The UK's Financial Conduct Authority (FCA) is proposing stricter regulations for crypto assets to protect investors and maintain market integrity.

These regulations aim to limit public offers of crypto assets to regulated platforms and enhance transparency and security.

While these regulations may make the market safer, they could also increase costs for companies and limit options for investors.

Various countries are embracing Bitcoin and crypto while some are trying to push leash on the ecosystem. The UK is one of the countries that are trying to bring strict regulations to protect the investors. The Financial Conduct Authority (FCA) has shared its latest proposals for tight regulations on crypto assets. The objective behind them is to make the market safer.

The FCA has made it clear: if you’re trading crypto, you’ll need to play by their rules. But what does that mean for the average investor—or the companies behind these digital coins? Are crypto regulations in the UK going to be tougher? Let’s find out.

Why the FCA is Introducing Stricter Rules

The FCA wants to protect investors and ensure a fair market. Recent controversies like scams, insider trading, and market manipulation have dented trust in cryptocurrencies. These issues have pushed the FCA to take action, aiming to clean up the industry and rebuild confidence.

One major proposal is to allow public offerings of crypto assets only on regulated trading platforms. This means that unregulated or risky crypto projects will find it harder to enter the market. The goal is to offer investors safer and more reliable options for their investments.

New Standards for Crypto Companies

Crypto companies will face tougher requirements. They will need to provide detailed information about their projects, including risks, governance, and environmental impacts like energy usage and emissions. The FCA also plans to introduce stricter checks on project teams, ensuring only credible players can operate in the UK market.

To prevent unethical practices like insider trading, trading platforms will need systems to detect and report market abuses. The FCA is also pushing for greater transparency—companies must make all documents related to their crypto offerings publicly available through the National Storage Mechanism. This aligns with the blockchain principle of openness.

Implementing Crypto Regulations in The UK

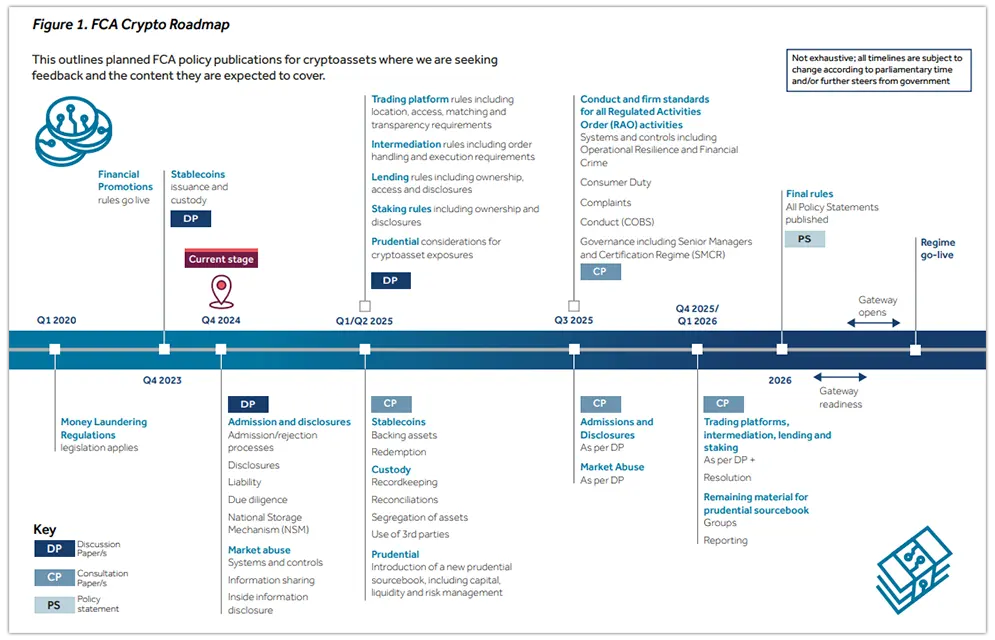

The FCA is inviting feedback on these proposals from the public and industry experts, with a deadline in March 2025. Based on this input, the final regulations are expected to be rolled out by 2026.

The proposed rules aim to make the crypto market safer, but they come with challenges. Companies will face higher compliance costs, and investors might have fewer choices. Still, the FCA’s goal is clear: to strike a balance between fostering innovation and protecting consumers.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.