After an impressive upside rally, the overall cryptocurrency market dropped significantly again, erasing almost all its gains. This sharp decline has not only instilled fear among investors but also led to multi-million dollar liquidations of intraday traders, as reported by the on-chain analytics firm CoinGlass.

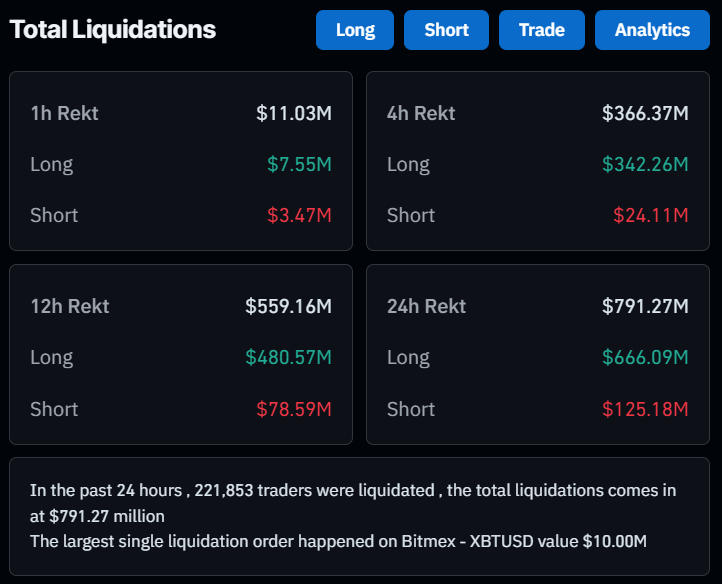

Data from CoinGlass revealed that approximately 222,235 traders were liquidated amid ongoing market uncertainty, resulting in a total liquidation of $801.30 million worth of cryptocurrencies. Additionally, CoinGlass data further revealed that the largest single liquidation order occurred on BitMEX.

Out of these substantial liquidations in the past 24 hours, the majority came from long positions, with over $665 million worth of long positions liquidated. This significant long-position liquidation likely resulted from traders’ bullish sentiment yesterday following the Crypto Strategic Reserve announcement.

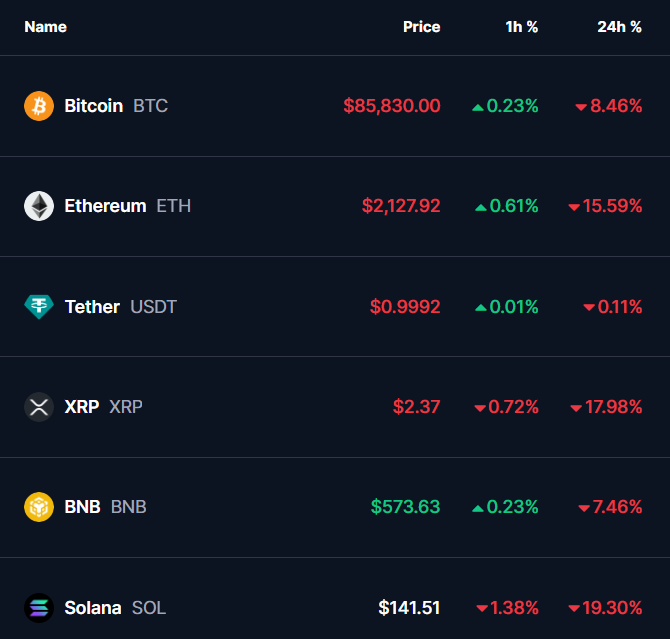

Besides these liquidations, top assets have significantly plummeted, including Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL). Data from CoinMarketCap revealed that these assets have lost over 9%, 15%, 18%, and 20% of their value in the past 24 hours.

Today, following a 9% price drop, Bitcoin (BTC) is trading near $85,410. This notable decline has led to a 30% surge in trading volume, indicating heightened participation from traders and investors.