ZEC rebounds 7% after core developer exit triggers selloff; short liquidations and rising open interest hint at potential intraday gains.

Zcash sees sharp bounce as whales accumulate post-dip; $432 intraday price rise may signal short-term bullish momentum toward $500.

Zcash (ZEC) has experienced a sharp correction following news of a core developer’s exit, which negatively impacted short-term market sentiment. This triggered an aggressive selloff, driving the price below key EMAs.

Despite this negative news and the initial selloff, ZEC has rebounded during intraday trading, rising over 7% to $432 on increased trading volume.

The intraday bounce comes just a day after panic-driven selling pushed the price into oversold territory, suggesting that much of the selloff may already be priced in.

The key question now is whether this bounce will develop into sustained buying or fade into another decline.

ZEC Bounces After Selloff: Is More Volatility Ahead?

Zcash (ZEC) surged 7% following a sharp selloff, indicating that buyers are stepping in at key support levels.

The rebound suggests that the market is absorbing the recent negative news. On-chain data also shows that whales and large holders are accumulating after the dip.

Furthermore, analyst Crypto Fella expressed a bullish view, stating that ZEC’s price reversal has played out and it could rally toward $500 soon.

However, looking at recent price action, after consecutive losses last month, ZEC has formed a fresh lower low, indicating a potential trend change.

Unless ZEC closes strongly above $450, the bullish trend may not resume. Otherwise, a deeper correction toward $400 could unfold in the coming sessions.

What Do Derivatives Data Signals?

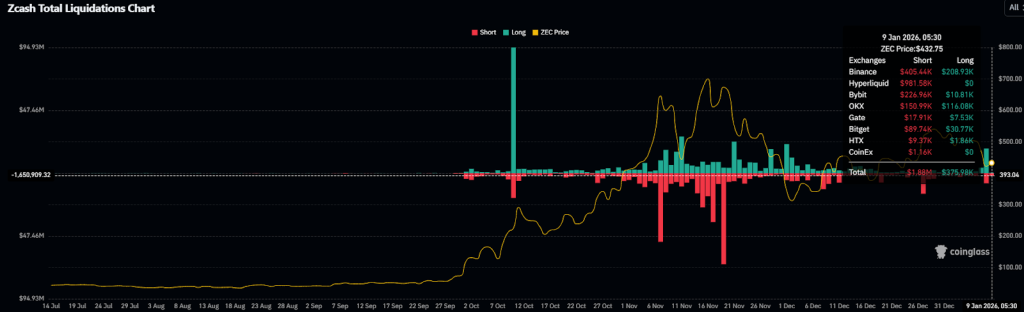

Liquidation data from Coinglass indicates a bullish short-term signal. Over $1.88 million in short positions have been liquidated compared to $375,000 in long positions, showing that the closure of a large number of shorts has triggered a quick bounce.

Additionally, open interest (OI) has risen 12.76% to $1.01 billion, reflecting fresh long-position buildup, which could support further gains during the intraday session.

FAQs

ZEC could trade between $380 and $840 in 2026, depending on zero-knowledge upgrades, adoption growth, and overall market conditions.

ZEC’s price depends on privacy demand, zk-upgrades, regulatory trends, institutional interest, and adoption of shielded transactions.

If adoption accelerates and scalability improves, Zcash could reach up to $7,060 by 2030, driven by privacy infrastructure demand.

Zcash can be a good investment for those seeking privacy-focused crypto, but consider market volatility and technology adoption before investing.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.