The crypto market is currently gripped by fear, with the Fear & Greed Index stuck in the “Extreme Fear” zone – below 30. In times like this, instead of chasing falling altcoins, smart investors are turning to pre-TGE tokens, and many of them are looking at Unich as a safe net to do it.

Smart Money Is Changing Direction

Looking at previous market cycles when fear takes over, professional investors often move toward what we can call ‘high-upside, low-risk bets’ when fear dominates.

For example, a $50 position in a good pre-TGE token might turn into $500 or even $5,000 in just a few weeks, if the token gets listed and captures strong market attention. But if things don’t work out, your max loss is just the initial $50 – a manageable risk in a larger portfolio. This is the kind of asymmetric reward smart money loves.

Take Jupiter as another example – one of Solana’s biggest DEXs. Its pre-market price was just $0.02–0.03, but it launched around $0.30 and soared past $0.70 in the first month. Early investors gained over 20x returns without risking large capital.

Recent data also shows trading on DEXs and CEXs is slowing, but pre-TGE OTC is on the rise. As of June 27, the DEX/CEX volume ratio hit a record 27.92%, representing a clear shift toward early listings.

Unich Is Attracting That Smart Money Flow

The biggest problem with pre-TGE trading in the past was the lack of trust. OTC deals usually happened in private Telegram or Discord groups, with no contracts, no protection, and no way to safely exit the position. Just recently, on June 21st, a $50M scam by a group called Aza Ventures exposed just how risky trust-based OTC really is. They posed as insiders offering early allocations in top tokens like SUI, SEI, and NEAR, targeting VCs, KOLs, and whales.

Unich Pre-Market was built to solve exactly that problem. Everything runs on smart contracts, so trades happen transparently, without relying on trust between buyers and sellers. Anyone can list or buy pre-TGE positions on Unich, and all conditions are enforced automatically by code.

One of the most powerful features Unich offers is something no other OTC platform in the world has: Cashout Order. This lets buyers or sellers exit their positions anytime before the token launches (TGE). So if you change your mind or want to reduce risk, you can swap your position for another whenever you want.

With Cashout Order, Unich gives users full control over their money and risk.

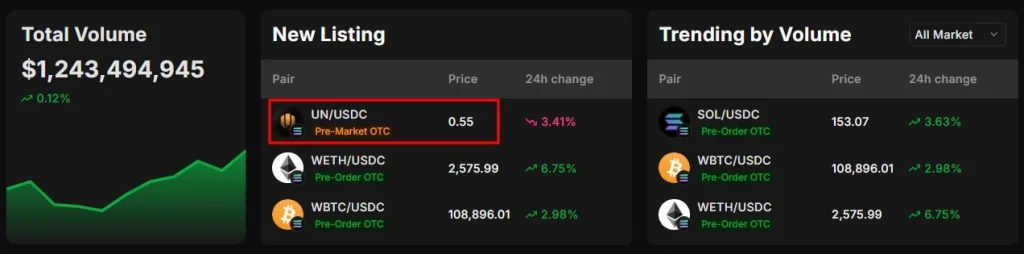

Since launching its mainnet, Unich has processed over $1.1 billion in total trading volume, with more than 1 million transactions completed. Even more impressive: the platform has generated over $20 million in revenue, all while maintaining a perfect record – zero reported cases of lost funds, system errors, or fraud. That level of performance is almost unheard of in OTC trading, which is often known as crypto’s “wild west.”

Unich’s Native Token – $UN – Is Now On Sale

As Unich continues to dominate the pre-TGE trading space, it’s now opening up access to its own foundation: the $UN token – currently being sold through the fully on-chain Unich IDO, hosted directly on the Unich platform. The IDO is split into two public rounds, with 100 million $UN allocated in total.

$UN sits at the heart of the entire Unich economy. All platform revenue flows back into this token, which means every OTC trade, every cashout, and every pre-order generates real demand for $UN. The more people trade, cash out, and use Unich, the more pressure builds on $UN from the demand side. That’s why $UN has strong pump potential.

And we’re already seeing it happen. After $UN went live on the Unich Pre-Market, its price jumped from $0.16 to $0.50-0.80 in just 24 hours – a clean x5 upswing.

$UN now available for trading before TGE

Users who hold or stake $UN will benefit from reduced trading fees, priority access to future features, and increased earnings from the affiliate program.

When markets panic, smart capital will look for asymmetric paths with controlled risk. Pre-TGE tokens offer exactly that. And Unich gives those investors a safe home: with transparent execution, programmable safety, and liquidity you can actually exit from.

Disclaimer and Risk Warning

The content on Coinpedia's sponsored page is provided by third parties and is intended for promotional purposes. Coinpedia does not endorse, guarantee, or take responsibility for the accuracy, quality, or effectiveness of any services, products, or information presented in these sponsored materials. The inclusion of sponsored content does not imply Coinpedia’s approval or support. Readers are advised to exercise due diligence and conduct their research before making decisions or taking action based on the information presented in sponsored content.