El Salvador agreed to amend its Bitcoin policy as a condition for a $1.4 billion loan, likely contributing to the recent Bitcoin price drop.

Divergence between Bitcoin's price and RSI suggested an impending price correction, which has now occurred.

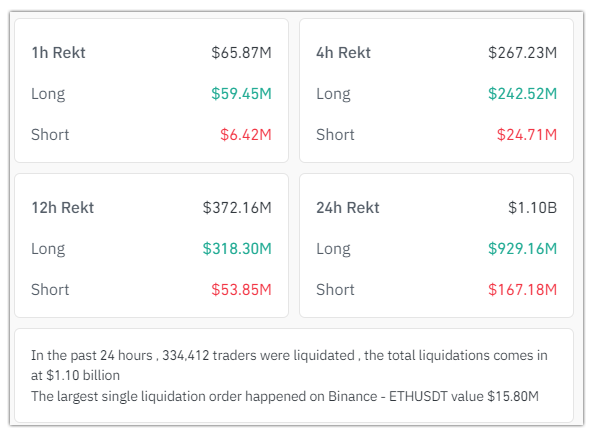

The recent price drop resulted in over $1 billion in liquidations, primarily affecting long traders, highlighting the market's volatility.

Bitcoin has shocked the crypto world with an 11.25% drop in the past three days, losing nearly $12,000 in value. It’s now trading at $94,715, and the entire crypto market has seen $1.10 billion in liquidations. This downturn is a win for bears, while long traders are taking heavy losses.

So, what’s causing this sudden drop, and why is the market down today? Let’s take a closer look.

El Salvador Feels the Heat

El Salvador, the first country to make Bitcoin legal tender, has faced significant opposition from traditional financial institutions. The International Monetary Fund (IMF) has warned the country about its Bitcoin policy, urging them to reduce public sector exposure to crypto. However, El Salvador has stood firm, refusing to change its stance.

Now, El Salvador has reached an agreement with the IMF for a $1.4 billion loan to support its economy—but with one condition. The country must make changes to its Bitcoin policy. El Salvador has accepted the terms, and many experts believe this deal played a big part in Bitcoin’s recent price drop.

The Bitcoin Market Analysis

Bitcoin reached a new all-time high of $108,364 on December 17, but has since fallen. As of now, it’s down 12.74% from that peak. Bitcoin is currently hovering near a key support level, but it’s unclear whether it will hold there.

However, if we take a look at the 4-hour chart, there’s reason for hope. The Relative Strength Index (RSI) has dropped below 30, which usually signals that a price rebound may be coming. This could be a great time for whales to buy more Bitcoin at a lower price.

What the Charts Tell Us

Looking at Bitcoin’s daily chart, the price and RSI movements are showing something interesting. Even though Bitcoin’s price was rising from $89K to its all-time high, the RSI kept falling. This divergence was a warning sign that a price drop was likely. Now that Bitcoin is falling, the price and RSI are expected to realign, which could lead to a bounce back.

Crypto Market Impact

Bitcoin’s price moves have a big influence on the entire crypto market. With Bitcoin’s drop, the overall market cap has fallen by 9.31%, now sitting at $3.21 trillion. However, trading volume has increased by 13.77%, as more short traders are getting involved.

The figures say it all. In the last 24 hours, around 334k traders got liquidated and lost around $1.10 billion of funds. The biggest liquidation happened for the ETH/USDT pair with a value of $15.80 million. $929.16 million were lost to long trades as the market took a nosedive.

What to Expect Next?

The crypto market is always full of surprises. While many expect Bitcoin to hold its current price and eventually bounce back, the market is waiting for large buy orders to come in. Whales often accumulate assets during market dips, and we could see that happening soon. The current support level is critical—if Bitcoin falls further, it could reach $91,900, where the 50-day moving average is sitting.

Traders should stay vigilant and be aware of the market’s volatility. This isn’t always the best time to trade, and protecting your funds should be a top priority.