Have you ever looked at a chart and wondered if there’s a way to predict where the price might go next? What if I told you that traders have been using a simple mathematical tool for decades to find hidden support and resistance levels? That tool is called Fibonacci retracement, and when combined with price action, it can be a game-changer.

In this guide, we’ll break it down step by step. No complex jargon, just clear explanations and practical tips. Ready? Let’s dive in!

What is Fibonacci Retracement?

Fibonacci retracement is based on the Fibonacci sequence, a series of numbers where each one is the sum of the two before it (1, 1, 2, 3, 5, 8, 13, and so on). When these numbers are turned into ratios, they create levels that traders use to predict price movements.

The most commonly used Fibonacci retracement levels are:

- 23.6%

- 38.2%

- 50% (not a Fibonacci number but widely used)

- 61.8%

- 78.6%

These levels act as potential support or resistance areas. In simple terms, they are points where the price might bounce or reverse.

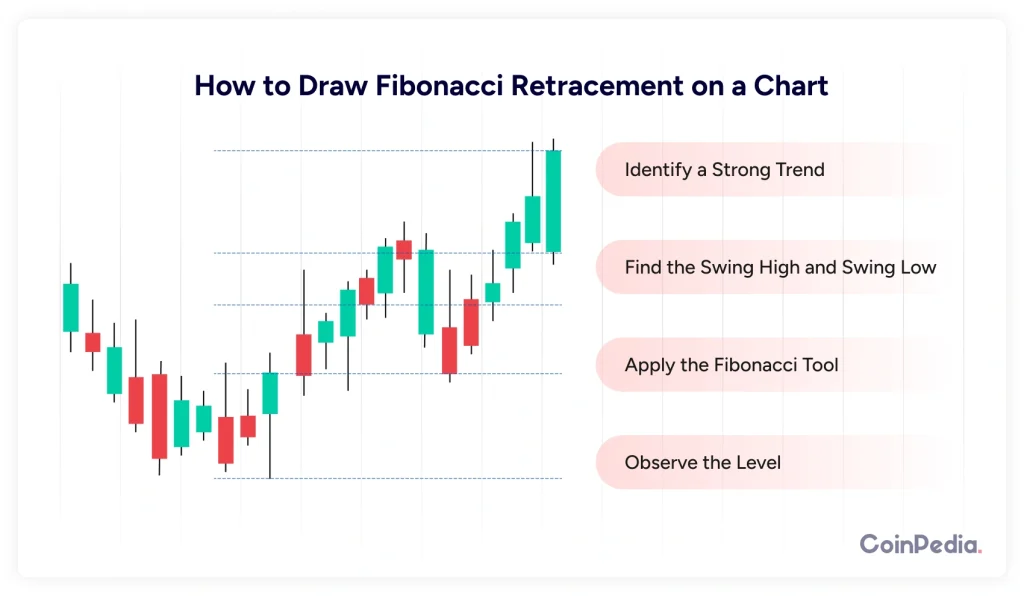

How to Draw Fibonacci Retracement on a Chart

Let’s keep this simple.

- Identify a Strong Trend – You need a clear uptrend or downtrend before applying Fibonacci retracement.

- Find the Swing High and Swing Low – In an uptrend, the swing low is the lowest point before the price starts rising. The swing high is the highest point before it starts pulling back. In a downtrend, it’s the opposite.

- Apply the Fibonacci Tool – Most trading platforms have a Fibonacci retracement tool. Simply click on the swing low (or high) and drag it to the opposite point.

- Observe the Levels – The tool will automatically plot the retracement levels. Now, we wait and watch how the price reacts at these levels.

Example: Imagine Bitcoin is in an uptrend, rising from $40,000 to $50,000. You plot Fibonacci from $40,000 (swing low) to $50,000 (swing high). If the price retraces to the 61.8% level at $44,000 and finds support, it could be a great buying opportunity.

