VIRTUAL price rises 17% as BTC recovery halts the multi-week decline.

Falling wedge breakout retest appears complete by late November.

On-chain activity jumps from 119.7K to 158.2K monthly active users.

The VIRTUAL price is gaining attention after a 17% weekly rise supported by Bitcoin’s broader market recovery and a confirmed breakout from a falling wedge pattern. As VIRTUAL crypto strengthens from its November retest, improving on-chain activity and new product momentum are adding fuel to a potential December continuation rally.

VIRTUAL Price Breakout Reasserts Bullish Structure

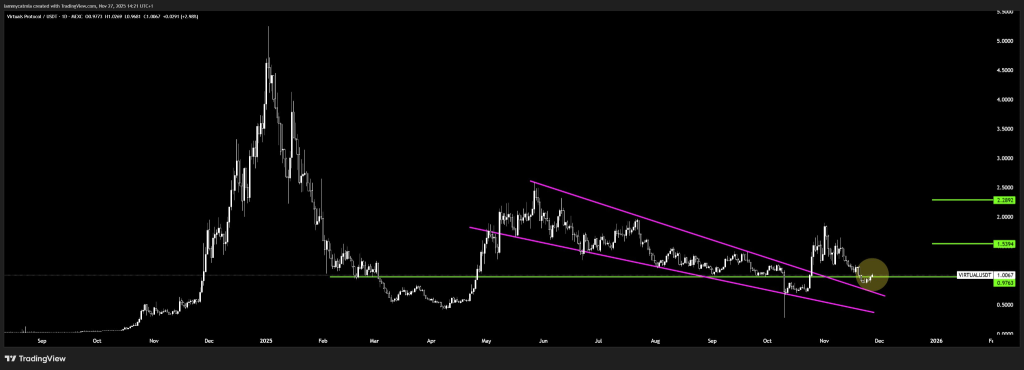

The latest VIRTUAL price chart shows a clean falling wedge breakout that initially formed in October. Following the breakout, VIRTUAL/USD pulled back to retest the upper boundary of the pattern, a common post-breakout behavior. By late November, this retest appears complete, setting the stage for the next potential leg of recovery.

According to chart observations shared on X, the reversal structure remains valid as long as VIRTUAL price USD maintains above the wedge. This suggests that the bullish continuation anticipated in December could attempt upside targets around $1.53 and $2.28, levels highlighted as major resistance zones for year-end.

VIRTUAL Price Today Benefits From Bitcoin’s Rebound

Despite moderate momentum, one clear catalyst behind VIRTUAL price today and this week is Bitcoin’s strong recovery from this week’s lows. The renewed BTC strength helped halt the steep multi-week decline across altcoins. As Bitcoin regains dominance, the stabilization has provided the breathing room VIRTUAL needed to resume its breakout trajectory.

Furthermore, the 17% rise this week reaffirms that the VIRTUAL price action is highly sensitive to broader market movements. This reinforces the importance of BTC’s ongoing direction as traders evaluate the durability of the current trend.

Product Updates Strengthen the VIRTUAL Price Forecast

Beyond chart-driven signals, ecosystem developments have also supported the improving VIRTUAL price forecast opinions. One highlight this week was the announcement that Virtuals’ agent, Butler, is now powered by Google Gemini 3 Pro, a move revealed on November 25. This integration amplifies product capability and injects fresh sentiment into the project’s narrative.

Although momentum is still not as strong as some outperforming altcoins, but this upgrade still contributes to buyer confidence and helps support the bullish structure formed on the daily timeframe.

On-Chain Metrics Reinforce the VIRTUAL Price Prediction

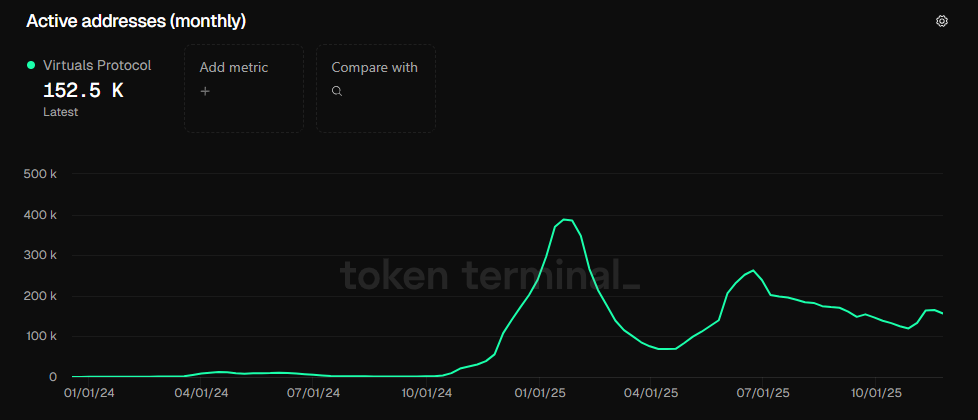

Meanwhile, on-chain activity continues strengthening the case for upside. Monthly active addresses rose from 119.7K in October to 158.2K in November, marking a significant rise in network usage.

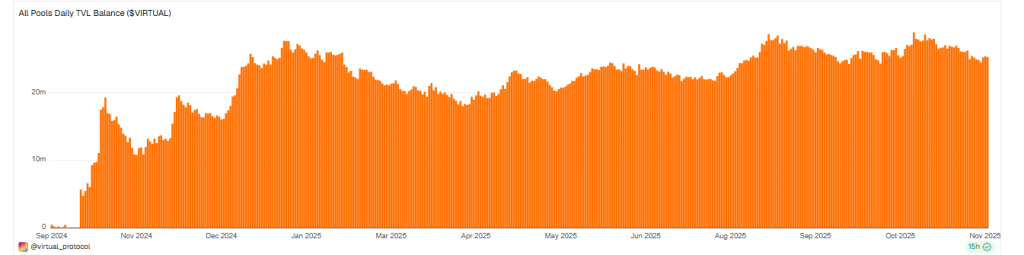

Similarly, Dune Analytics data highlights that all pools’ daily TVL balance has reached $25.60 billion, up sharply from Q4 2024’s low of $5.69 million.

While several smaller metrics still show declining readings, these improvements stand out as meaningful signals. Together, they align with the broader trajectory supporting the next phase of VIRTUAL’s recovery, shaping a more confident VIRTUAL price prediction as December approaches.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.