Zcash price prediction 2025 strengthens as ZEC hits a new ATH of $529 amid a powerful privacy coin resurgence.

Shielded adoption growth, whale accumulation, and futures OI expansion fuel the bullish narrative.

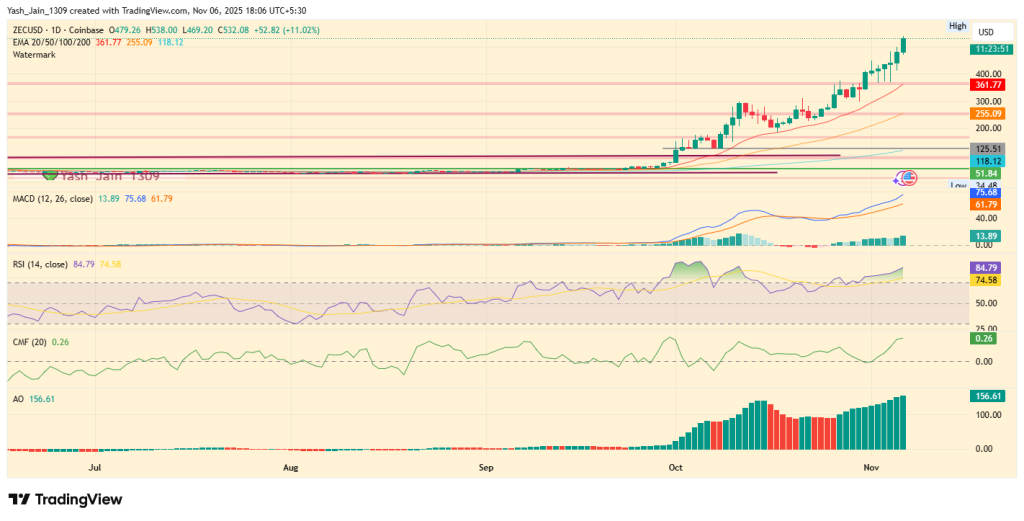

Technical charts show strong momentum, though overheated indicators point to a needed cooldown toward $360.

As the privacy coins narrative is booming, how can Zcash stay silent? It’s booming, and now the topic of Zcash price prediction 2025 is gaining immense limelight. This fame is evident as ZEC enters a historic phase after surpassing the $500 mark to reach a new all-time high at $538. It doesn’t look like an easy climb, but it is hard-earned by all means of survival. With the Zcash price today soaring, privacy is emerging as Q4’s dominant theme, fueled by adoption metrics, network upgrades, whale demand, and a renewed push for financial anonymity.

ZEC Hits $538 ATH as Privacy Narrative Takes Center Stage

The Zcash price chart delivered one of the year’s most explosive breakouts as ZEC climbed to $538, marking a fresh all-time high. This surge aligns with the broader Q4 rotation into privacy-focused assets, driven partly by uncertainty surrounding future Federal Reserve rate cuts and brief recovery signs from Bitcoin’s today’s price action that lifted overall market sentiment.

Even the whales aren’t sitting idly, like Arthur Hayes, who has been another undeniable strong factor acting as a key catalyst, with multi-million-dollar long positions opening across exchanges, further amplified by vocal support from major market participants like Arthur Hayes, who has called for $1,000 per ZEC ahead.

Many traders and users believe that ZEC is not merely “pumping,” but actively reclaiming its narrative, as privacy once again becomes a core theme of rebellion in crypto.

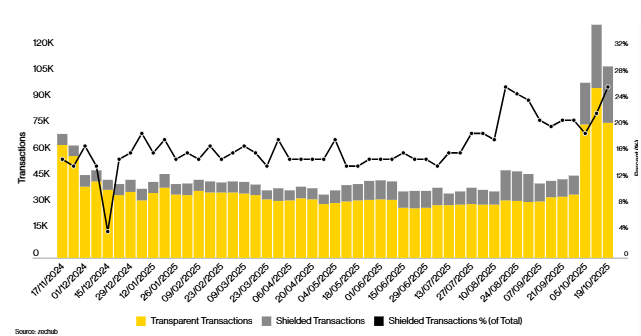

Shielded Adoption Surges as Zcash Strengthens Its Core Use Case

Fundamentally, Zcash crypto is gaining traction due to its defining feature: encrypted transactions, according to a recent CoinDesk research report. While most crypto transfers leave a public trail, ZEC’s shielded pool protects financial activity at scale. Each shielded transaction expands a global privacy set, strengthening protection for all users.

A recent deep-dive analysis highlighted several structural growth metrics, like One-fifth of ZEC supply is now shielded, which rose from approx. 1.2M to 4.5M ZEC over the years.

Similarly, Active shielded addresses have grown from a few thousand in 2018 to tens of thousands in 2025, per the report.

Likewise, its transparent balances remain flat, while its encrypted holdings continue to climb.

These trends indicate a rapidly rising adoption among users who prioritize financial privacy, and they point to a strengthening foundation for the Zcash price forecast 2025.

Moreover, the report notes that network upgrades have also continued to contribute to this growth. With NU6.1 in the planned stage and NU7 in the planning stage, this speaks strongly for their ecosystem. The ZEC’s roadmap signals ongoing improvements that could lift the Zcash price USD throughout the coming cycles.

Market Metrics, Futures Growth, and Technical Signals Shape Outlook

While examining more technical aspects of Zcash charts, ZEC’s explosive rise has pushed it ahead of major altcoins like Sui (SUI) and Hedera (HBAR), although it remains slightly behind. As a result, it now boasts a market cap of $8.56 billion.

Similarly, the futures data support this momentum, with ZEC open interest reaching an all-time high amounting $897.40 million, hinting at sustained bullish positioning.

However, while momentum still appears strong, this is cross-confirmed by indicators such as MACD, AO, and CMF, which also indicate strong upward momentum. Nevertheless, risk metrics still suggest caution.

According to one of the most reliable technical indicators also echoes this warning, as the RSI at 84 reflects extreme overbought conditions.

This suggests that a corrective move may be necessary for a sustainable upside if investors view this rally as a potential extension in the future.

Based on its price action, the ideal cooldown zone appears near $360, aligning with a healthier market structure. This would be nearly 35% decline from ATH $538.

That said, if ZEC price stabilizes above this level, Zcash price prediction models suggest that the 2025 cycle could still push significantly higher.

FAQs

ZEC is up due to strong privacy demand, whale buying, rising shielded adoption, and improved market sentiment lifting the broader crypto sector.

Yes. Growing shielded adoption, active upgrades, and rising demand for privacy tools suggest Zcash still has long-term relevance.

No. ZEC’s new highs, rising usage, and active development show it remains a functioning and evolving crypto project.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![XRP Community Day [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/02/05161327/XRP-Price-Drops-10-as-Leverage-Dries-Up-and-Whale-Activity-Remains-Absent-390x220.webp)