Why Price Action Matters

Fibonacci levels alone don’t guarantee success. That’s where price action comes in. Price action is the study of how price moves and reacts at certain levels.

So, when price reaches a Fibonacci level, we need confirmation before making a trade. Here’s how:

- Look for Candlestick Patterns – If you see a bullish engulfing candle or a pin bar at a Fib level, it signals a potential reversal.

- Check Volume – If volume increases at a retracement level, it shows strong buying or selling pressure.

- Observe Market Structure – Is the trend still intact? If yes, the retracement level could act as a strong support or resistance.

Also Read: Creating Excellent Price Action Strategies using Breakout Pullbacks

Using Fibonacci with Price Action – Trading Strategies

Now that you understand Fibonacci retracement and price action, let’s combine them into actionable strategies.

1. Trend Continuation Strategy

This strategy is for traders who want to ride the trend.

- Find an uptrend or downtrend.

- Wait for a pullback to a Fibonacci retracement level (38.2%, 50%, or 61.8%).

- Look for price action confirmation (bullish/bearish candlestick patterns, volume spike, etc.).

- Enter a trade in the direction of the trend.

- Set a stop-loss below the retracement level and aim for the previous swing high/low.

Example: Ethereum is trending up from $2,000 to $2,500. After hitting $2,500, it pulls back to $2,300 (61.8% retracement). A bullish engulfing candle forms. This signals a good entry point to buy.

2. Reversal Strategy

Sometimes, Fibonacci retracement levels act as resistance, leading to trend reversals.

- Identify a strong previous trend that might be losing momentum.

- Watch for prices to hit a Fibonacci level (especially 61.8% or 78.6%).

- Look for bearish price action (such as a shooting star or bearish engulfing candle).

- Enter a short trade (or sell your position).

- Place a stop-loss above the recent high and target lower levels.

Example: Bitcoin surges from $30,000 to $40,000, then retraces to $37,000 (78.6% level). A shooting star candle appears, signaling a reversal. This could be a shorting opportunity.

Common Mistakes to Avoid

Many traders misuse Fibonacci retracement. Here’s how to avoid common mistakes:

- Ignoring Price Action – Fibonacci works best with confirmations like candlestick patterns and volume spikes.

- Forcing Fibonacci on Every Chart – Not every move follows Fibonacci levels. If the trend is messy, it won’t work well.

- Placing Stops Too Close – Give your trade some breathing room. Place stops slightly beyond the retracement level.

- Trading Without a Plan – Don’t jump in just because price touches a level. Wait for confirmation.

Final Thoughts

Fibonacci retracement is a powerful tool, but it’s not magic. When combined with price action, it helps traders find high-probability trades. The key is patience—wait for confirmation, manage risk, and stick to your strategy.

Now it’s your turn. Open your charts, plot Fibonacci retracement, and see how price reacts. With practice, you’ll start spotting opportunities like a pro!

FAQs

Yes, Fibonacci retracement works on all timeframes, but its reliability increases on higher time frames like the 1-hour, 4-hour, daily, and weekly charts. Lower time frames (e.g., 1-minute or 5-minute) may have more noise, making the levels less effective.

Yes! Many traders place their stop-loss slightly beyond the nearest Fibonacci retracement level. For example, if you enter at the 61.8% retracement level, placing a stop just below the 78.6% level can help manage risk.

Fibonacci retracement is most effective in trending markets. In ranging markets, price action is choppy, making it harder to find reliable retracement levels.

Absolutely! Traders often combine Fibonacci retracement with moving averages, RSI (Relative Strength Index), MACD, or trendlines for stronger confirmations before entering a trade.

Fibonacci levels do not always hold, which is why price action confirmation is crucial. The effectiveness of Fibonacci depends on market conditions, volume, and overall trend strength.

We'd Love to Hear Your Thoughts on This Article!

Was this writing helpful?

Yes

Yes  No

No

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.