XRP price sees whale inflows halt after weeks of heavy exchange deposits, signaling potential market stabilization.

On-chain data suggests institutions are absorbing retail panic selling while traders are squaring off at losses.

Symmetrical triangle pattern has formed hinting at a possible breakout odds toward $3.66 or even $5 if momentum returns.

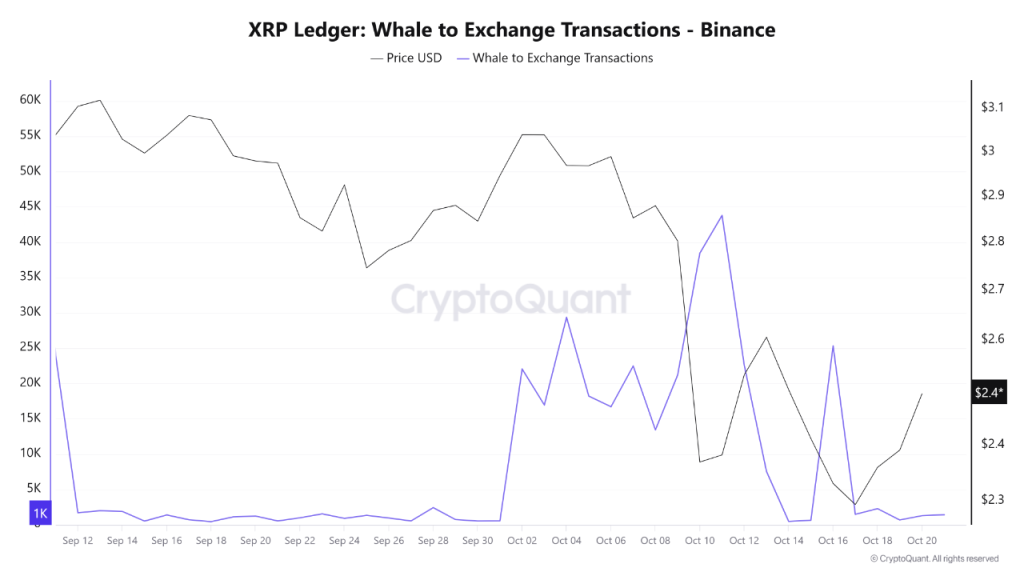

The XRP price is showing encouraging signs of stabilization after enduring heavy selling pressure throughout the first half of October. According to CryptoQuant insights, a wave of large whale deposits began on October 1 and continued until October 17, peaking on October 11 when the Whale-to-Exchange Transactions surged to over 43,000. These activity signals that whales have secured their profits.

As the inflows increased at those times, the XRP price chart data also faced a decline, which confirmed an accelerated decline due to whales, as a result, it dropped from above $3 to nearly $2.40, when writing.

However, since October 17, these large transfers have subsided, suggesting the odds that whales might have completed their selling phase. This shift has coincided with a calmer market tone, where institutions now appear to be absorbing retail-driven panic selling, helping XRP price maintain a steady footing above the $2.20 mark.

On-Chain Data Points to Institutional Absorption Amid Retail Capitulation

Recent metrics from Santiment indicate that after experiencing such a shock, the retail sector has been massively spooked. As a result, XRP crypto is experiencing crowd selling at a loss, which remains a dominant theme.

Retail traders have been offloading their holdings amid growing fear and uncertainty, even as institutional players quietly accumulate. This behavior highlights a typical market reversal setup, where prices begin to consolidate as stronger hands absorb weak-hand selling pressure.

Interestingly, this market reversal could be true because just 10 days after the XRP price USD dropped below $1.90, and only three days after rebounding to $2.20, it managed to rise above $2.40 once again. It is holding on to this level, which is a good sign for XRP.

Additionally, such rapid recoveries often indicate that selling pressure is waning and that a potential reversal may be underway. Historically, when retail traders panic-sell their assets, most of those are absorbed by smart money. As a result, the price tends to move against the crowd’s expectations, signaling a possible bullish turn ahead.

Technical Setup Hints at Major Breakout Potential

From a technical standpoint, XRP price prediction 2025 could gain traction as a symmetrical triangle pattern continues to develop on the daily chart.

This formation is defined by a rising trendline connecting June and October’s swing lows and a descending resistance line linking July and October’s swing highs. The trading range within this setup spans between $1.90 and $3.66, marking a crucial area for upcoming price action.

If a bullish catalyst emerges, possibly through improving macro conditions or renewed institutional inflows, the Ripple XRP price prediction suggests a potential retest of the $3.66 level before year-end.

In a stronger scenario, the token could even challenge a new all-time high near $5 as momentum builds into early 2026. While consolidation remains the near-term trend, the combination of declining whale sell-offs and ongoing institutional interest paints a structurally bullish picture for the months ahead.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.