Algorand Price Prediction 2026, 2027 – 2030: Will ALGO Price Hit $1?

Story Highlights

- The live price of the Algorand is $ 0.08441296

- Price predictions suggest that ALGO has the potential to hit $0.65 to $1.35 by the end of 2026.

- Long-term forecasts indicate potential highs of $5.65 by 2030.

Algorand’s strong push for scalability, security, and decentralization is paying off. With the launch of AlgoKit 3.0 in Q1 2025 and growing developer interest, ALGO adoption has improved and is now on the rise. The rising adoption is beneficial for an asset, as it is directly proportional to a token’s price.

But the big question for intrigued market participants still remains: Can ALGO Price hit $1 this cycle? Read our in-depth Algorand Price Prediction 2025 and long-term outlook through 2030 to find out.

Table of Contents

Algorand Price Today

| Cryptocurrency | Algorand |

| Token | ALGO |

| Price | $0.0844 |

| Market Cap | $ 750,056,586.61 |

| 24h Volume | $ 32,254,489.6610 |

| Circulating Supply | 8,885,561,587.1746 |

| Total Supply | 10,000,000,000.00 |

| All-Time High | $ 3.2802 on 21 June 2019 |

| All-Time Low | $ 0.0822 on 06 February 2026 |

Coinpedia’s ALGO Price Prediction 2026

Since the 2021 crash, ALGO price has struggled to regain the $0.4000 mark and has hit a new all-time low of $0.0806 in Q1 2026. The market remains unstable, but if conditions improve, ALGO could recover to around $0.2000, provided it closes above that level. Otherwise, it may continue to consolidate near its lows.

Algorand February Price Prediction 2026

In January, the price fell below the $0.1125 support level and dropped to $0.0806 by February. Although it briefly dipped, it managed to climb back and trade within a demand area. Despite being in a multi-year demand zone, the anticipated bullish momentum has not yet materialized. There are only a few days left until the ALGO price moves into March 2026.

If broader market momentum supports the price and it breaks out of the current consolidation, February could end near $0.1108, and Q1 might see a rise toward $0.1400. However, if the downward trend continues, the price may slide back to $0.0806 or even lower.

ALGO Price Prediction 2026

Since the crash in 2021, ALGO’s price has struggled to recover beyond the $0.4000 mark and has remained in a consolidation phase on the monthly chart below this level. In Q1 2026, it slipped beneath this monthly consolidation range and marked a new all-time low (ATL) of $0.0806, yet it continues to consolidate around the lower edge of this multi-year range.

The broader market shows no bullish developments, and even blue-chip cryptocurrencies are facing challenges, making the entire altcoin market unstable in the first quarter of 2026. However, there are still many days remaining before the end of Q1 in March 2026, and ALGO is trading near the lower edge, where demand could increase if the broader market improves.

In this scenario, ALGO’s price could potentially recover to $0.1400. However, to move beyond this point, it needs to achieve a monthly close above $0.1400. Otherwise, it will likely continue to consolidate near the lower border of the monthly range.

