SUI surges 15–20% as USDsui stablecoin launch, Coinbase NY listing, and strong demand after token unlock boost confidence and drive major market momentum.

SUI nears key resistance at $1.67 with bullish December trends and rising liquidity support; analysts eye potential move toward the $1.80–$2.30 zone.

SUI Token has become one of the strongest-performing major cryptocurrencies in the past 24 hours. The SUI price today jumped from $1.35 to around $1.55, rising about 15–20%.

Apart from a few meme tokens, SUI recorded the highest daily gain among large-cap assets. The rally comes amid a wave of ecosystem updates, improved market sentiment, and increased accessibility for U.S. users.

Why SUI Price is Surging?

SUI’s price is rising today due to several key factors in its ecosystem and market activity:

- USDsui Stablecoin Launch: Sui introduced USDsui, a fiat-backed stablecoin designed for real-world payments. It supports yield-sharing, works across Sui wallets, apps, and DeFi protocols, and is compatible with other bridge-backed stablecoins. This launch has strengthened confidence in the Sui ecosystem and signals its long-term growth potential.

- Coinbase Expansion: SUI trading is now open to New York residents on Coinbase, significantly increasing accessibility in a major regulated market. This expansion adds more buying demand and liquidity.

- Major Token Unlock: SUI recently completed a $86.86 million token unlock, releasing 55.54 million tokens on November 30. Despite the increase in supply, the price moved higher, showing strong market interest and accumulation of the new tokens.

SUI Price Prediction

Analysts note that SUI’s upward momentum is closely tied to Bitcoin’s movement. The next critical level sits at $1.80, a zone that, if broken and confirmed as support, could open the door to an extension toward $2.00–$2.30.

The resistance zone for SUI is still between $1.67 and $2.21. SUI has now reached $1.67, which is an important level for confirming that the recent bounce is strong. The next key level near $1.95 is still possible, but it looks a bit far away for now.

On the downside, immediate support lies at $1.58, followed by a key demand region known as the green box band. A drop below $1.48 would be the first clear sign that SUI has likely formed a local top and that a downside move may be starting.

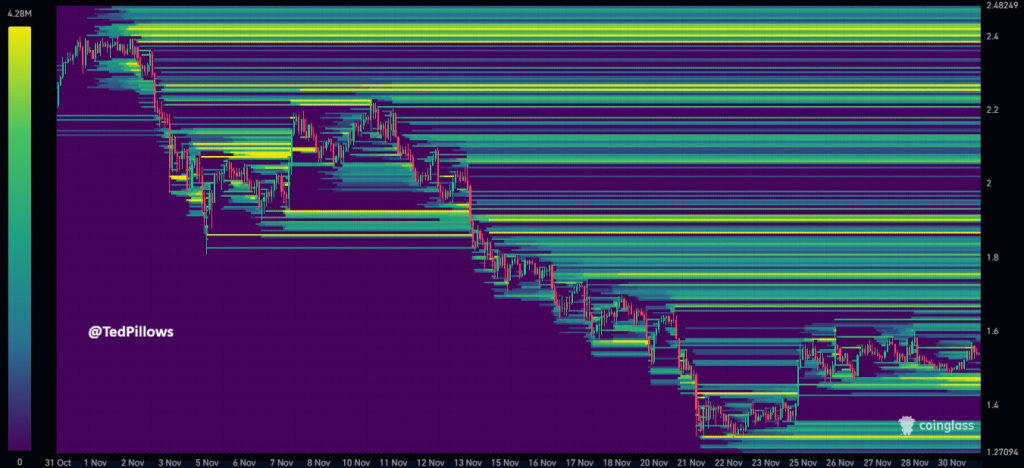

According to crypto analyst TED, Liquidity data also shows sizeable upward liquidity clusters, while long liquidations around $1.40–$1.50 may still need to be swept before the next leg higher.

Historically, December has been a bullish month for risk assets, and Bitcoin tends to rally after Thanksgiving, another tailwind that could support SUI’s upside.

FAQs

SUI is climbing due to new ecosystem updates, a stablecoin launch, rising demand on major exchanges, and stronger overall market sentiment.

Despite more supply entering the market, strong buying demand absorbed the unlock, signaling healthy interest and supporting higher prices.

Seasonal trends and stronger crypto sentiment often support December gains, but SUI’s move still depends on market momentum and BTC strength.

Yes, the SUI blockchain is one of the most prominent projects and is projected to gain significant value in the coming time.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.