XRP’s EVM sidechain launch connects it to Ethereum’s dApp ecosystem

$1.7M in XRP withdrawn from Binance, signaling strong whale accumulation

Rounded bottom on chart forms as XRP eyes a move past $2.35 resistance

The XRP Ledger has officially launched its much-anticipated EVM-compatible sidechain on the mainnet. Thus marking a monumental leap forward in functionality, and possibly opening doors to a new era. With this integration, XRP unlocks access to Ethereum-based dApps and smart contracts, bringing it in line with top DeFi platforms.

As investor interest accelerates, as a meeting is scheduled for July 3rd to discuss the Ripple vs SEC lawsuit. The key question emerges: Can XRP hit a new ATH this July? If this is one of your queries, then join me as I decode the XRP price analysis for this month.

Whales Ride the Bullish Wave?

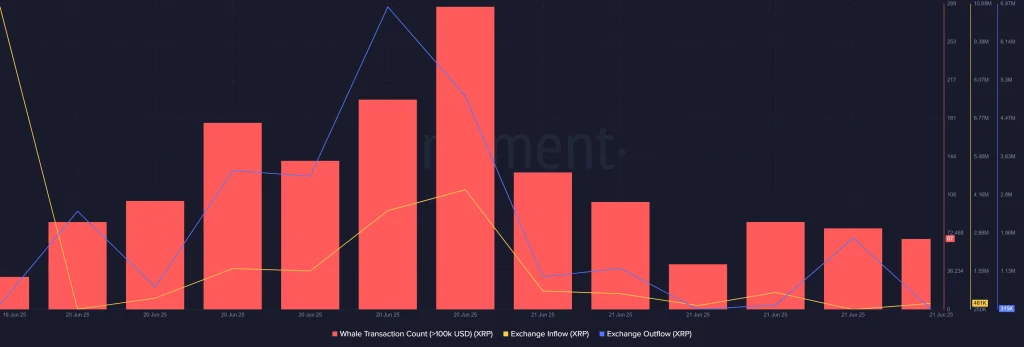

Recent on-chain data from Santiment reveals increasing interest from large XRP holders. According to Santiment, the whale transaction count above $100k surged significantly between June 20–23, aligning with a sharp uptick in exchange outflows.

Notably, over $1.7 million worth of XRP was pulled from Binance’s hot wallet in the past 24 hours. This here is a classic signal of accumulation rather than selling. Which typically precedes upward price movements, especially when paired with ecosystem-wide upgrades like the EVM launch.

The chart also shows that exchange inflows have decreased, which supports the thesis that holders are moving XRP into cold storage or DeFi applications, not preparing to dump it on the market.

Ripple XRP Price Analysis

As of press time, XRP is changing hands at $2.21, with a 2.73% weekly gain. More impressively, trading volume has spiked by 136%, indicating renewed market participation.

On the daily chart, XRP is clutching the upper Bollinger Band at $2.26, suggesting it’s gearing up for a breakout. The RSI sits at 52.25, slightly above neutral, giving the bulls breathing room without being overbought.

The key level to watch is $2.35, a breakout here could open the door to a rally toward $2.80–$3.00. However, breaching the ATH of $3.84 in July would require not just a technical breakout but broader market bullishness, or a settlement in the Ripple vs SEC lawsuit.

Also read our long term Ripple XRP Price Prediction 2025, 2026-2030!

FAQs

Unlikely in July, but a move toward $2.80–$3.00 is feasible if momentum holds.

It enables Ethereum dApps to run on XRP Ledger, expanding XRP’s utility and adoption.

Yes, large Binance withdrawals and rising whale transactions suggest accumulation is underway.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.