AVAX Onchain Outlook

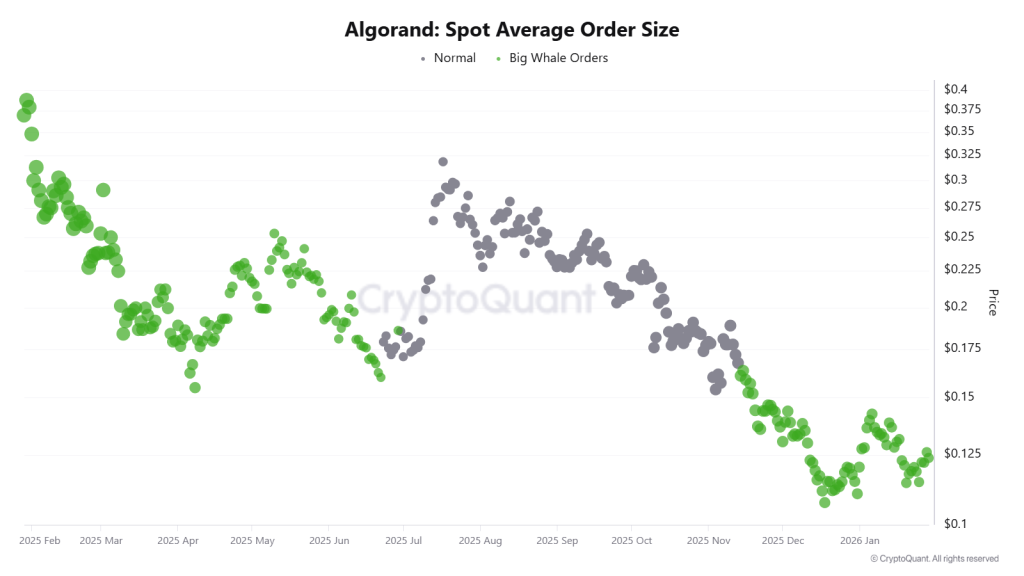

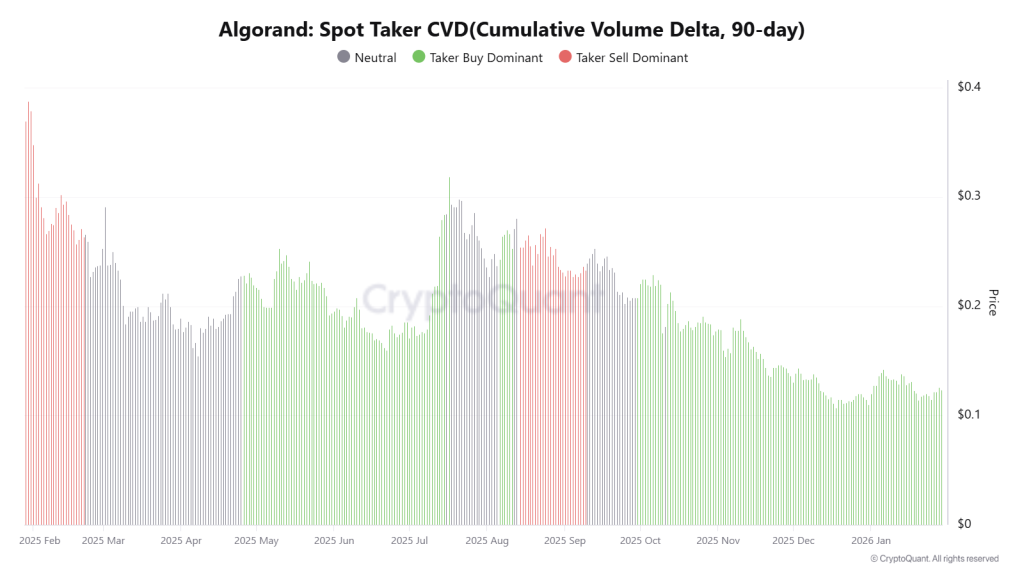

The on-chain outlook for Algorand (ALGO) is flashing bullish signals that suggest a transition from retail-led speculation to institutional-grade accumulation. A notable increase in average order sizes indicates that “whale” investors are actively participating, effectively absorbing supply during consolidation phases to reduce downside risk.

Simultaneously, the 90-day Cumulative Volume Delta (CVD) has entered a “Taker Buy Dominant” phase, which historically correlates with upward price movement as aggressive buyers consistently outpace sellers in the open market. These metrics, paired with a “cooling” spot and futures volume bubble map, suggest the market is moving through a healthy period of stabilization and building the necessary liquidity for a potential breakout.

Algorand Price Targets 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 0.65 | 1.0 | 1.35 |

| 2027 | 0.90 | 1.50 | 2.00 |

| 2028 | 1.40 | 2.10 | 2.90 |

| 2029 | 1.75 | 2.95 | 4.15 |

| 2030 | 2.50 | 4.05 | 5.65 |

Algorand (ALGO) Price Forecast 2026

Moving forward to 2026, the ALGO price may record a maximum price of $1.35. With a potential low of $0.65, the average price could settle at around $1.0.

ALGO Coin Price Projection 2027

Looking ahead to 2027, the Algorand crypto token may range between $0.90 and $2.0. With this, the average trading price could settle at around $1.50 for the year.

Algorand Crypto Price Action 2028

In 2028, the ALGO coin with a potential surge could reach a high of $2.90, a low of $1.40, and an average of $2.10.

ALGO Token Price Analysis 2029

Moving into 2029, the Algorand coin could range between $1.75 and $4.15. Considering the buying and selling pressure, the average price could settle at around $2.95.

ALGO Price Prediction 2030

By 2030, the value of a single Algorand token could reach a high of $5.65, a low of $2.50, and an average of $4.05.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Currencyanalytics | $0.67 | $0.97 | $4.06 |

| Priceprediction.net | $0.18 | $0.258 | $1.10 |

| DigitalCoinPrice | $0.82 | $1.28 | $2.60 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Algorand’s price in 2026 is forecasted between about $0.65 and $1.35, with an average near $1 if momentum and adoption improve.

In 2027, ALGO may range from $0.90 to $2.00, with an average price around $1.50, depending on market demand and adoption.

By 2030, ALGO could reach a high of $5.65, a low of $2.50, and an average price of $4.05, reflecting growing adoption.

Over the next 10 years, ALGO could reach $5.65 at its peak, driven by network growth, adoption, and real-world asset tokenization.

Network adoption, scalability, institutional participation, and real-world asset tokenization are key factors driving ALGO’s price potential.

ALGO

BINANCE

Disclaimer and Risk Warning

The price predictions in this article are based on the author's personal analysis and opinions. CoinPedia does not endorse or guarantee these views. Investors should conduct independent research before making any financial decisions.