XRP's price explodes 12%, flipping key Fibonacci resistance amid surging volume

On-chain activity reveals lively wallet engagement, supporting bullish momentum

RSI stays neutral, giving bulls room to run while the next resistance looms at $2.69

Excitement charged the XRP market as buyers powered a stunning 12% price surge. Over $4.97 billion in volume engulfed the chart, shaking off last week’s caution. Traders flooded in after five XRP ETFs appeared on DTCC, signaling that regulators are warming up to the token.

Meanwhile, a resolution to the U.S. government shutdown helped patch systemic cracks, pumping up risk appetite across markets. But the magic moment came when XRP price smashed through $2.55. Thereby, unleashing a technical breakout that’s now the talk of crypto circles.

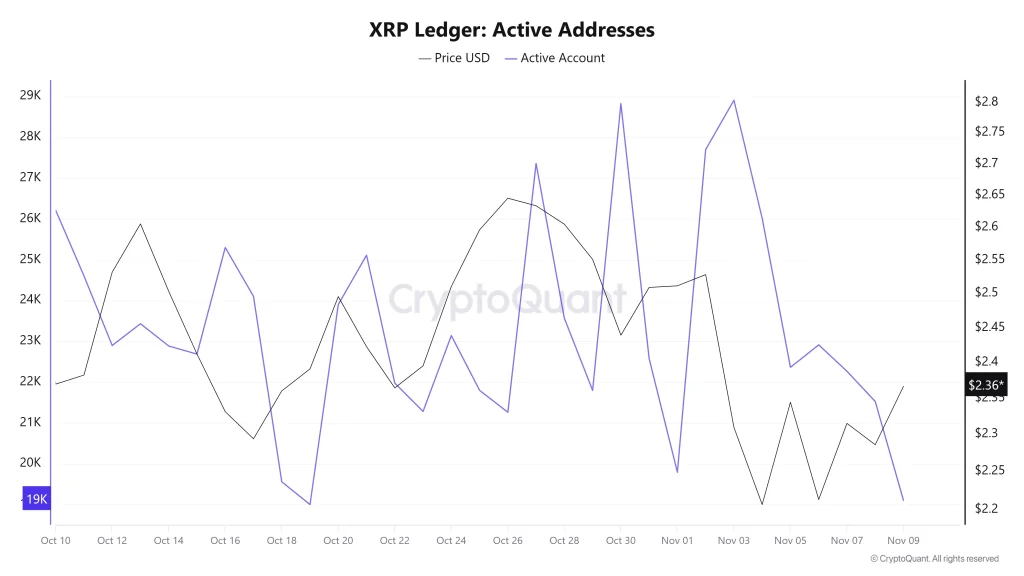

Behind-the-Scenes Momentum: XRP Ledger Alive?

Activity on the XRP Ledger is nothing short of thriving. The latest CryptoQuant chart shows active addresses swinging between 19,000 and 29,000 in recent weeks. As the price moved north of $2.36, daily active wallets also ticked up. This engagement proves adoption isn’t just hype, as more wallets are waking up and participating, matching the price action and fueling the rally.

Breakout or Pullback? Let Me Decode It

Looking closely at the technicals, the bullish case here is strong. XRP price burst past the descending channel, invalidating the previous bearish structure as traders raced to buy the clean breakout. The move above $2.55 Fibonacci resistance was powered by volume nearly doubling the average. This dramatic spike makes an immediate retest of $2.69, the crucial swing high, and 38.2% retracement. Which is likely to happen by mid-week if the buying continues.

If the price faces resistance at $2.69 and fails to push higher, there’s support waiting at $2.46, so the downside is buffered. However, if bears regain control, the drop may test $2.36. Right now, the RSI hovers in the mid-40s, avoiding the exhaustion zone and hinting that buyers still have stamina. If buyers reclaim momentum, XRP price could capture $2.83 next, riding ETF-fueled optimism and volume spikes.

FAQs

XRP price exploded as traders reacted to ETF listings, bullish market sentiment, and a textbook technical breakout above $2.55, supported by huge volume.

Key support now sits at $2.46, while resistance looks solid at $2.69. Breaking $2.69 may set up a run at $2.83, with $2.36 as the deeper support if a pullback unfolds.

No, the RSI lingers in the low 40s, signaling more room for upside before buyers risk exhaustion, making further price moves very plausible.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.