XRP price slid nearly 10% as leverage unwound and open interest hit multi-month lows, signaling a structural reset rather than panic-driven selling.

XRP tests the $1.30–$1.40 demand zone as whale activity remains muted, raising questions over whether the market can form a durable price base.

XRP price saw a sharp downside pressure during the latest session, dropping close to 10% before stabilizing near intraday lows. The move unfolded alongside broader market weakness, but on-chain data shows XRP’s decline is being driven less by panic selling and more by a structural reset in positioning. As price slipped, leverage exited aggressively, and large holders stayed on the sidelines. Together, these forces reshaped XRP’s short-term outlook, shifting focus away from momentum and toward whether the market can form a durable base.

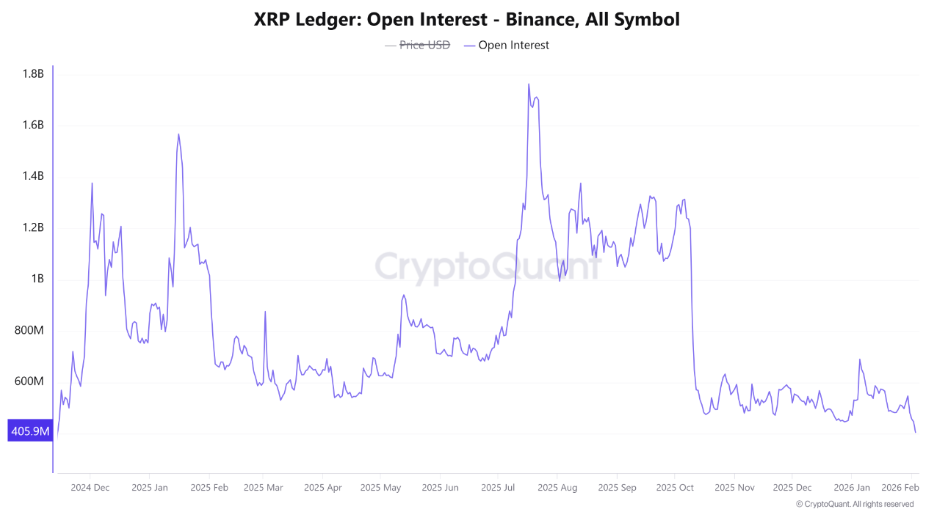

Leverage Unwinds as Open Interest Falls to Multi-Month Lows

The most significant signal behind XRP’s decline is the sharp contraction in derivatives positioning. Open interest has now dropped to levels last seen in November 2024, effectively erasing the speculative buildup that accumulated during prior recovery attempts. Unlike liquidation-driven crashes, this reset unfolded gradually, with traders closing positions voluntarily rather than being forcibly liquidated.

With leverage largely flushed, XRP no longer faces the same downside risk from overcrowded long positioning. However, the reset also means the market lacks speculative momentum needed for a quick rebound.

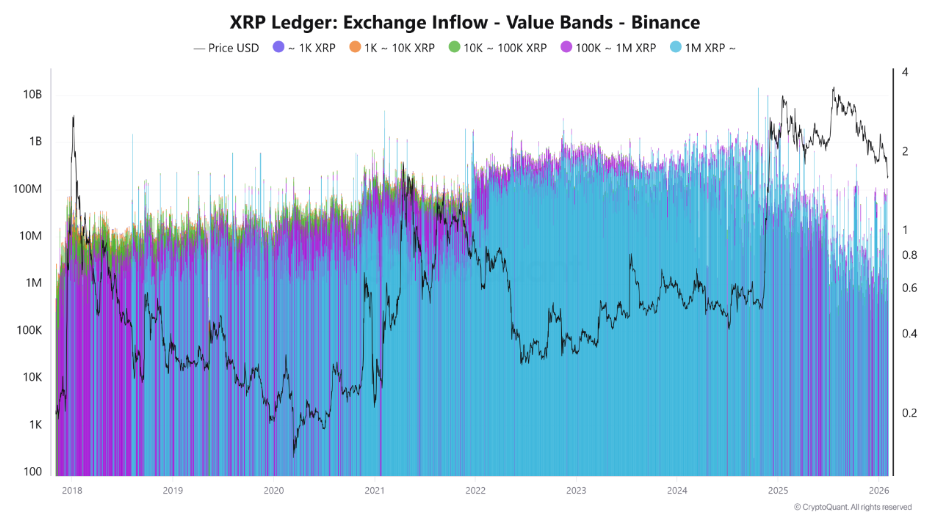

Whale Activity Remains Muted Despite Lower XRP Prices

While derivatives exposure has been reduced, large holders have yet to step in meaningfully. On-chain data shows no notable increase in whale accumulation during the sell-off. Wallet activity among large XRP holders remains muted, suggesting institutional and high-net-worth participants are waiting for stronger confirmation before deploying capital.

In previous XRP recoveries, whale inflows often provided a stabilising base, absorbing sell pressure and helping price form durable support. The absence of that behaviour this time leaves XRP exposed to extended consolidation, even as selling pressure eases. Simply put, leverage has exited, but strong hands have not yet replaced it.

XRP Price Slips to Channel Lows: What’s Next?

XRP price has been trapped inside a falling channel for months. The latest drop has pushed the price toward the lows of the channel, a structure that has guided price action for several months. The decline accelerated after XRP failed to hold the channel’s midline, triggering a clean rejection and confirming sellers control in the short term. Currently, XRP price slid into a high-confluence demand zone around $1.40, making it a technically significant region. Historically, XRP has shown short-term stabilization when price reaches this zone.

XRP price action shows longer lower wicks, hinting that selling pressure is slowing, but there is no confirmed reversal yet. As long as XRP trades below the channel midline and former support level of $1.30, any rebound risks being corrective. A sustained recovery would require a decisive reclaim of broken resistance. Failure to hold the current demand zone of $1.30-$1.40, however, could expose XRP to a deeper move into lower liquidity pockets near $1.10.

FAQs

XRP’s drop is driven by a structural reset, not panic selling. Leverage is unwinding, and large holders are waiting, removing speculative momentum for a quick rebound.

Currently, large “whale” investors aren’t accumulating, suggesting a wait for stability. With price in a falling channel, it may consolidate further before a durable base forms.

XRP needs to reclaim and hold above the $1.30-$1.40 zone as solid support, alongside renewed buying interest from large holders, to signal a potential trend reversal.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is Crypto Crashing Today [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/02/23165659/Why-Is-Crypto-Crashing-Today-Live-Updates-1-1-390x220.webp)