XRP Price Faces Bearish Outlook; Says Peter Brandt Amid Growing Impatience from Traders

The demand for XRP from whale investors has declined amid a notable increase in its exchanges’ supply.

The XRP community has shown growing impatience as BNB overtook its market cap for the first time in several months.

The anticipated 2025 altseason may help XRP price rebound to a new all-time high before the end of this year.

Peter Brandt, a veteran trader, has cautioned a potential bearish outlook for XRP in the midterm. Brandt has noted that the XRP price may be developing a descending triangle with a midterm target of around $2.68.

While using historical data to compare price action, Brandt noted that the XRP price may be eyeing $2.22 if the support level around $2.68 fails to hold. He highlighted that XRP’s weekly timeframe has been forming a bearish divergence of the Relative Strength Index (RSI).

Why is XRP Price Dropping Today?

Rising Exchanges Supply amid Low Demand from whales

The supply of XRP on major crypto exchanges has been on the rise in the recent past. According to on-chain data analysis from glassnode, more than 320 million XRP were deposited to major crypto exchanges in the past seven days, thus increasing their net supply to over 3.8 billion coins.

Meanwhile, the overall demand for XRP from whale investors has declined compared to the exchanges’ net supply.

High Liquidation of Long Traders

The XRP price likely dropped following the notable liquidation of long crypto traders. Notably, XRP’s leveraged liquidation amounted to over $23 million in the past 24 hours, while the long traders accounted for over $21 million.

As such, the odds of a long squeeze increased the midterm bearish outlook for XRP.

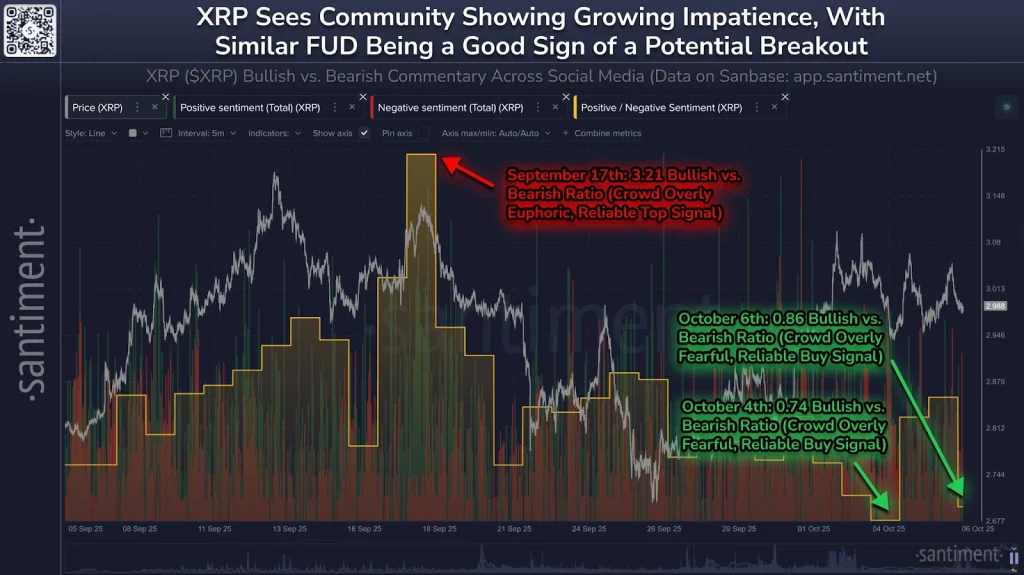

Rising Community FUD

Earlier on Tuesday, market intelligence platform Santiment revealed that the XRP community has been showing a growing impatience. With the rising bearish FUD (fear, doubt, and uncertainty), XRP selling orders have surged.

Nonetheless, Santiment noted that the XRP price has performed exceptionally well after periods of FUD and vice versa.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.