitability. Understanding the nuances of market conditions, from identifying trends to recognising range-bound movements, empowers traders to adapt and thrive in various scenarios. By employing a combination of simple and advanced techniques, incorporating indicators, and maintaining vigilance for trend shifts, traders can enhance their decision-making processes and navigate the dynamic landscape of cryptocurrency markets with confidence and effectiveness. Ultimately, a comprehensive approach to price action trading facilitates the pursuit of trading success amidst the volatility and opportunities inherent in digital asset markets.

Also read: Price Action Mastery: Round Numbers and Their Crypto Trading Impact

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.