ZORA price jumps 109% in a week, hits a new ATH of $0.1409.

Whale wallets boost holdings 16% in 7 days, tightening exchange supply.

Creator-coin boom on Base drives record activity, but derivatives risk lingers.

ZORA is the talk of the crypto town for its jaw-dropping price surge. The token has risen 31.57% in the past 24 hours and a 1377% over the last month. The token hit a fresh all-time high of $0.1409 earlier today before a minor pullback. The run was fueled by whale accumulation, a wave of new creator-coin launches on Coinbase’s Base app, and growing speculation in the derivatives market.

With a market cap of $409.6 million and daily trading volume nearing $342 million, ZORA’s liquidity and attention have never been higher. Wondering if a pullback is on the cards? Read this Zora price analysis for all details.

On-Chain Insights

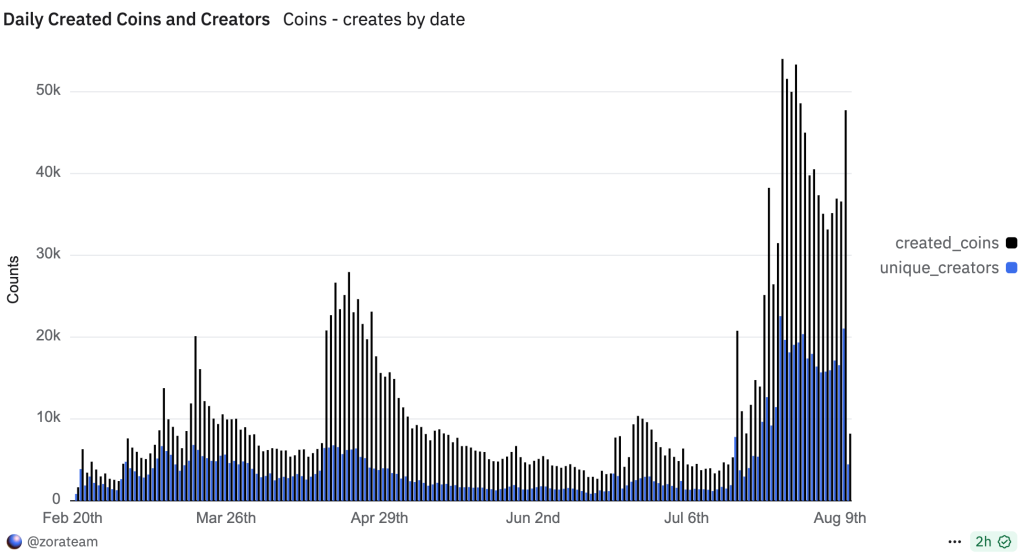

Whale wallets have been the clearest bullish signal, increasing holdings from $29 million to $33.97 million since August 4, a 16.61% rise. This accumulation has coincided with reduced supply on exchanges, which now hold 4.56 billion tokens, down 1.88%. The number of unique creators issuing coins on ZORA’s Base integration has risen tenfold month-over-month, with daily coin issuances recently exceeding 47,000.

Engagement is equally strong, 2.92 million unique traders have interacted with these creator coins, generating over $512 million in volume since mid-July. While this activity boosts ZORA’s utility, the sheer speed of issuance hints that some of this demand may be speculative rather than purely organic.

Derivatives data adds a layer of caution. Open interest has spiked 47% in the past 24 hours. But the funding rates have turned negative, and the long/short ratio has dipped below 1. This signals an increase in bearish bets, meaning any sudden long unwinds could trigger sharp downside volatility.

Zora Price Analysis

ZORA’s price breakout above the $0.10 resistance last week triggered a parabolic run to $0.1409. This was before the sellers emerged at the $0.1432 zone. The current price action shows support around $0.10 and $0.09, with the next key resistance remaining $0.1432.

Coming to indicators, the RSI recently pushed above 72, indicating short-term overbought conditions. Combined with the proximity to a major resistance level, this suggests the possibility of a pullback before another leg higher. However, if whales continue accumulating and Base ecosystem usage remains elevated, a decisive breakout above $0.1432 could open the door to $0.16 in the coming time.

FAQs

Strong whale accumulation, rapid Base adoption, and high trading volumes are driving ZORA’s price demand.

High leverage in derivatives markets and overbought technicals could trigger sharp pullbacks.

Sustainability depends on continued creator activity on Base and whether whales maintain positions.