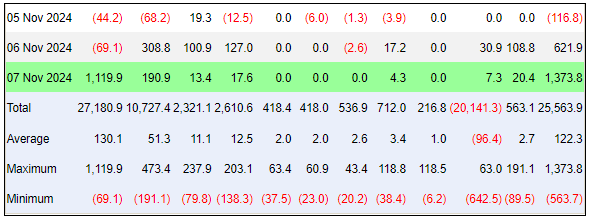

BlackRock's spot Bitcoin ETF saw a massive inflow of $1.119 billion on November 7th, making up 82% of all spot Bitcoin ETF inflows that day.

Bitcoin's recent price surge to an all-time high of $76,943, fueled by positive sentiments about Trump's win.

Other Bitcoin ETFs like Fidelity's and ARK's are also seeing significant inflows

BlackRock’s spot Bitcoin ETF has just hit a major milestone. On November 7, the fund saw an incredible $1.119 billion in inflows, a remarkable recovery after losing $113 million just two days earlier. To put it in perspective, BlackRock’s ETF made up a massive 82% of all spot Bitcoin ETF inflows that day. With Bitcoin reaching new record highs, investor excitement is clearly growing.

But what’s driving this wave of enthusiasm?

Bitcoin Hits New Heights: What’s Fueling the Rally?

Bitcoin recently reached an all-time high of $76,943, following a jump to $76,500 the day before. This surge didn’t happen in isolation—it came right after Donald Trump’s political win, which many see as a positive for crypto. Some analysts believe his pro-crypto views could push Bitcoin even higher, with a few predicting it could hit $100,000 soon. Investors are clearly sensing an opportunity, which may explain the large inflows into Bitcoin ETFs. If Bitcoin prices continue to rise, these funds are likely to see even more investment.

Other Bitcoin ETFs Join the Action

Although BlackRock is leading the charge, other Bitcoin ETFs are also benefiting from the growing demand. Fidelity’s Wise Origin Bitcoin Fund saw inflows of $190.9 million, while ARK’s 21Shares Bitcoin ETF brought in $17.6 million. While these numbers are smaller than BlackRock’s, they still show strong investor interest in Bitcoin. Once dominated by direct Bitcoin trading, the market is now seeing ETFs becoming a major way for people to invest in crypto.

A Bullish Outlook for Bitcoin ETFs

Currently, Bitcoin’s price is around $75,950, still up nearly 2% in the last 24 hours. With Trump’s potential influence on the crypto market, optimism is high, and investors are looking for more big moves. As long as the bullish trend continues, it looks like Bitcoin ETFs—especially BlackRock’s—will stay in the spotlight.

And if Bitcoin keeps climbing, new records could be just around the corner.