Bitcoin has historically followed a four-year boom and bust cycle, with crashes occurring roughly every fourth year.

Despite this pattern, experts like Matt Hougan predict a less severe crash in 2026 due to increased market maturity, favorable US political climate and Wall Street's crypto focus.

Hougan forecasts Bitcoin reaching $200,000 by the end of 2025, driven by these factors.

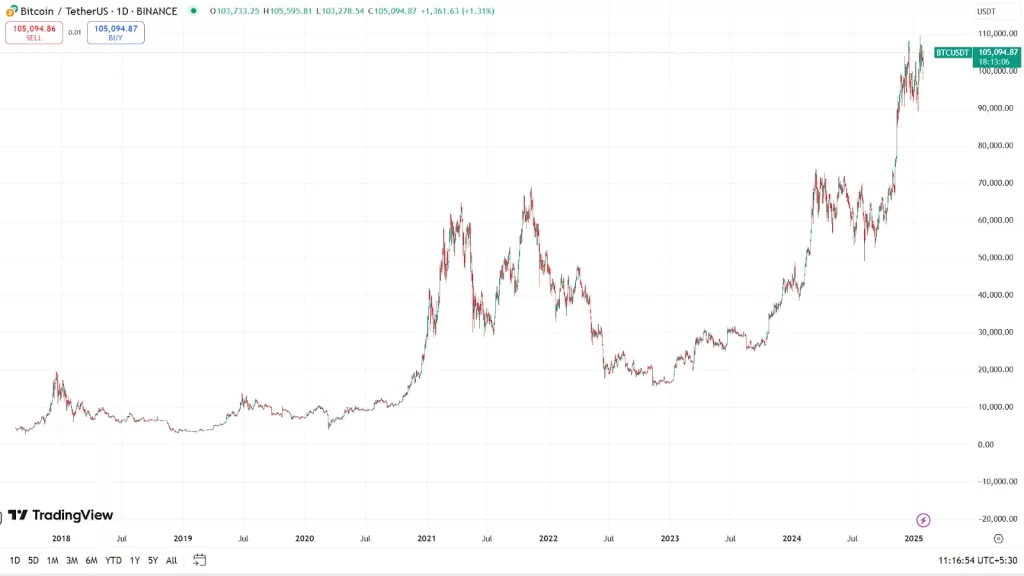

Bitcoin has a history of boom and bust cycles, following a pattern of significant price swings every four years. In 2014, 2018, and 2022, Bitcoin experienced declines of -57.6%, -73.3%, and -64.3%, respectively.

With 2026 on the horizon, many are wondering if history will repeat itself. Will Bitcoin’s four-year cycle lead to another crash, or is this time different?

A surprising insight from expert Matt Hougan suggests the future of Bitcoin may not be as predictable as it seems.

Curious to find out why? Let’s dive in.

Understanding the Bitcoin Price Cycle

Bitcoin’s price history has been marked by incredible highs and significant crashes. In 2011 and 2012, Bitcoin saw huge gains of +1,435% and +183.5%. Then, in 2013, Bitcoin experienced a massive surge of +5,435%. The market dropped sharply in 2014, by -57.6%, marking the first major crash in the cycle.

The next cycle followed a similar pattern, with Bitcoin climbing +1,369% in 2017, only to drop by -73.3% in 2018. In 2022, Bitcoin saw another decline of -64.3%, but it was not as severe as earlier crashes.

However, the growth in 2021 (+304.1%) was much higher than the +59.6% in 2022.

What Caused Past Bitcoin Crashes?

Each crash had its own causes. In 2014, the collapse of Mt. Gox, a major Bitcoin exchange at the time, played a big role. In 2018, the crash was triggered by the US Securities and Exchange Commission (SEC) cracking down on Initial Coin Offerings (ICOs).

In 2022, the downfall of major players like FTX, Three Arrows Capital, Celsius, and BlockFi caused the market to spiral. These events created uncertainty, but will history repeat itself in 2026?

Why Some Experts Don’t Expect a 2026 Bitcoin Crash

Despite Bitcoin’s past cycles, not all experts believe a severe crash is coming in 2026. Matt Hougan, Bitwise Asset Management’s Global Head of Research, argues that the cryptocurrency market has matured significantly since 2014, 2018, and 2022. With more institutional involvement and a clearer regulatory framework, the market is better prepared to handle potential shocks.

Trump’s Crypto-Friendly Policies: A Turning Point?

Hougan also points to the political changes in the US as a key factor. Following Donald Trump’s victory, the political climate has shifted in favor of the cryptocurrency industry. Soon after taking office, Trump signed an executive order aimed at clarifying cryptocurrency regulations and exploring the creation of a digital assets reserve for the US. This could bring billions, if not trillions, of dollars into Bitcoin, changing the outlook for the market by 2026.

Additionally, the removal of the controversial Staff Accounting Bulletin 121 rule, which required financial firms to treat crypto holdings as liabilities, has created a more favorable environment for Bitcoin. While Hougan remains optimistic, he notes that the full impact of these changes may not be felt immediately.

Bitcoin Price Prediction

Hougan forecasted that the Bitcoin market will reach as high as $200,000 before the end of this year 2025. Interestingly, he claimed that the creation of a Bitcoin reserve by the US is not a prerequisite to achieving this price milestone.

Bitcoin’s four-year cycle has been a strong pattern in the past, but Trump’s crypto-friendly policies and Wall Street’s increasing involvement may change the game. While 2026 could still bring volatility, experts believe the market is stronger than ever. With predictions of $200,000 BTC by 2025, the coming years could reshape the future of crypto.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

In 2030, the price of 1 Bitcoin could reach a height of $610,646.

As per our latest BTC price analysis, the Bitcoin could reach a maximum price of $5,148,828.

By 2050, a single BTC price could go as high as $12,436,545.