XRP consolidates near $2.10 after leverage flush, signaling market reset and reduced short-term risk.

Whale activity declines from December highs as large holders pause after strong rally phase.

Golden Cross forms on XRP chart, historically preceding major upside moves toward record highs.

XRP is trading near the $2.10 level after a strong move earlier this month. While the market has cooled, excess leverage has been cleared. On top of it, XRP has formed a Golden Cross, a signal that previously appeared before the token rallied to its all-time high, raising questions about whether the pattern could repeat.

Leverage Reset Pushes XRP Into a Tight Range

One of the biggest changes came from the derivatives market. XRP recently went through a rare two-sided liquidation event on Binance Futures. First, on January 5, the price pushed sharply higher, triggering around $4.4 million in short liquidations as late sellers were forced to exit.

Just a day later, the move reversed. Nearly $5.5 million in long positions were wiped out, pulling the price back down.

This back-to-back cleanup removed leverage from both directions and left XRP trading in a narrow $2.07 to $2.17 range as traders waited for a fresh catalyst.

Whale Activity Cools After Months of Heavy Participation

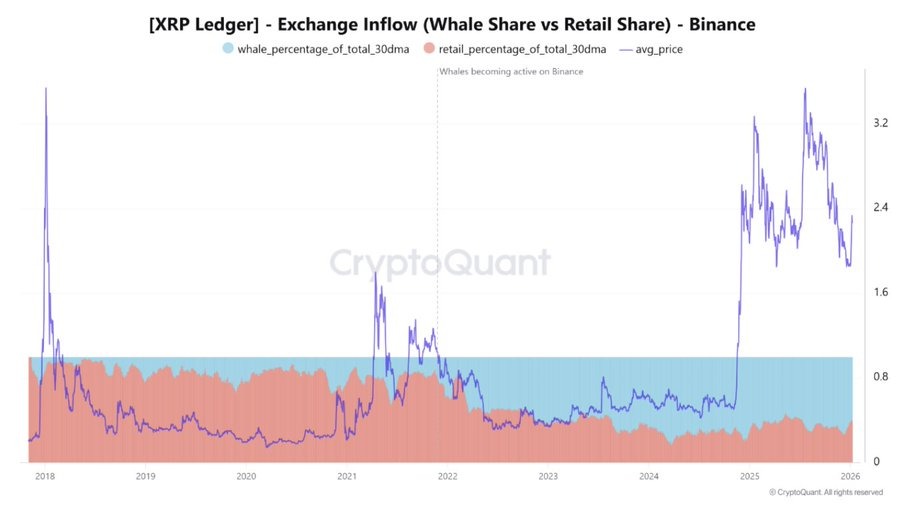

With leverage flushed out, attention has shifted to on-chain and institutional signals. According to CryptoQuant data, whales are still the dominant force, accounting for about 60% of XRP inflows to Binance, while retail traders make up the rest.

However, whale activity has been slowly declining since mid-December. This suggests large holders may be stepping back after months of heavy involvement near the top of the rally, allowing the market to cool and stabilize.

Institutional & ETF Flows Remain Key Support

At the same time, institutional interest remains a key support. Spot XRP ETFs have attracted nearly $1.49 billion in inflows since launch, even though they saw a $40.8 million outflow on January 7 during the recent price dip.

This shows that while short-term sentiment can weaken, longer-term interest has not disappeared.

XRP Chart Forming Golden Cross

On the technical side, analysts are watching early signs of strength. Chart data shared by ChartNerd shows XRP printing a Golden Cross on the 5-day MACD, with the histogram turning positive. The last time this signal appeared was in July, just before XRP pushed to new highs.

If the historical pattern follows again, XRP price will soon hit its all-time high of $3.68.

FAQs

XRP price prediction for 2026 ranges between $1.75 and $5.05, depending on market recovery, adoption growth, and overall crypto sentiment.

Major risks include regulatory setbacks, weak market liquidity, competition from other payment-focused blockchains, and prolonged bearish market cycles.

Triple-digit targets assume massive global adoption and long-term dominance in payments, making them highly speculative rather than guaranteed outcomes.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.