After a 6% price decline, XLM, the native token of Stellar, has begun heading toward its next support level. As of today, April 9, 2025, the market appears to be continuing its downward trend, as the tariff war between the United States and other countries shows no sign of ending soon.

XLM Price Action and Its Key Levels

Amid the bearish market sentiment, the XLM price prediction has become a key topic of discussion. According to expert technical analysis, the asset has been moving within a falling wedge pattern on the daily time frame. With the recent price drop, XLM has failed to hold its key support level of $0.23 and is now heading toward the lower boundary of the pattern.

Historically, this support level has acted as a zone for price reversals or rebounds. However, after failing to hold this level, XLM could decline by 16% and reach the next support level at $0.19 in the coming days.

XLM Price Prediction

This continuous price decline has raised concerns about whether it will come to an end or if the asset might see a reversal with upside momentum.

The daily chart indicates a strong possibility that the asset could reach the $0.19 level. However, this could be the point where XLM experiences a price reversal. If the downside momentum continues, though, the asset’s price could decline by another 25%, potentially reaching the $0.14 level.

Current Price Momentum

At press time, XLM is trading near $0.22 and has recorded a price decline of over 6% in the past 24 hours. During the same period, its trading volume dropped by 50%, indicating lower participation from traders and investors compared to the previous day.

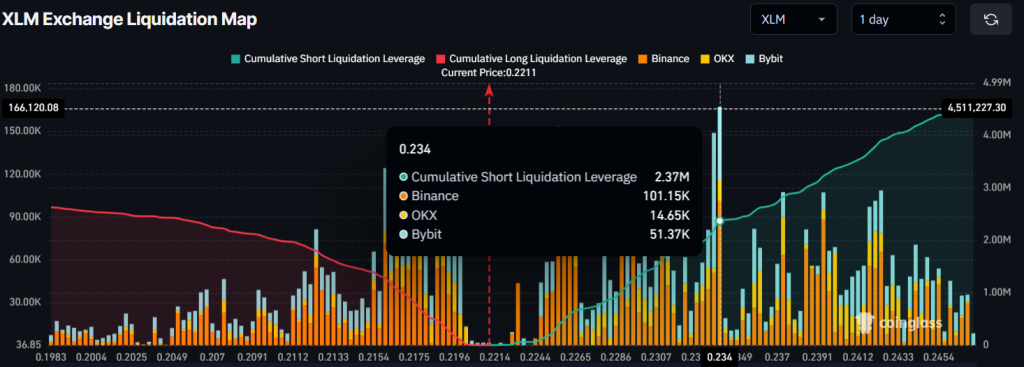

$2.37 Million Worth of Bearish Bet

In addition to the bearish price action, traders also appear to be following the overall market sentiment, as many are strongly betting on the downside.

Data from the on-chain analytics firm Coinglass reveals that traders are currently over-leveraged at the $0.212 level on the lower side, with $1.80 million worth of long positions. On the other hand, the $0.234 level is another over-leveraged zone on the upper side, with $2.37 million worth of short positions opened by traders.

This metric clearly reflects traders’ bearish view of XLM, which could push the asset lower in the coming days.